最新

熱門

Core Points:

1 management change, but this does not mean big strategy or culture shifts.

2 advertising platforms: 1) open only 2 months and the demand is exceeding supply. This is a testament to lots of hard work for both Microsoft and Netflix teams. 2) plan switching. Not seeing as expected much switching from high-arm subscription plans like premium into the ads plan.

3 subscribers:a bunch of people around the world in countries were not d...

1 management change, but this does not mean big strategy or culture shifts.

2 advertising platforms: 1) open only 2 months and the demand is exceeding supply. This is a testament to lots of hard work for both Microsoft and Netflix teams. 2) plan switching. Not seeing as expected much switching from high-arm subscription plans like premium into the ads plan.

3 subscribers:a bunch of people around the world in countries were not d...

3

現在正值盈利旺季的時候!

銀行業績公佈後,我們開始控制項 $奈飛 (NFLX.US)$.

奈飛以前是一隻受人矚目的股票,也是FAANG的成員之一,奈飛在2023年第一季表現如何?

表現還可以。

以下是一些需要注意的最新收益要點。

1. 它仍然在成長。

收入從USD 78.7億增長了3.7%,達到USD 81.6億。

然而,營業利潤和凈利潤分別下降了13%和18%。

但是,稀釋EPS縮水了。

銀行業績公佈後,我們開始控制項 $奈飛 (NFLX.US)$.

奈飛以前是一隻受人矚目的股票,也是FAANG的成員之一,奈飛在2023年第一季表現如何?

表現還可以。

以下是一些需要注意的最新收益要點。

1. 它仍然在成長。

收入從USD 78.7億增長了3.7%,達到USD 81.6億。

然而,營業利潤和凈利潤分別下降了13%和18%。

但是,稀釋EPS縮水了。

已翻譯

+1

4

The main focus of Netflix's financial report is as follows:

1) The growth of the number of users of the company, and the progress of cracking down on shared accounts.

2) The company's ARM performance, the effectiveness of advertising and other multi-monetization.

3) The company's industry competitiveness, including content competitiveness, etc.

1. The company's revenue fell short of expectations, its profits exceeded expectations, and its perf...

1) The growth of the number of users of the company, and the progress of cracking down on shared accounts.

2) The company's ARM performance, the effectiveness of advertising and other multi-monetization.

3) The company's industry competitiveness, including content competitiveness, etc.

1. The company's revenue fell short of expectations, its profits exceeded expectations, and its perf...

+2

4

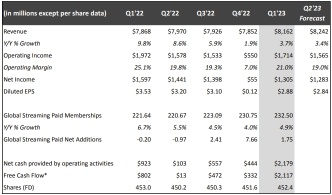

Netflix Q1 FY23:

Subs +1.75M Q/Q.

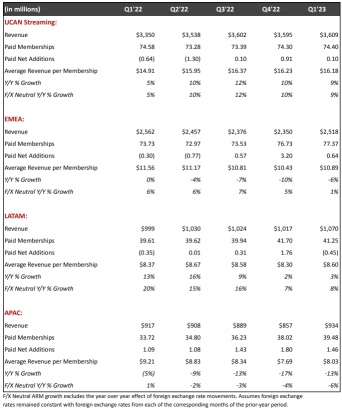

ARM +4% Y/Y fx neutral.

• Revenue +4% Y/Y to $8.16B ($20M miss).

• +8% Y/Y fx neutral.

• Operating margin 21% (1pp beat).

• EPS $2.88 ($0.01 beat).

Q2 FY23 Guidance:

• Revenue +3% Y/Y (+6% fx neutral).

• Operating margin 19%.

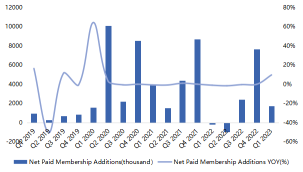

Netflix subscribers Q1 FY23:

Overall: 232.50M (+1.75M Q/Q).

• UCAN: +0.10M Q/Q.

• EMEA: +0.64M Q/Q.

• LATAM: (0.45M) Q/Q.

• APAC: +1.46M Q/Q.

$奈飛 (NFLX.US)$earnings after hours

Sell puts, they will report HORRIBLE earnings

Buy...

Subs +1.75M Q/Q.

ARM +4% Y/Y fx neutral.

