博通盈利預覽:猜中開盤價,獲得豐厚獎勵!

嗨,mooer們!

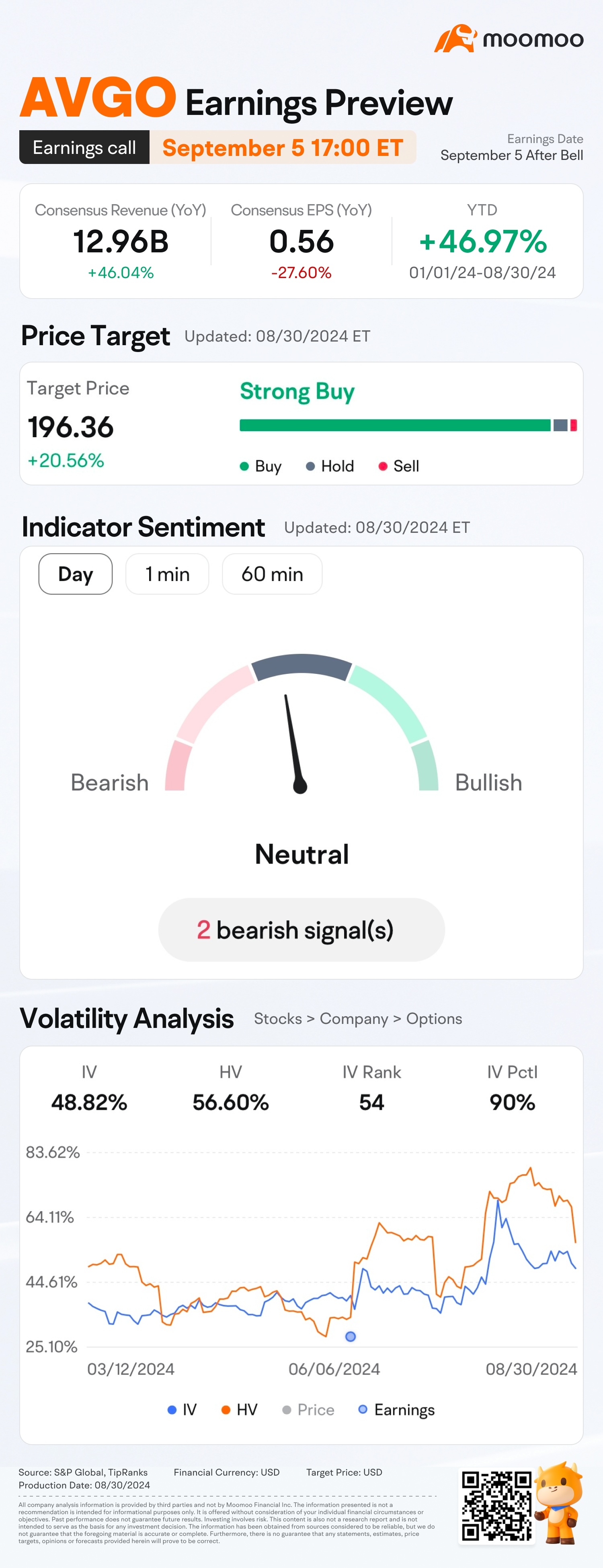

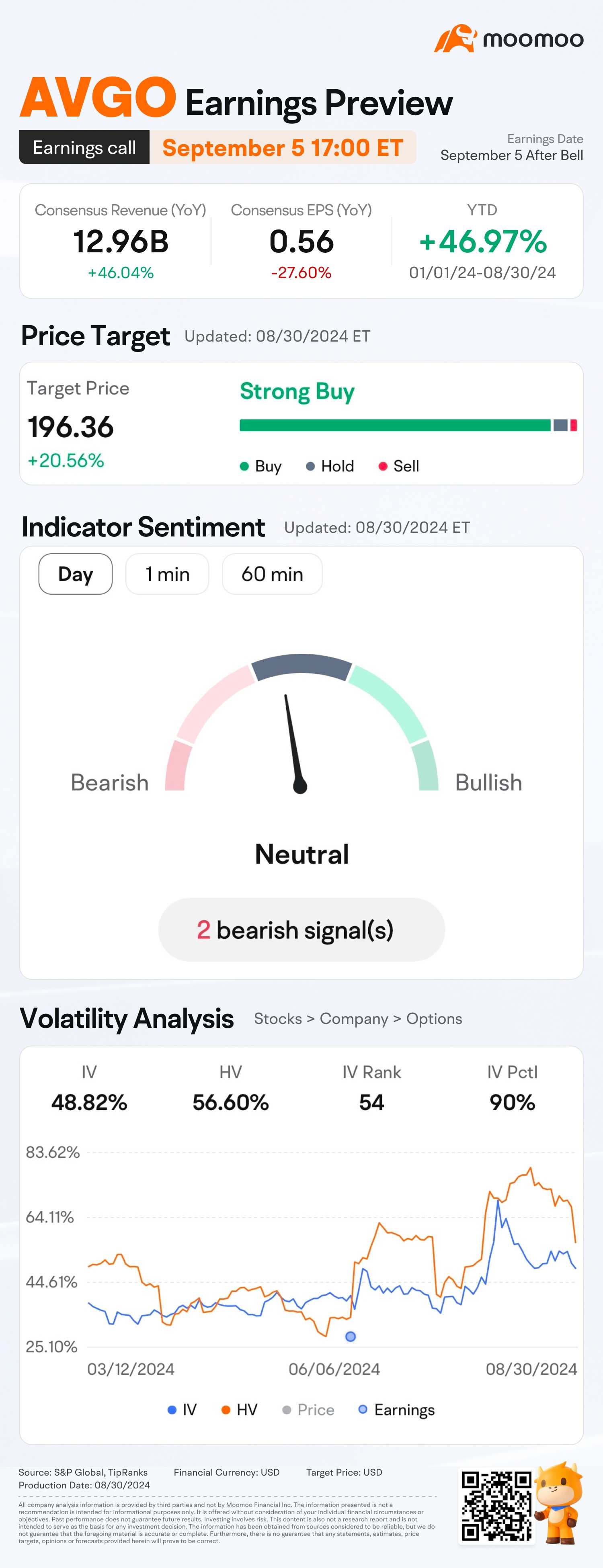

自從第二季財報公佈以來,股票價格已經上漲 $博通 (AVGO.US)$ 12.7% 。如果其Q1盈利符合預期,我們可能會歡迎第五家科技巨頭加入2兆美元的俱樂部 9.22%. 市場將如何對即將公佈的結果作出反應?立即猜測!

積分商城

● 5,000分積分均分: 對於那些正確猜測的mooer們 價格區間 $博通 (AVGO.US)$的開盤價 在9:30 Et 9月6日 (例如,如果有50個mooer猜對了,他們中的每個人將獲得100積分。)

(投票將在Et時間9月6日6:00關閉)

● 獨家300積分: 給發帖區間內最佳文章的作者 分析博通的盈利前景.

註:

1. 獎勵將在結果公佈後的5-7個工作日內發放。

2. 積分可在積分商城(moomoo app >> Me >> 積分商城)上兌換禮品。

3. 免責聲明: T&C條款適用。投資涉及風險。完整免責聲明

1. 獎勵將在結果公佈後的5-7個工作日內發放。

2. 積分可在積分商城(moomoo app >> Me >> 積分商城)上兌換禮品。

3. 免責聲明: T&C條款適用。投資涉及風險。完整免責聲明

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

ZnWC : Thanks for the event![合十 [合十]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

mr_cashcow : My prediction is slightly bullish although time and time again I have been proven wrong...looking at u Nvidia![俾我睇下 [俾我睇下]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Let's us dive into a deeper analysis of Broadcom (AVGO) Q3 earnings prospect:

Potential bullish signals:

▲Diversified product portfolio: AVGO's broad range of semiconductor and infrastructure software products reduces dependence on a single market

▲Growing demand for cloud and data center solutions: AVGO's data center and cloud-related businesses are expected to benefit from the ever increasing demand

▲Strong track record of acquisitions and integration: A long history of successful acquisitions, expanding its product offerings and customer base

Potential challenges & speed bumps ahead:

▼Cyclical nature of semiconductor industry: AVGO's semiconductor business may be impacted by industry cycles and fluctuations

▼Strong competition: Increasing competition in the semiconductor and software markets may pressure pricing and market share

▼Global economic uncertainty: Economic downturns or recessions may affect demand for AVGO's products

Some key areas to keep an eye out for:

①Semiconductor segment growth

②Software segment performance

③Gross margin expansion

④Free cash flow generation

Disclaimer: All the above are purely for educational purposes & are NOT financial advice, plz DYOR/DD!

102362254 : Broadcom has consistently exceeded revenue expectations, despite lower profit margins due to higher expenses. Its strategic acquisitions and strong product lineup position it well against competitors, with analysts confident in its future success. However, I'm guessing it will open between 152-161 on Sept 6, as strong earnings don’t always translate to a rise in stock price, just look at Nvidia recently.

AlexPuffin Two Smoke : vgg

70212528 : 财报利好

71391098 : 9月

henry coolbaugh : good

73209919 : 基本面

Patrick Czaplewski : Nailed it… I hope

72140291 : 63,809

查看更多評論...