最新

熱門

$矽谷銀行 (SIVB.US)$ $星展集團控股 (D05.SG)$ $華僑銀行 (O39.SG)$ $大華銀行 (U11.SG)$ $Signature Bank (SBNY.US)$

新加坡銀行系統仍然 “穩健和有彈性” 在矽谷銀行(SVB)最近倒閉和其他幾家小型銀行倒閉的情況下,新加坡金融管理局(MAS)星期一表示,分析師也預計SVB的崩潰對新加坡銀行的影響有限,考慮了當地銀行和SVb之間的基本差異。

分析師也預期矽谷銀行(SVB)的崩潰對新加坡銀行的影響有限 分析師也預期,考慮了當地銀行和SVb之間的基本差異,SVb的倒塌對新加坡銀行的影響有限在新加坡銀行(MAS)星期一表示,新加坡銀行系統在矽谷銀行(SVB)和其他一些小銀行最近倒閉的情況下仍然“穩健和有彈性”之間,考量了當地銀行和SVb之間的基本不同。

新加坡銀行系統仍然 “穩健和有彈性” 在矽谷銀行(SVB)最近倒閉和其他幾家小型銀行倒閉的情況下,新加坡金融管理局(MAS)星期一表示,分析師也預計SVB的崩潰對新加坡銀行的影響有限,考慮了當地銀行和SVb之間的基本差異。

分析師也預期矽谷銀行(SVB)的崩潰對新加坡銀行的影響有限 分析師也預期,考慮了當地銀行和SVb之間的基本差異,SVb的倒塌對新加坡銀行的影響有限在新加坡銀行(MAS)星期一表示,新加坡銀行系統在矽谷銀行(SVB)和其他一些小銀行最近倒閉的情況下仍然“穩健和有彈性”之間,考量了當地銀行和SVb之間的基本不同。

已翻譯

1

I don’t think SVB will be the end of troublesome signs coming from banks. The fractional reserve system of the banks is going to reveal how fragile and how thin of a line the banks walk on.

2

$星展集團控股 (D05.SG)$ $華僑銀行 (O39.SG)$ $大華銀行 (U11.SG)$ $矽谷銀行 (SIVB.US)$

“我們的新加坡銀行如今資本充足,並有足夠的備付金以應對任何需要減記的情況,並且在世界排名和基準中位列最強大和最安全。”

“我們認為新加坡銀行今天的股價下跌是一個“累積”的機會 如:

![]() 由於銀行運行的傳染效應不應該傳播到新加坡,因為...

由於銀行運行的傳染效應不應該傳播到新加坡,因為...

“我們的新加坡銀行如今資本充足,並有足夠的備付金以應對任何需要減記的情況,並且在世界排名和基準中位列最強大和最安全。”

“我們認為新加坡銀行今天的股價下跌是一個“累積”的機會 如:

已翻譯

1

華倫·巴菲特的伯克希爾哈薩威公司可能在僅僅3個交易日內看到大約800億元的金融股價蒸發。 80億美元 僅僅3個交易日內,硅谷銀行崩潰引發了這一行業的大甩賣,華倫·巴菲特的伯克希爾哈薩威公司的金融股票價值可能蒸發了800億元。

這位著名投資家的公司在去年12月底時持有大約的銀行、保險和金融服務股票,最新的投資組合報告顯示。 740億美元 在去年12月底,這位著名投資者的公司擁有銀行、保險和金融服務股票的份額約為

這位著名投資家的公司在去年12月底時持有大約的銀行、保險和金融服務股票,最新的投資組合報告顯示。 740億美元 在去年12月底,這位著名投資者的公司擁有銀行、保險和金融服務股票的份額約為

已翻譯

$矽谷銀行 (SIVB.US)$ $星展集團控股 (D05.SG)$ $華僑銀行 (O39.SG)$ $大華銀行 (U11.SG)$

分析師們仍對新加坡銀行的前景持樂觀態度 樂觀的 對於新加坡銀行的前景,分析師們認為存在幾個重大的差異,使得當地的貸款機構與SVB有著顯著的區別:

新加坡联昌证券研究部负责人Thilan Wickramasinghe:

![]() (興衰緣何)更像是一場老式的流動性危機,而非真正的償債危機...

(興衰緣何)更像是一場老式的流動性危機,而非真正的償債危機...

