Markets Weekly Update (January 10) : Dollar Index Holds Above 109 as Market Anticipates U.S. Jobs Report

Markets Weekly Update (January 10) : Dollar Index Holds Above 109 as Market Anticipates U.S. Jobs Report

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

欢迎来到市场每周更新,本栏目致力于提供本周的重要投资见解以及可能在未来一周影响市场的关键事件。

Macro Matters

宏观问题

Dollar Index Holds Above 109 as Market Anticipates U.S. Jobs Report

美元指数保持在109以上,市场预期美国就业报告

The dollar index remained steady above 109 on Friday as investors braced for the December nonfarm payrolls report, seeking insights into the strength of the labor market. A strong jobs report could reinforce expectations for fewer interest rate cuts from the Federal Reserve this year. Minutes from the Fed’s December meeting, released earlier this week, suggested a potential slowdown in the pace of policy easing, driven by renewed concerns over inflation. Fed officials also expressed apprehension about the impact of potential changes in trade and immigration policy under the incoming Trump administration. Additionally, strong services activity and rising prices have intensified inflationary concerns. Meanwhile, Philadelphia Fed President Patrick Harker remarked on Thursday that he expects the Fed to eventually cut rates, but stressed that an immediate move is not necessary.

周五,美元指数在109上方保持稳定,投资者为12月的非农就业报告做好准备,寻求劳动力市场强度的见解。强劲的就业报告可能会加强对今年美联储降息次数较少的预期。本周早些时候发布的美联储12月会议纪要显示,政策放松步伐可能会减缓,因对通货膨胀的担忧重现。美联储官员还对即将上任的特朗普政府可能对贸易和移民政策的变化表示忧虑。此外,强劲的服务活动和价格上涨加剧了通货膨胀的担忧。与此同时,费城联邦储备银行行长帕特里克·哈克周四表示,他预计美联储最终将降息,但强调立即采取行动并非必要。

U.S. Job Cuts Drop to Five-Month Low in December, Yet Annual Totals Rise

美国裁员在12月降至五个月低点,但年度总数上升

In December 2024, U.S. employers announced 38,792 job cuts, marking the lowest figure in five months and a significant decrease from November's 57,727. Despite this monthly decline, the total job cuts for 2024 reached 761,358, the highest since 2020 and a 5.5% increase from 2023. Technology led all sectors with 133,988 cuts, though this was 20.3% lower than the previous year. Conversely, the automotive sector saw a 43.2% increase in cuts, totaling 48,219. "2024 witnessed significant changes due to technological advancements and economic shifts, leading to cautious hiring and increased layoffs," explained Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.

在2024年12月,美国雇主宣布裁员38,792人,创五个月以来的最低数字,较11月的57,727人显著减少。尽管本月降低,2024年的总裁员人数达到了761,358人,是自2020年以来的最高水平,比2023年增长了5.5%。科技板块裁员人数领先所有板块,达到了133,988人,但比去年减少了20.3%。相反,汽车板块的裁员增长了43.2%,总计达到48,219人。安德鲁·挑战者,挑战者、格雷和圣诞公司高级副总裁解释道:“2024年由于技术进步和经济变革带来了显著的变化,导致招聘谨慎和裁员增加。”

Smart Money Flow

智能资金流动

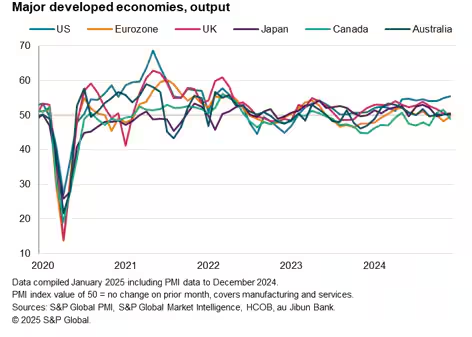

U.S. Leads Major Economies: Fastest Growth Since April 2022 in November

美国在主要经济体中领先:11月以来最快增长

Among the major developed economies, the US saw the strongest expansion for an eighth successive month [in Nov], the rate of growth rising to the fastest since April 2022 as surging services growth (a 33-month high) offset a steepening manufacturing decline.

