美十年期國債收益率突破4.8%,這意味著什麼?

美十年期國債收益率突破4.8%,這意味著什麼?

瀏覽 6.5萬

內容 117

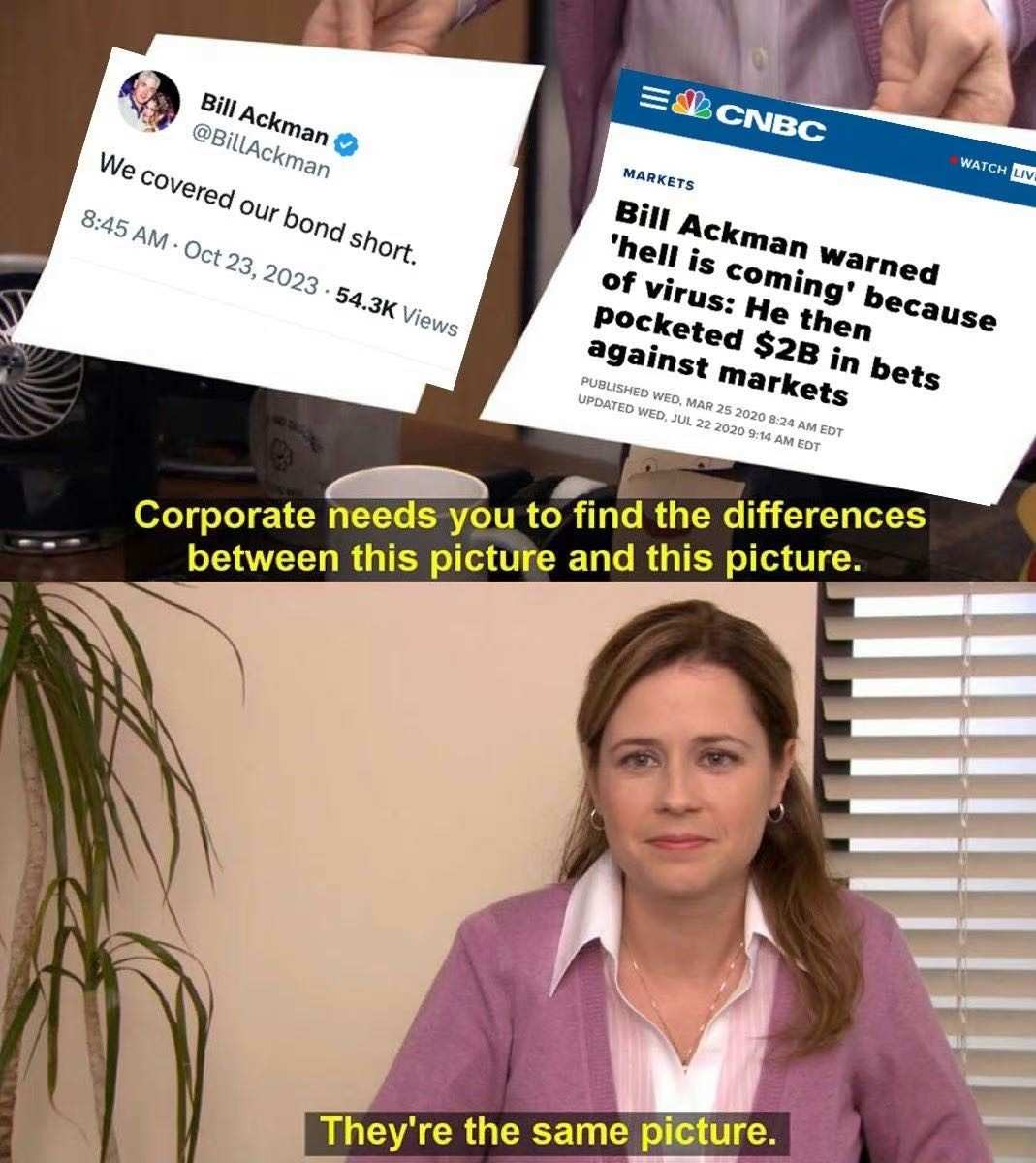

比爾·阿克曼對美國國庫債投注 200 億美元。他是否在正確的時間兌現?

消息人士告訴《金融時報》,億萬富翁對沖基金經理比爾·阿克曼從對美國 30 年期國庫債投注中獲利約 200 萬美元。

珀盛廣場資本管理公司的創始人週一在社交媒體帖子中寫道,他在中解決了投注 增加的全球風險。

準時的市場比賽有助於推動漲幅。在阿克曼 8 月宣布短投注時,債券收益率正在上升,引起預期: 由於穩固的通脹和庫務供應增加的可能性,利率更高。 然後,不久之後,大量買家流出使庫務局陷入混亂。

阿克曼的推文引發了庫務價格復甦。週一,30 年期國債收益率上漲至 5.17%,在阿克曼宣布退出空頭寸,以色列-哈馬斯衝突中死亡人數上升的消息使投資者恐懼,使收益率回歸 5% 以下。

瑞銀全球財富管理分析師週二表示,國庫收益率不太可能進一步上漲,並增加了投資者表示美國政府債券的賣出即將接近結束。

然而,美國經濟實力的新跡象表明,債券收益率仍有更大的增長潛力。 9 月新建住宅的銷售額上升 12.3%,支持利率可能長期維持高的擔憂。今天的每週失業索償數據預計將走高。

雖然預計進一步數據將支持這種前景,但美聯儲預計下週將保持利率穩定,並可能在 12 月份上漲。無論比爾·阿克曼是否支付,債券收益率仍可能會有更大的推動向上升,因為通脹預期導致上升。

穆爾斯,您相信我們已經看到收益率最高?阿克曼早點交易了嗎?

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

lightfoot : 美國市場的不確定性太大。納斯達克將持續下跌。債券上漲更多利率上漲。現金看起來很好休息一下。你好床墊