分析師們仍對新加坡銀行的前景持樂觀態度 樂觀的 對於新加坡銀行的前景,分析師們認為存在幾個重大的差異,使得當地的貸款機構與SVB有著顯著的區別:

新加坡联昌证券研究部负责人Thilan Wickramasinghe:

已翻譯

1

$矽谷銀行 (SIVB.US)$ $星展集團控股 (D05.SG)$ $華僑銀行 (O39.SG)$ $大華銀行 (U11.SG)$

自2008年全球金融危機(GFC)以來,SVB成為最大的美國銀行破產,在上周四(3月9日)開始的該銀行股票暴跌,波及其他美國和歐洲銀行。

在該銀行宣布計劃進行資本增資不到48小時之後,該銀行經歷了一波提款潮...

自2008年全球金融危機(GFC)以來,SVB成為最大的美國銀行破產,在上周四(3月9日)開始的該銀行股票暴跌,波及其他美國和歐洲銀行。

在該銀行宣布計劃進行資本增資不到48小時之後,該銀行經歷了一波提款潮...

已翻譯

2

在過去的一個星期裡,美國的整個金融體系被質疑。我們有美國第16大銀行稱為矽谷銀行被接管,許多初創公司正在掙扎,因為他們的資金被凍結。

如果這些初創企業和存款人無法收回他們的無法保險存款,這將嚴重損害美國的創新。我對某些監管方最終對該系統採取行動不感到驚訝。這可能不是為硅谷銀行,而是為其他銀行而存在。 但對於其他銀行、基金和其他公司,他們需要密切關注市場以避免影響他們的業務和投資。

如果這些初創企業和存款人無法收回他們的無法保險存款,這將嚴重損害美國的創新。我對某些監管方最終對該系統採取行動不感到驚訝。這可能不是為硅谷銀行,而是為其他銀行而存在。 但對於其他銀行、基金和其他公司,他們需要密切關注市場以避免影響他們的業務和投資。

已翻譯

矽谷銀行(SVB)的新CEO Tim Mayopoulos向客戶發送了一封電子郵件 該銀行已經重新開放,並且一切業務都如常新銀行將接受新的存款,現有存款也將由聯邦存款保險公司(FDIC)保護

該電子郵件提到 FDIC已將SVB的存款和資產轉移到一家新的臨時銀行 所有於3月9日或10日提交但尚未處理的電匯已被取消,並將...

該電子郵件提到 FDIC已將SVB的存款和資產轉移到一家新的臨時銀行 所有於3月9日或10日提交但尚未處理的電匯已被取消,並將...

已翻譯

3

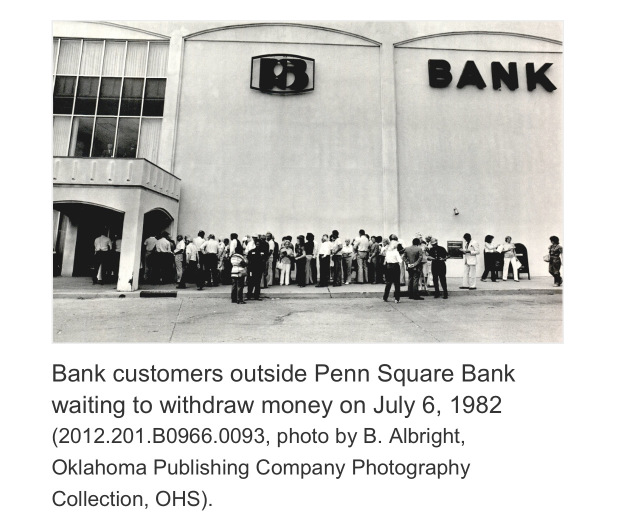

當賓夕法尼亞廣場銀行被聯邦調查局關閉在 '81 存款人失去了 163 百萬美元的無保險賬戶.

位於華盛頓的西雅圖第一國民銀行(Seafirst)是第一批因參與活動損失而導致的失敗之一。不久之後,伊利諾伊州大陸國家銀行和信託公司在芝加哥參與了近 10 億美元的貸款,成為迄今為止美國歷史上最大的銀行倒閉。

到了晚 1...

位於華盛頓的西雅圖第一國民銀行(Seafirst)是第一批因參與活動損失而導致的失敗之一。不久之後,伊利諾伊州大陸國家銀行和信託公司在芝加哥參與了近 10 億美元的貸款,成為迄今為止美國歷史上最大的銀行倒閉。

到了晚 1...

已翻譯