Nikkei225 – “no rate hike when financial markets are unstable”

➡️ This morning, global equities are rebounding for a second day, led by the Nikkei 225 Index which is up 3%s as of 1145AM. Japanese equities have headed higher, and the Japanese yen as well as Japanese government bonds lower. This follows the latest comments from Bank of Japan’s deputy governor Shinichi Uchida that the BoJ “needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile.”

➡️ Investors are taking this as a dovish signal that the Bank of Japan is on hold with rate hikes for a while after the BoJ ended its ultra-easy policy with its first hike in 17 years on 31 July 2024. The Japanese stock market had dived 20% in the three days after the rate hike, and suffered its biggest drop since 1987 following chatter that the BoJ may hike for a second time in October.

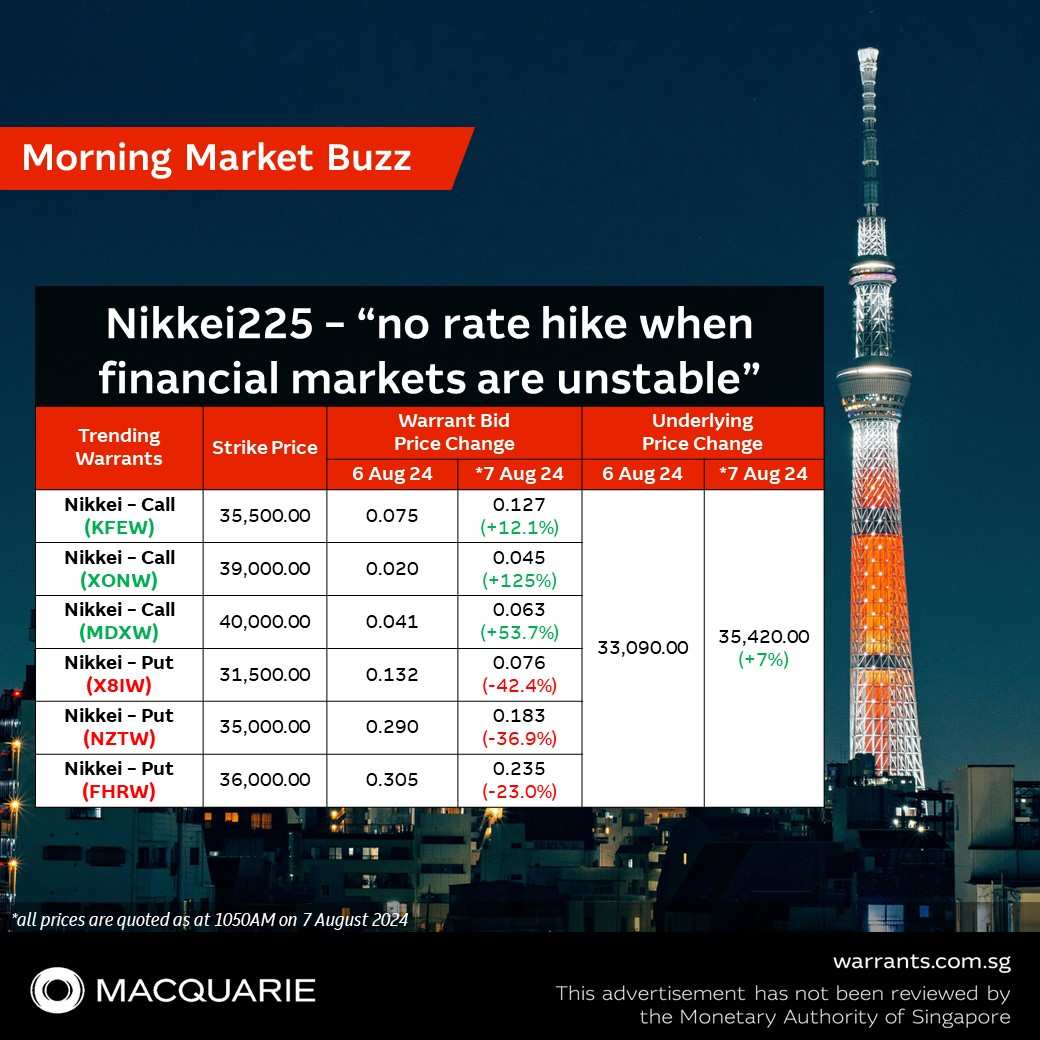

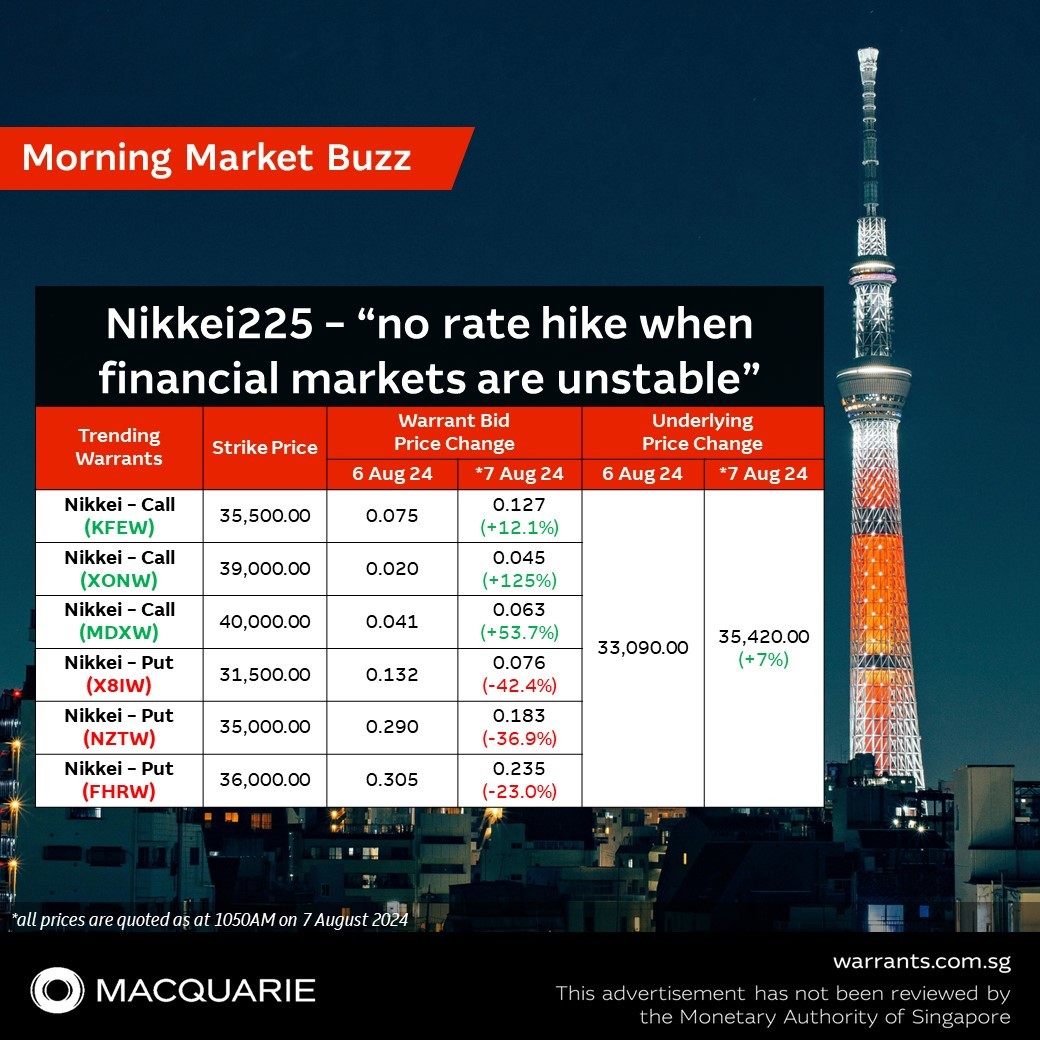

➡️ Those who foresee further volatility in the Nikkei 225 may wish to use Macquarie’s trending Nikkei225 call or put warrants – which move in greater percentages than the Nikkei 225 futures index. As an example, Macquarie’s trending Nikkei call warrant NKY 40000MBeCW241213 (MDXW) is up 58.5% to SGD 0.065 whilst trending put warrant NKY 36000MBePW241213 (FHRW) is down 24.6% to SGD 0.230 with the Nikkei225 futures trading 4.2% higher as of 1145AM.

▪️ Uchida: the bank will not raise interest rates when financial and capital markets are unstable

➡️ Uchida’s speech this morning was to local business leaders in Hakodate, northern Japan, and were the first public remarks by a BOJ board member since the bank hiked interest rates on July 31. “In contrast to the process of policy interest rate hikes in Europe and the United States, Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy interest rate at a certain pace,” Uchida said. “Therefore, the bank will not raise its policy interest rate when financial and capital markets are unstable.”

➡️ Uchida was heavily involved with designing the BOJ’s massive monetary easing program that ran for more than a decade, and is widely known for playing a prominent role in mapping out Governor Kazuo Ueda’s journey toward normalizing policy. (Bloomberg)