• Revenue +4% Y/Y to $8.16B ($20M miss).

• +8% Y/Y fx neutral.

• Operating margin 21% (1pp beat).

• EPS $2.88 ($0.01 beat).

Q2 FY23 Guidance:

• Revenue +3% Y/Y (+6% fx neutral).

• Operating margin 19%.

Netflix subscribers Q1 FY23:

Overall: 232.50M (+1.75M Q/Q).

• UCAN: +0.10M Q/Q.

• EMEA: +0.64M Q/Q.

• LATAM: (0.45M) Q/Q.

• APAC: +1.46M Q/Q.

$奈飛 (NFLX.US)$earnings after hours

Sell puts, they will report HORRIBLE earnings

Buy...

奈飛在收盤後公布了營收報告。以下是結果。

每股收益: 實際$2.88 相對預期$2.86

營業收入: 實際$81.6億 相對預期$81.8億

一年前,奈飛報告了十年來的首次訂閱用戶數損失,使其股價和其媒體同行的股價一起下跌。 這些結果促使奈飛和其流媒體競爭對手將利潤放在訂閱用戶數之上。

該國新的支持廣告的套餐結果將會是...

每股收益: 實際$2.88 相對預期$2.86

營業收入: 實際$81.6億 相對預期$81.8億

一年前,奈飛報告了十年來的首次訂閱用戶數損失,使其股價和其媒體同行的股價一起下跌。 這些結果促使奈飛和其流媒體競爭對手將利潤放在訂閱用戶數之上。

該國新的支持廣告的套餐結果將會是...

已翻譯

Netflix $奈飛 (NFLX.US)$ released its Q1 earnings report, which showed mixed results and raised questions about the company’s future growth potential.

While Netflix's earnings per share (EPS) of $2.88 beat analysts' expectations of $2.86, the company fell short on subscriber growth and revenue expectations, with 1.75 million net additions versus the expected 2.3 million, and revenue of $8.16 billion versus $8.18 billion expected.

Thei...

While Netflix's earnings per share (EPS) of $2.88 beat analysts' expectations of $2.86, the company fell short on subscriber growth and revenue expectations, with 1.75 million net additions versus the expected 2.3 million, and revenue of $8.16 billion versus $8.18 billion expected.

Thei...

1

Netflix $奈飛 (NFLX.US)$ 今年開始緩慢,在第一季度僅增加了 175 萬客戶後,缺少了華爾街的估計值,而預期的 231 萬名客戶則缺少。該公司還預測本季度的銷售額和利潤會降低,從而延遲了其打擊美國密碼共享的計劃。這標誌著 Netflix 已經開始連續第二年...

已翻譯

3

3

$奈飛 (NFLX.US)$ 剛公布了他們的 Q1'FY23 財報 他們的每股收益僅超出0.70%的預測(每股收益為$2.88),然而他們的營業收入只略微低於0.10%的預測(營業收入為$8.17億)。

主要亮點(Q1'FY23):

- 營業收入相較前年改善至+3.7%

- 營業利潤率相較前年改善至+21.0%

- 全球付費流媒體訂戶相較前年改善至+4.9%

- 營業活動產生的淨現金流量也大幅改善了

- 他們還延遲了...

主要亮點(Q1'FY23):

- 營業收入相較前年改善至+3.7%

- 營業利潤率相較前年改善至+21.0%

- 全球付費流媒體訂戶相較前年改善至+4.9%

- 營業活動產生的淨現金流量也大幅改善了

- 他們還延遲了...

已翻譯

1

今天讓我們來看看為什麼 $奈飛 (NFLX.US)$ 最近一直表現很好。

原始內容:Netflix 對原始內容進行大量投資的策略獲得了很好的回報。他們創建了一個大型屢獲殊榮且受好評的電視節目和電影圖書館,包括「陌生事物」,「皇冠」,「Narcos」和「卡牌屋」。

用戶體驗:Netflix 的用戶界面易於導航,並且提供了個性化的經驗...

原始內容:Netflix 對原始內容進行大量投資的策略獲得了很好的回報。他們創建了一個大型屢獲殊榮且受好評的電視節目和電影圖書館,包括「陌生事物」,「皇冠」,「Narcos」和「卡牌屋」。

用戶體驗:Netflix 的用戶界面易於導航,並且提供了個性化的經驗...

已翻譯

1