在主要发达经济体中,美国在十一月连续第八个月实现了最强劲的扩张,增长率上升至自2022年四月以来的最快水平,_services_增长(达到了33个月来的最高点)抵消了制造业的急剧下降。

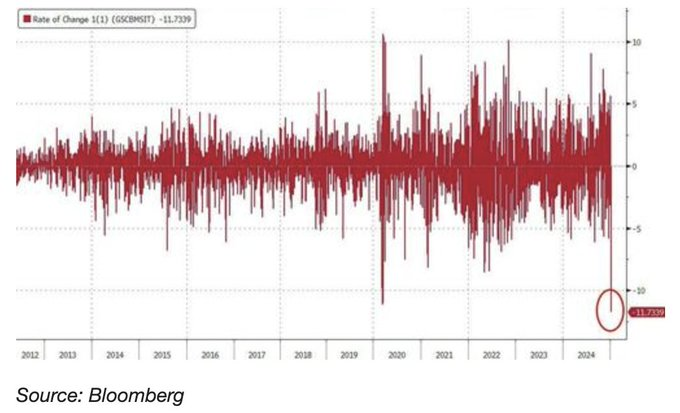

The Most Heavily-Shorted Tech Stocks Basket experienced its largest loss in history on Tuesday

被大量做空的科技股票篮子在周二经历了历史上最大的损失

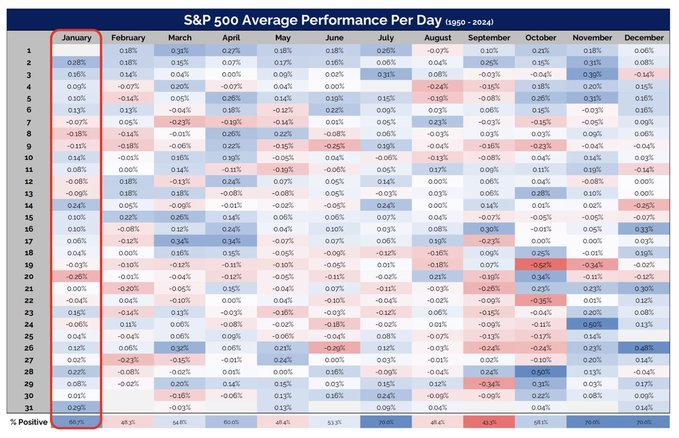

Here's the average daily performance of the S&P 500 during January. Up on 67% of days.