▪️ Traders remain short on futures across major indices

While volatility in the Nikkei 225 exchange-traded options market has decreased, it continues to hover at elevated levels.

📖 Read more: https://tinyurl.com/MMB7Aug24

➡️ Investors are taking this as a dovish signal that the Bank of Japan is on hold with rate hikes for a while after the BoJ ended its ultra-easy policy with its first hike in 17 years on 31 July 2024. The Japanese stock market had dived 20% in the three days after the rate hike, and suffered its biggest drop since 1987 following chatter that the BoJ may hike for a second time in October.

➡️ Those who foresee further volatility in the Nikkei 225 may wish to use Macquarie’s trending Nikkei225 call or put warrants – which move in greater percentages than the Nikkei 225 futures index. As an example, Macquarie’s trending Nikkei call warrant NKY 40000MBeCW241213 (MDXW) is up 58.5% to SGD 0.065 whilst trending put warrant NKY 36000MBePW241213 (FHRW) is down 24.6% to SGD 0.230 with the Nikkei225 futures trading 4.2% higher as of 1145AM.

▪️ Uchida: the bank will not raise interest rates when financial and capital markets are unstable

➡️ Uchida’s speech this morning was to local business leaders in Hakodate, northern Japan, and were the first public remarks by a BOJ board member since the bank hiked interest rates on July 31. “In contrast to the process of policy interest rate hikes in Europe and the United States, Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy interest rate at a certain pace,” Uchida said. “Therefore, the bank will not raise its policy interest rate when financial and capital markets are unstable.”

➡️ Uchida was heavily involved with designing the BOJ’s massive monetary easing program that ran for more than a decade, and is widely known for playing a prominent role in mapping out Governor Kazuo Ueda’s journey toward normalizing policy. (Bloomberg)

▪️ Traders remain short on futures across major indices

While volatility in the Nikkei 225 exchange-traded options market has decreased, it continues to hover at elevated levels.

📖 Read more: https://tinyurl.com/MMB7Aug24

免責聲明:社區由Moomoo Technologies Inc.提供,僅用於教育目的。

更多信息

評論

登錄發表評論