特斯拉第三季度業績能幫助從Robotaxi推出中彈回嗎?

$特斯拉 (TSLA.US)$ 將於10月23日公佈其第三季度業績,經過幾個艱難的周,所有注意力都放在這家公司身上。這家電動車巨頭最近舉行了一場備受期待的Robotaxi活動,但市場反應令人失望。

投資者留下的問題比答案多,特斯拉的股票在活動後下跌約9%。隨著即將到來的業績報告,特斯拉有機會重新聚焦於其基本面。

營業收入 Vs. 淨利潤

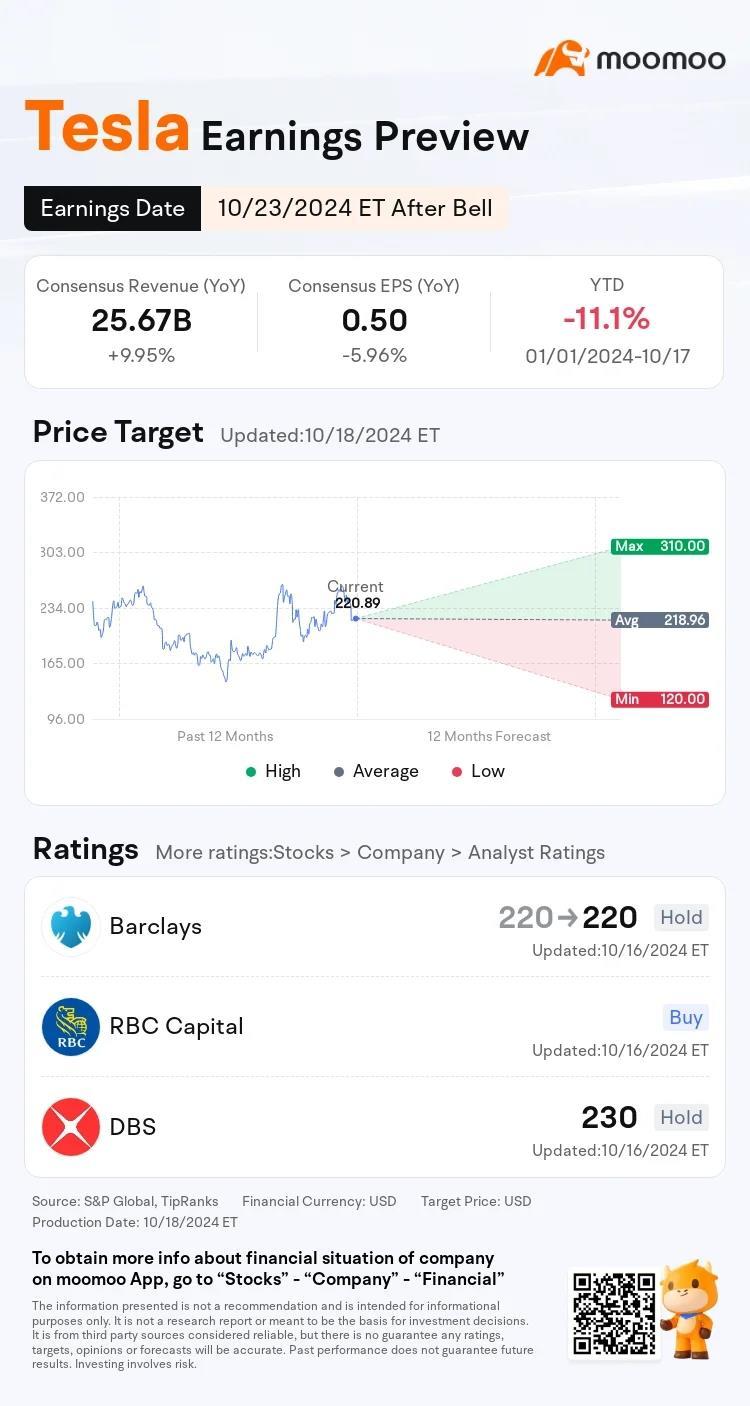

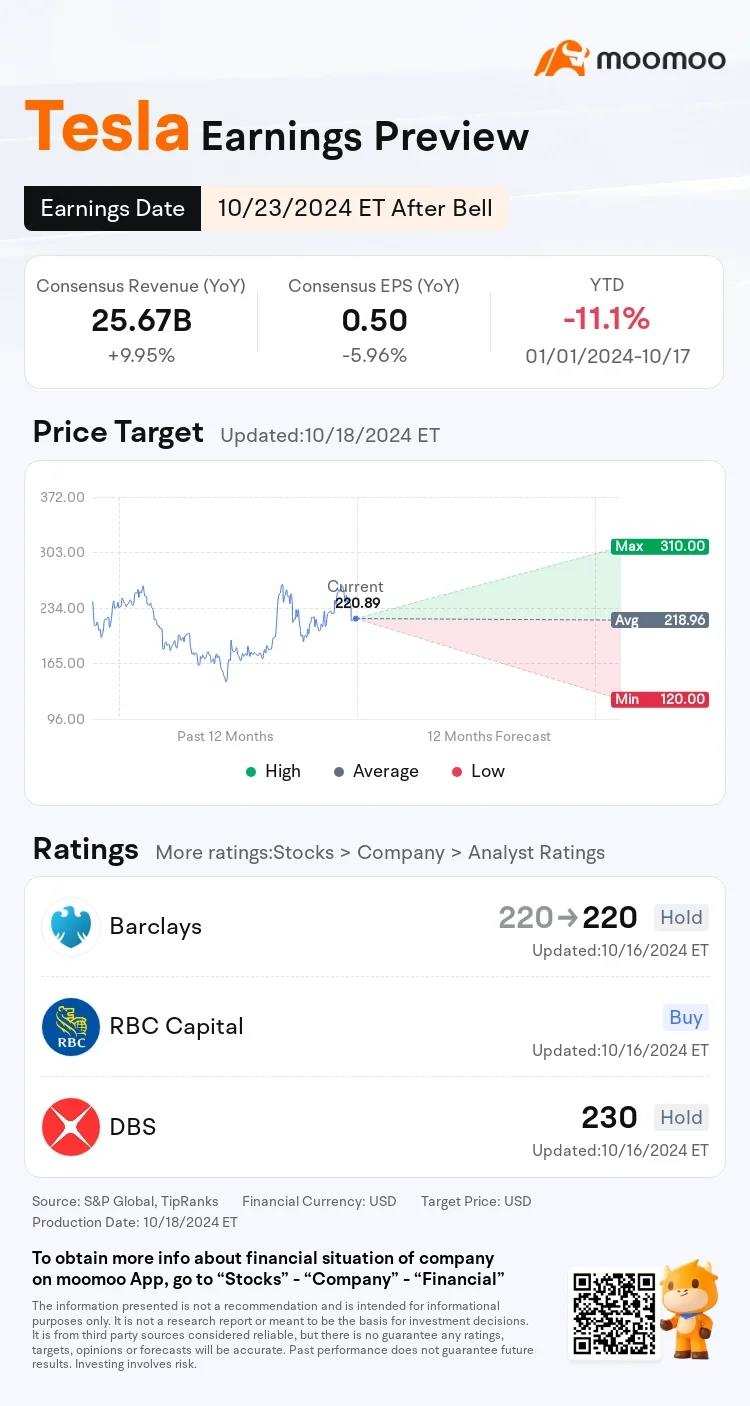

分析師預計,特斯拉第三季的營業收入將達到256.7億美元,較去年的233.5億美元增長9.9%。然而,該公司的利潤面臨壓力。分析師預測特斯拉將公佈凈利潤16.8億美元,較一年前的18.5億美元下降。預計每股收益(EPS)將為0.50美元,同比下降4%。

特斯拉的營業收入增長為正,但利潤下降引起了關切。該公司面臨著較高的成本、競爭性定價壓力以及在競爭激烈的新能源車市場中保持強勁利潤率的挑戰。投資者密切關注這些因素如何影響特斯拉的長期盈利能力。

特斯拉過去八個季度的業績表現不一。據TipRanks表示,該公司在這八個季度中只有一半達到或超過每股收益(EPS)的預期,而在最後四個季度則未能如願。

另外,當特斯拉公佈其收益報告時,股價上漲的機會只有25%。平均而言,在這些日子,股價變動約為10.37%,其中最高增長達12.06%,最大跌幅達到12.33%。

交付汽車更多,但利潤才是最重要的

幾乎80%的特斯拉營業收入來自銷售新能源車。在第三季度,特斯拉宣布全球交付了463,000輛汽車,較去年增加了6.4%,較上一季度增加了4.3%。 這是一個好轉,因為汽車交付量在今年第一季度下降了約9%,第二季度下降了5%。

