Gold ETFs expected to record first monthly inflows in 8 months

Gold ETFs expected to record first monthly inflows in 8 months

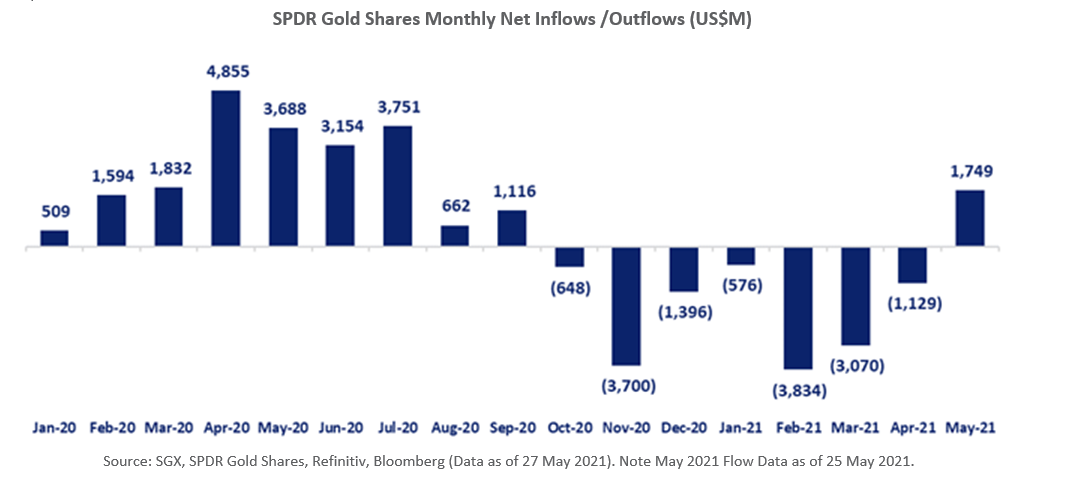

The five SPDR Gold Shares (「GLD」) ETFs have seen global inflows of US$1.7 billion in the May month-to-date. This poises these purported safe haven ETFs to record their first monthly inflows since September 2020. The preceding seven months had seen total outflows of US$14.4 billion.

The SGX-listed SPDR GLD ETF has seen its unit price gain 7.0% from 165.75 to 177.50 over the course of May, extending the 4.8% gains in April. The non-SIP ETF, also included under the CPFIS-OA/SA, has a min board lot size of 5 units (approx. 0.47 ounces of Gold), which at US$175.50, has a value of US$877.50 (approx. S$1,160).

Trading turnover of the SGX-listed SPDR GLD ETF at US$54 million for the May month-to-date is at the highest monthly level since US$63 million recorded in January. During May, another ETF, also recognised as an 'inflation play', the non SGX-listed iShares TIPS ETF, edged higher to form a new high since its inception in Dec 2003.

今年5月至今,这5只SPDR Gold Shares(“GLD”)ETF的全球资金流入已达17亿美元。这使得这些号称避险的ETF自2020年9月以来首次录得月度资金流入。在此之前的7个月中,资金流出总额为144亿美元。

在新加坡交易所上市的SPDR GLD ETF的单位价格在5月份从165.75上涨至177.50,涨幅为7.0%,延续了4月份4.8%的涨幅。非SIP ETF也包括在CPFIS-OA/SA中,最小板批量为5个单元(约0.47盎司黄金),价值175.50美元,价值877.50美元。(1160新元)。

新加坡交易所上市的SPDR GLD ETF 5月迄今成交额为5,400万美元,为1月录得6,300万美元以来的最高月度成交额。今年5月,另一只同样被视为“通胀游戏”的ETF--非新加坡交易所上市的iShares TIPS ETF--小幅走高,创下2003年12月成立以来的新高。

Gold ETF's Portfolio Application

黄金ETF的投资组合应用

The objective of the SPDR Gold Shares ETF is to reflect the performance of the price of gold bullion, less the trust’s expenses of 0.4% per annum. The ETF units represent fractional, undivided interests in the trust, the primary asset of which is allocated gold. The ETF also uses the LBMA Gold Price PM as the reference benchmark price in calculating the net asset value of the trust.

SPDR Gold Shares ETF的目标是反映金条价格的表现,减去信托每年0.4%的费用。ETF单位代表信托中的部分、不可分割的利益,信托的主要资产是黄金。ETF还使用LBMA Gold Price PM作为计算信托资产净值的参考基准价格。

Since its inception in the United States in November 2004, the ETF has generated an annualised return of 9% in USD terms or 8% in SGD terms through to May 2020. The SPDR Gold Shares ETF was subsequently listed on SGX in October 2006 with the intention of lowering barriers such as access, custody, and transaction costs that had traditionally prevented investors from investing in gold. When the price of gold peaked in 2011, SPDR Gold Shares was briefly ranked the world’s biggest ETF by assets under management.

