最新

熱門

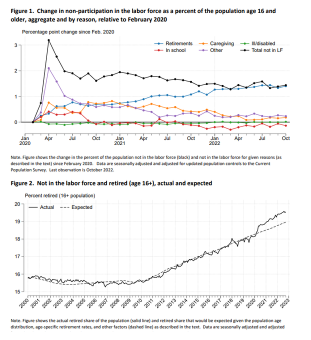

美聯儲研究:自2020年以來退休潮激增 “基本上造成所有就業參與率的不足” “退休人口激增佔去了所有就業參與率下降的部分”

“超過一半退休人數的增加似乎是疫情的直接結果”

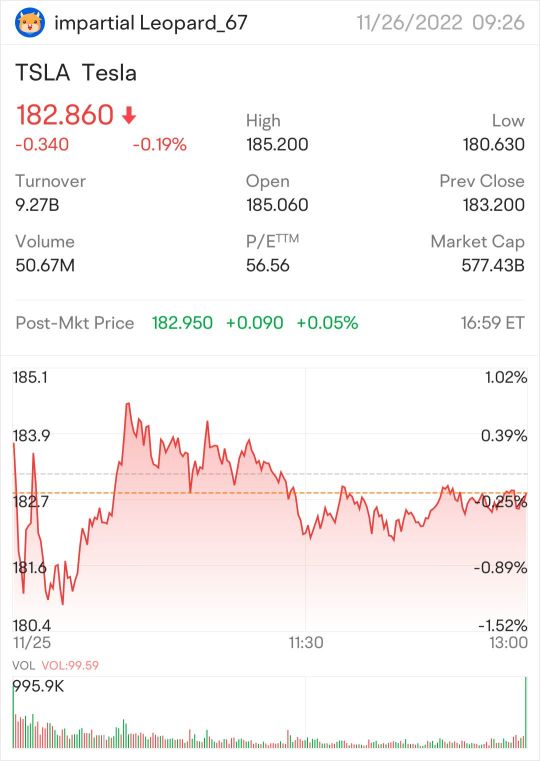

$SPDR 標普500指數ETF (SPY.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $亞馬遜 (AMZN.US)$ $微軟 (MSFT.US)$ $蘋果 (AAPL.US)$ $特斯拉 (TSLA.US)$

“超過一半退休人數的增加似乎是疫情的直接結果”

$SPDR 標普500指數ETF (SPY.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $亞馬遜 (AMZN.US)$ $微軟 (MSFT.US)$ $蘋果 (AAPL.US)$ $特斯拉 (TSLA.US)$

已翻譯

1

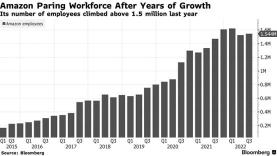

$亞馬遜 (AMZN.US)$ 將有超過18,000名員工被解雇,比之前計劃的10,000多名更多。

“這些變革將幫助我們以更強大的成本結構追求長期機會。” 亞馬遜首席執行官安迪·賈斯在一份發給員工的備忘錄中說。

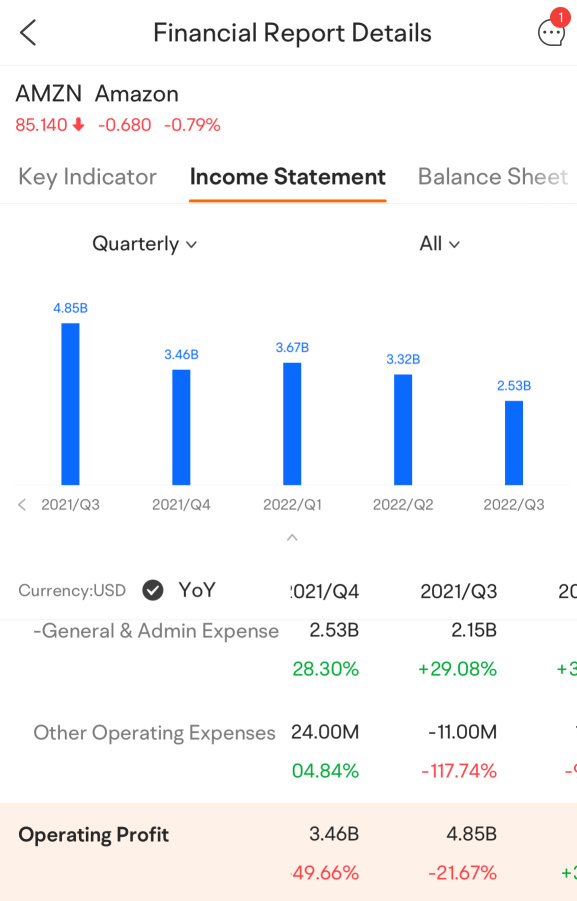

員工規模的高峰出現在2021年第三季度和第四季度,這也是財報顯示營業利潤同比下降的轉折點。

亞馬遜的...

“這些變革將幫助我們以更強大的成本結構追求長期機會。” 亞馬遜首席執行官安迪·賈斯在一份發給員工的備忘錄中說。

員工規模的高峰出現在2021年第三季度和第四季度,這也是財報顯示營業利潤同比下降的轉折點。

亞馬遜的...

已翻譯

+1

12

3

$亞馬遜 (AMZN.US)$ 根據《電腦世界》報導,亞馬遜可能在未來幾個月裁員多達20,000名員工,是最初報導數量的兩倍。這是一家資訊科技出版物。

本月初,紐約時報報導,這家零售商將裁減約10,000名企業員工,主要影響零售和人力資源部門的員工,以及那些從事亞馬遜設備(如語音助手Alexa)工作的人員。 11月17日,亞馬遜CEO安迪·賈西在一份通知中證實公司正在進行裁員,但沒有說明具體人數。他還表示,亞馬遜已經向人員經驗和技術團隊提供自願購買的機會,該團隊為公司的員工設計科技。

本月初,紐約時報報導,這家零售商將裁減約10,000名企業員工,主要影響零售和人力資源部門的員工,以及那些從事亞馬遜設備(如語音助手Alexa)工作的人員。 11月17日,亞馬遜CEO安迪·賈西在一份通知中證實公司正在進行裁員,但沒有說明具體人數。他還表示,亞馬遜已經向人員經驗和技術團隊提供自願購買的機會,該團隊為公司的員工設計科技。

已翻譯

4

1

$GlobalFoundries (GFS.US)$ $英偉達 (NVDA.US)$ $3倍做多半導體ETF-Direxion (SOXL.US)$ 領先的半導體製造商GlobalFoundries正準備裁員高達800名員工,佔全球約15,000人的員工人數的約5.3%。

裁員並不集中在任何特定地理區域,根據維蒙特州的新聞網站VTDigger報導,這是有關裁員人數的消息首先曝光的地方。 彭博曾首先報導...

裁員並不集中在任何特定地理區域,根據維蒙特州的新聞網站VTDigger報導,這是有關裁員人數的消息首先曝光的地方。 彭博曾首先報導...

已翻譯

3

在失業期間

Twitter、Facebook、Sears、CVS、Walgreens、雜貨商店、石油鑽井工人、所有類型的銀行、卡車司機、各類型醫院、酒店、所有類型的車行、餐廳和郵輪然後學校。

Twitter、Facebook、Sears、CVS、Walgreens、雜貨商店、石油鑽井工人、所有類型的銀行、卡車司機、各類型醫院、酒店、所有類型的車行、餐廳和郵輪然後學校。

已翻譯

1