A Look Into Walt Disney's Debt

A Look Into Walt Disney's Debt

Over the past three months, shares of Walt Disney (NYSE:DIS) decreased by 6.72%. Before having a look at the importance of debt, let us look at how much debt Walt Disney has.

在过去的三个月里,沃尔特·迪士尼(纽约证券交易所股票代码:DIS)下跌6.72%。在看债务的重要性之前,让我们先看看华特迪士尼有多少债务。

Walt Disney's Debt

沃尔特·迪士尼的债务

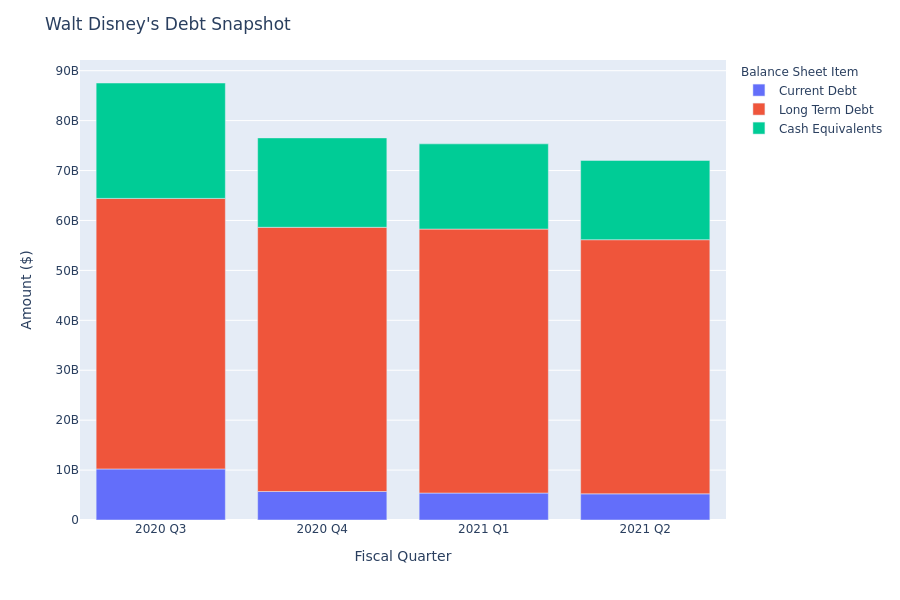

According to the Walt Disney's most recent financial statement as reported on May 13, 2021, total debt is at $56.15 billion, with $50.90 billion in long-term debt and $5.24 billion in current debt. Adjusting for $15.89 billion in cash-equivalents, the company has a net debt of $40.26 billion.

根据华特迪士尼2021年5月13日报道的最新财务报表,总债务为561.5亿美元,其中509亿美元是长期债务,52.4亿美元是流动债务。经158.9亿美元现金等价物调整后,该公司净债务为402.6亿美元。

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents include cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

让我们定义一下我们在上面段落中使用的一些术语。当前债务是指公司债务中1年内到期的部分,而长期债务是指1年以上到期的部分。现金等价物包括现金和到期日在90天或以下的任何流动证券。总债务等于当前债务加上长期债务减去现金等价物。

To understand the degree of financial leverage a company has, shareholders look at the debt ratio. Considering Walt Disney's $200.25 billion in total assets, the debt-ratio is at 0.28. As a rule of thumb, a debt-ratio more than one indicates that a considerable portion of debt is funded by assets. A higher debt-ratio can also imply that the company might be putting itself at risk for default, if interest rates were to increase. However, debt-ratios vary widely across different industries. A debt ratio of 35% might be higher for one industry and average for another.

为了了解一家公司的财务杠杆程度,股东们关注的是负债率。考虑到华特迪士尼2002.5亿美元的总资产,负债率为0.28。根据经验,债务比率超过1表明相当大一部分债务是由资产提供资金的。较高的负债率也可能意味着,如果利率上升,该公司可能会面临违约风险。然而,不同行业的负债率差别很大。对于一个行业来说,35%的负债率可能更高,而对另一个行业来说,平均水平可能更高。

Why Shareholders Look At Debt?

为什么股东要看债务?

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

债务是公司资本结构中的一个重要因素,可以帮助公司实现增长。债务的融资成本通常比股权相对较低,这使得它对高管来说是一个有吸引力的选择。

However, due to interest-payment obligations, cash-flow of a company can be impacted. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

然而,由于支付利息的义务,公司的现金流可能会受到影响。当公司将债务资本用于其业务运营时,股权所有者可以保留债务资本产生的超额利润。

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

寻找债务权益比较低的股票?看看Benzinga Pro,这是一个市场研究平台,为投资者提供了数十个股票指标的近乎即时的访问-包括债务与股本比率。单击此处了解更多信息。