自2004年11月在美国成立以来,截至2020年5月,ETF以美元计算的年化回报率为9%,以新元计算的年化回报率为8%。SPDR Gold Shares ETF随后于2006年10月在新交所上市,目的是降低传统上阻碍投资者投资黄金的准入、托管和交易成本等障碍。当金价在2011年见顶时,SPDR Gold Shares曾短暂地被评为全球管理资产规模最大的ETF。

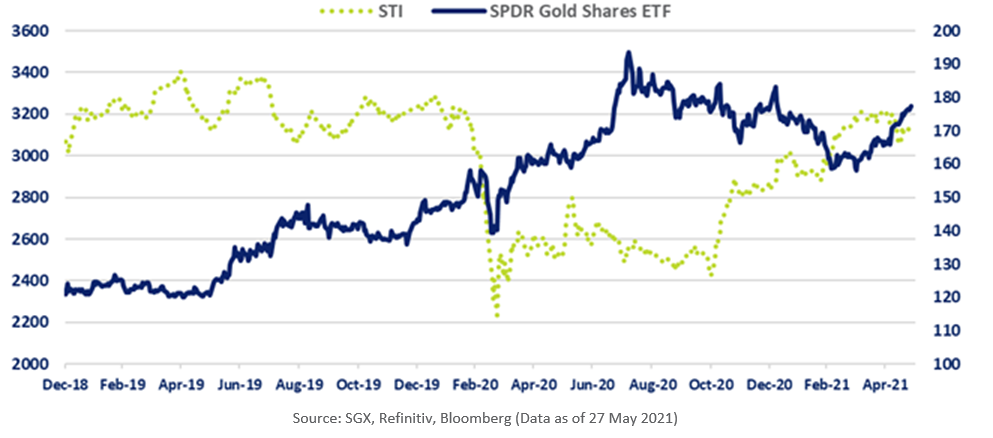

As a global asset class, Gold has multiple attributes. The predominant application of Gold ETFs is portfolio diversification. Including assets with a low correlation to each other does help reduce overall portfolio risk and the Straits Times Index has a minimal historical 5% correlation to Gold. The World Gold Council do suggest that when investors add risky assets, Gold should make up between 2% and 10% of the portfolio.

作为全球资产类别,黄金具有多种属性。黄金ETF的主要应用是投资组合多样化。纳入彼此相关性较低的资产确实有助于降低整体投资组合风险,海峡时报指数与黄金的历史相关性最低为5%。世界黄金协会(World Gold Council)确实建议,当投资者增加风险资产时,黄金在投资组合中的占比应在2%至10%之间。

More recently Gold’s application as a potential hedge against inflation has taken the spotlight, docketed as a reason for the 7.0% gains in the Gold ETFs observed in the May month-to-date.A non SGX-listed ETF, the iShares TIPS ETF, which is based on the Bloomberg Barclays Capital US Treasury Inflation Notes Index, edged higher to early May to form a new high since its inception in Dec 2003. Much of the current global inflation concerns are tied to surges in commodity prices, which has benefited the relevant commodity producer stocks. In addition, expansionary monetary policies of the Western economies has also raised inflation concerns, which in theory has the most impact on the prices of goods and services of those sectors that have been most impacted by the change in credit conditions, before working through to the broader gauges.

最近,黄金作为潜在的通胀对冲工具的应用成为聚光灯下的焦点,被认为是黄金ETF在5月份迄今上涨7.0%的原因。非新加坡交易所上市的iShares TIPS ETF基于彭博巴克莱资本美国国债通胀票据指数(Bloomberg Barclays Capital US Treasury Inflation Notes Index),小幅上涨至5月初,创下自2003年12月成立以来的新高。“iShares TIPS ETF”是一只非新加坡交易所上市的ETF,基于彭博巴克莱资本美国国债通胀票据指数(Bloomberg Barclays Capital US Treasury Inflation Notes Index)。当前全球通胀担忧很大程度上与大宗商品价格飙升有关,而大宗商品价格飙升令相关大宗商品生产商股票受益。此外,西方经济体的扩张性货币政策也引发了对通胀的担忧,理论上,在影响到更广泛的指标之前,通胀对受信贷状况变化影响最大的行业的商品和服务价格影响最大。

Gold ETF's S$1.7 Billion Inflows Since 30 April

黄金ETF自4月30日以来的17亿新元资金流入

The five SPDR Gold Shares ETFs have seen global inflows of US$1.7 billion in the May month-to-date. This poises these purported safe haven ETFs to record their first monthly inflows since September 2020. The preceding seven months had seen total outflows of US$14.4 billion.

今年5月至今,这五只SPDR Gold Shares ETF的全球资金流入已达17亿美元。这使得这些号称避险的ETF自2020年9月以来首次录得月度资金流入。在此之前的7个月中,资金流出总额为144亿美元。

The SGX-listed SPDR GLD ETF has seen its unit price gain 7.0% from 165.75 to 177.50 over the course of May, extending the 4.8% gains in April. The non-SIP ETF, also included under the CPFIS-OA/SA, has a min board lot size of 5 units (approx. 0.47 ounces of Gold), which at US$175.50, has a value of US$877.50 (approx. S$1,160). Trading turnover of the SGX-listed SPDR GLD ETF at US$54 million for the May month-to-date is at the highest monthly level since US$63 million recorded in January.

在新加坡交易所上市的SPDR GLD ETF的单位价格在5月份从165.75上涨至177.50,涨幅为7.0%,延续了4月份4.8%的涨幅。非SIP ETF也包括在CPFIS-OA/SA中,最小板批量为5个单元(约0.47盎司黄金),价值175.50美元,价值877.50美元。(1160新元)。新加坡交易所上市的SPDR GLD ETF 5月迄今成交额为5,400万美元,为1月录得6,300万美元以来的最高月度成交额。