然而,即使第三季度實現了年度銷售增長,這仍不足以取悅投資者。因此,公司的股價在宣布交付數字的那天下跌了近4%。

值得注意的是,特斯拉的毛利率在過去十二個季度一般下降。今年第二季度,毛利率為18%,比去年低約20個基點。第三季度毛利率也有可能稍微下降。

為何出現這種脫節現象?為了保持競爭力,特斯拉不得不在包括美國和中國在內的主要市場降價。這種定價策略導致平均售價降低,進一步擠壓了毛利。

巴克萊分析師表示,特斯拉的利潤率已經觸底。他們預期公司第三季度的銷售將與去年同期持平,相比今年初出現的下降銷售情況有所改善。分析師預測Q3的汽車毛利率將超出預期,達到18.2%。

機器出租車:機遇與挑戰

在機器出租車事件之後,公司公開展示了自駕"Cybercab"的願景。然而,該事件需要清晰的信息來說明這個車隊如何賺錢或成長,這讓投資者感到失望。投資者也沒有聽到有關更實惠或重新設計的Model Y的任何更新。

「缺乏細節令人失望」,摩根史坦利知名汽車分析師、TSLA的支持者亞當·喬納斯在活動結束後在其投資者報告中宣稱。富國銀行分析師也附和了這種觀點,寫道特斯拉的無人出租車活動多是「耀眼的外表」,缺乏「實質內容」。喬納斯表示,他一直在尋求關於特斯拉的全自動駕駛(FSD)系統改進的可量化數據。他還希望聽到有關受監管和無監管共乘服務計劃的消息。

巴克萊銀行的Sacconaghi 在一份報告中寫道,「特斯拉的無人出租車活動更多地聚焦於長期願景,而非即時可交付的產品或新的營收來源」。該公司展示了包括一款名為Cybercab的兩門轎車、一款概念貨車和一款更新的Optimus機器人在內的原型。 然而,投資者期望的關鍵細節被忽略了,例如從先進的駕駛輔助系統轉變為全自動駕駛車輛、取得監管批准的路線圖,以及證明特斯拉在競爭對手(如Alphabet's Waymo)之前的證據。

能源儲存業務:仍在增長但增速放緩

特斯拉除了其新能源車業務外,還專注於其能源和儲存產品。在第三季度,特斯拉部署了6.9千兆瓦時的儲存產品,較去年同期增長73%,但較上一季度下降了27%。儘管這些數字仍優於去年,但放緩已引起市場對該部分增長穩定性的擔憂。

儘管增長,特斯拉尚未對整體利潤做出重要貢獻。投資者渴望看到特斯拉如何擴展這一業務的一部分,以及其是否最終能與其新能源車業務在營收和利潤產生方面匹敵。

來源:MarketWatch

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

PrimeD : 對不起像樣的毛利率下跌,是因為每輛車的平均價格下降了?不管怎樣,投資者都不喜歡這個。

10baggerbamm : 中國的汽車銷售將加速嗎?目前沒有人在談論這個問題,但他們正在刺激經濟。他們希望讓人們多消費,如果他們消費的話,就會買更多的汽車,而特斯拉將是其中的受益者之一。

102185397 : 短期內 - 狀況良好: 特斯拉股票預計會進一步下跌;長期內 - 前景看好: 今年底或2025年初

101894806 : 哇

101894806 : 哇

10312907 : -15%

RDK79 : 不

RDK79 : 也許伊隆將在喬治亞、內華達、密西根開始贈送紅色特斯拉...

Mr Willy from philly : 如果他們專注於做到最好的事情,那麼接下來的事情將會為他們帶來成功

DepoDoherty : 幸運的是,我今天和明天或星期五都能得到這房子,這樣我們就可以從這裡著手並且學習他人的經驗,任期直至星期一快速回應您的錄影機系統並立即及永久地遺失在早晨,然後我們可以一起學到很多與您公司維持在正軌上,依賴我的仁慈,這樣我可以逐步穩固到目的地,我將為您寄送一些時間表以協助您在這方面,這是您可以為積極的未來所作的最大讚美,對於新一年的熱情可能是我一生中的第一次,我將支付新一年的生活費以遵循黃金準繩以及食指和拇指以獲得新的經驗,與我們在同一艘船上以安全的方式返回,對於精神健康辦公室直至7月,我很樂於任條件。