Amundi, the largest European asset manager, has published 'Investing in the great transform' outlook for 2022.

We could pay attention to some key points:

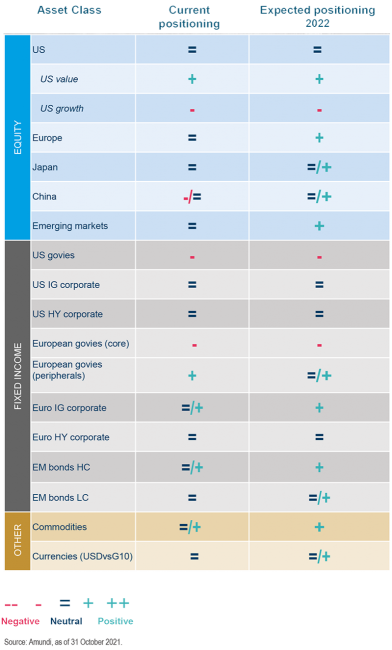

Key Investment Convictions For 2022-- Moving to a late cycle in H2: equities, EM and commodities favoured.

Play equity with a focus on the least stretched areas (value, EM, Europe) and sensitivity to higher rates.

Allocation: Start neutral and recalibrate risk

Focus on inflation-sensitive asset classes to build a resilient allocation.

Equities: Selection through inflation and ESG lenses

Balancing core value and momentum with quality. On themes, consider value (banks), pricing power (luxury, semi-conductors), rising commodities (energy), capex (capital goods) and quality (pharmaceuticals).

I am Molly. I would share with you information about wealth management, especially the holdings and opinions of professional investors, as well as the books for beginners.

![]()

![]()

Thanks for following me!

Let's explore more investment opportunities!

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$ $恒生指数 (800000.HK)$ $东汇A50-R (82843.HK)$