以下是S&P 500在一月份的平均每日表现。在67%的日子里上涨。

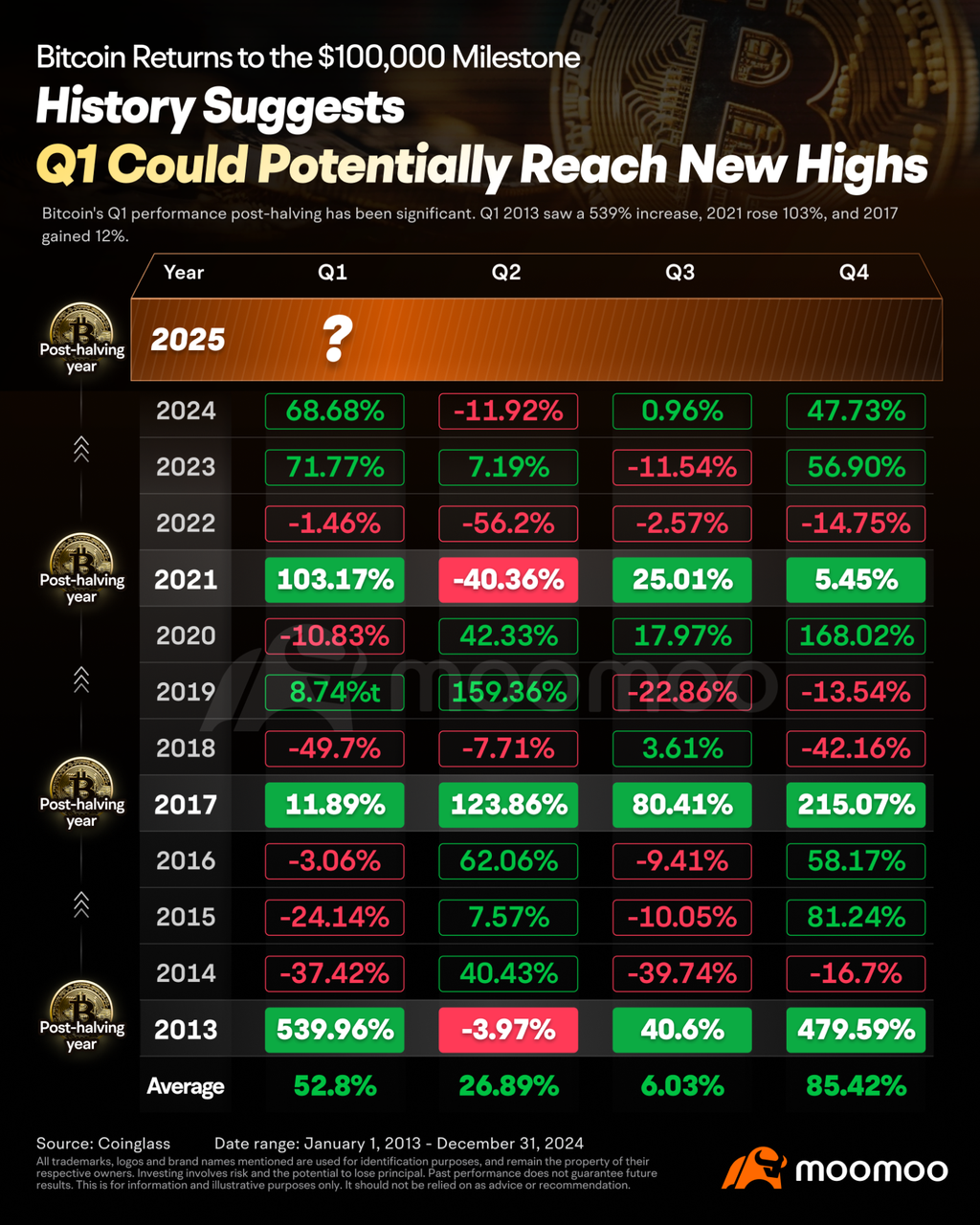

Bitcoin's Golden Moment: Will It Soar After Trump's Inauguration?

比特币的黄金时刻:特朗普就职典礼后它会飙升吗?

Top Corporate News

头条公司新闻

Tesla Launches Refreshed Model Y In China

特斯拉在中国推出了更新版Model Y

Tesla introduced the updated Model Y crossover to its China website on Thursday. According to the website, the new Model Y boasts a "longer range, new design, and higher quality interior," among other changes. The launch series of this updated vehicle is priced at 263,500 yuan, which is nearly 5.4% more expensive than the previous model that started at 249,900 yuan. Tesla indicates that deliveries of the new Model Y are expected to start in March, while the exact timing of the first deliveries will be contingent upon regulatory approval.

特斯拉在周四将更新版Model Y跨界车介绍到其中国网站上。根据网站信息,新Model Y具有“更长的区间、新设计和更高质量的内饰”等其他变化。该更新车型的发布系列定价为263,500元,比之前起价249,900元的车型贵了近5.4%。特斯拉表示,新Model Y的交付预计将在三月开始,而首次交付的确切时间将取决于监管审批。

"Nvidia Magic" Strikes Again! Exploring Nvidia's Latest AI Investment Landscape

"英伟达魔力"再次来袭!探索英伟达最新的人工智能投资格局

Recently, the "Nvidia Magic" has been a prominent feature in the U.S. stock market. Shares of Cerence, an AI developer collaborating with major automakers, skyrocketed over 140% last Friday after announcing an AI partnership with Nvidia. Similarly, Arbe Robotics, a leader in Perception Radar solutions, saw its shares soar over 50% on Monday following news of its collaboration with Nvidia to enhance AI-driven automotive capabilities.

最近,"英伟达魔法"在美国股票市场中成为一个显著的特点。与主要汽车制造商合作的人工智能开发商Cerence的股票上周五飙升超过140%,在宣布与英伟达的人工智能合作后。同样,感知雷达解决方案的领导者Arbe 机器人在周一宣布与英伟达合作以增强人工智能驱动的汽车能力后,股价飙升超过50%。

At CES 2025, Nvidia CEO Jensen Huang announced several collaborations: with Micron Technology for memory in AI-powered gaming chips, with Aurora Innovation and Continental for scaling self-driving trucks and with Toyota Motor to develop next-gen autonomous vehicles. Nvidia's influence extends beyond its own stock, frequently impacting the sectors and companies it partners with in the U.S. stock market.

在2025年国际消费电子展上,英伟达首席执行官黄仁勋宣布了几项合作:与美光科技进行人工智能驱动的游戏芯片内存合作,与Aurora Innovation和大陆集团合作扩大自动驾驶卡车,以及与丰田汽车合作开发下一代自主车辆。英伟达的影响力不仅限于自身股票,还经常影响它在美国股票市场上与之合作的板块和公司。

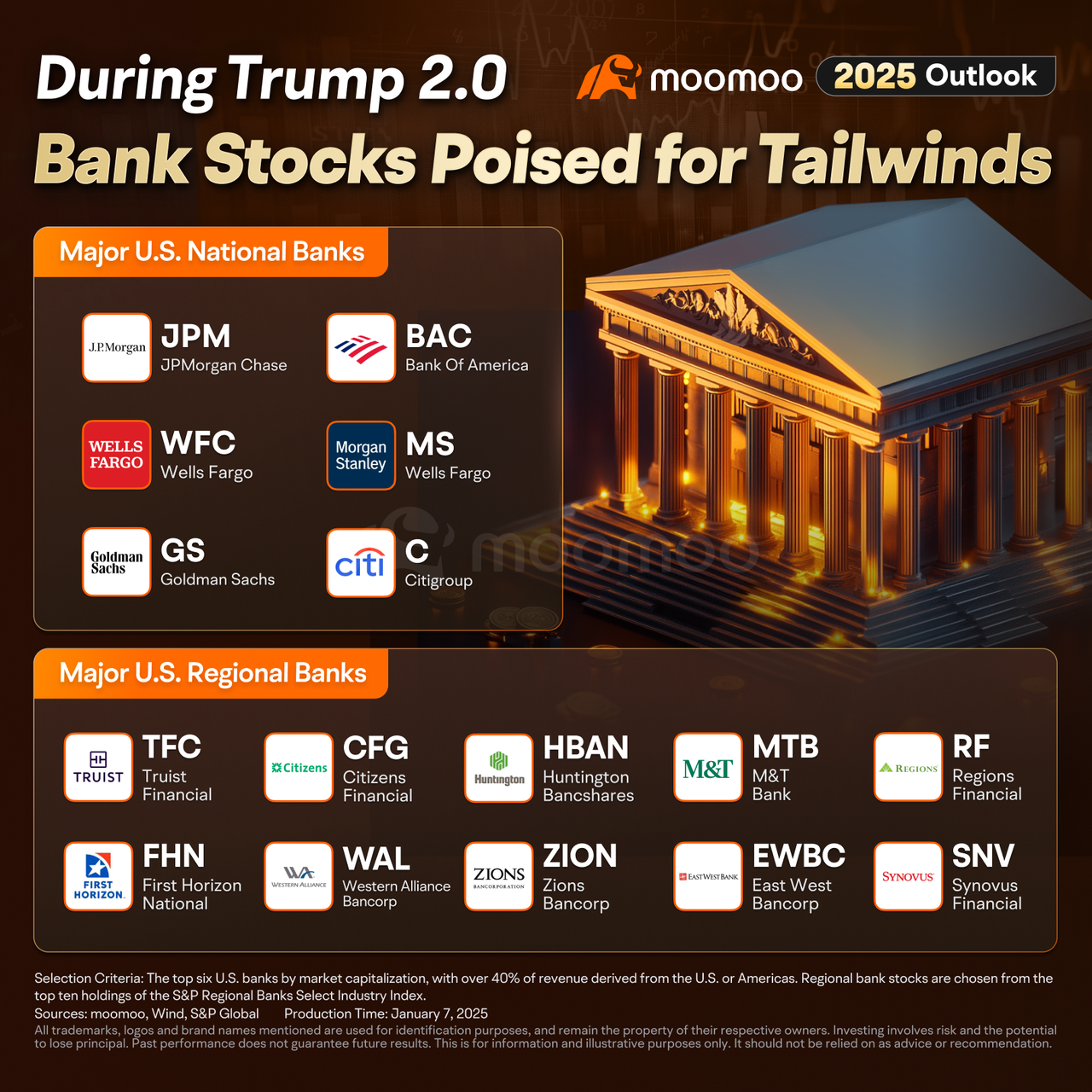

Barr to Step Down as Fed Vice Chair; Bank Stocks Poised for Gains in Trump 2.0

巴尔将辞去美联储副主席职务;银行股票在特朗普2.0时代有望上涨

With Barr's resignation, the U.S. banking sector appears to have secured a concession from regulators. As Trump's January 20 inauguration approaches, his policy emphasis on deregulation could make the banking sector a primary beneficiary during his term.

随着巴尔的辞职,美国银行业似乎从监管机构那里获得了让步。随着特朗普1月20日的就职典礼临近,他对放松监管的政策重点可能使银行业成为他任期内的主要受益者。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免责声明:本演示材料仅供信息和教育用途,并不构成对任何特定投资或投资策略的推荐或认可。本内容提供的投资信息具有一般性,仅供参考,可能不适用于所有投资者。信息提供时未考虑个人投资者的财务能力、财务状况、投资目标、投资时间框架或风险承受能力。在做出任何投资决定之前,您应考虑根据自己相关的个人情况,该信息的适当性。过去的投资表现并不表明或保证未来的成功。收益会有所不同,所有投资都存在风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo科技公司提供的金融信息和交易应用。在美国,moomoo提供的投资产品和服务由moomoo金融公司提供,成员为FINRA/SIPC。