Evergreen maximising golden potential in pawnbroking and gold trading businesses

Evergreen Max Cash Capital (EMCC) has been enjoying a good run as it continued to rise to close at its 1-month high of 48 sen on May 24.

This was backed by higher trading volume, likely suggesting that the stock’s longer-term uptrend may have resumed.

Follow-through buying may lift prices towards the historical resistances at 54.5 sen and 56 sen next.

The counter hit a high of 56 sen from a low of 30 sen.

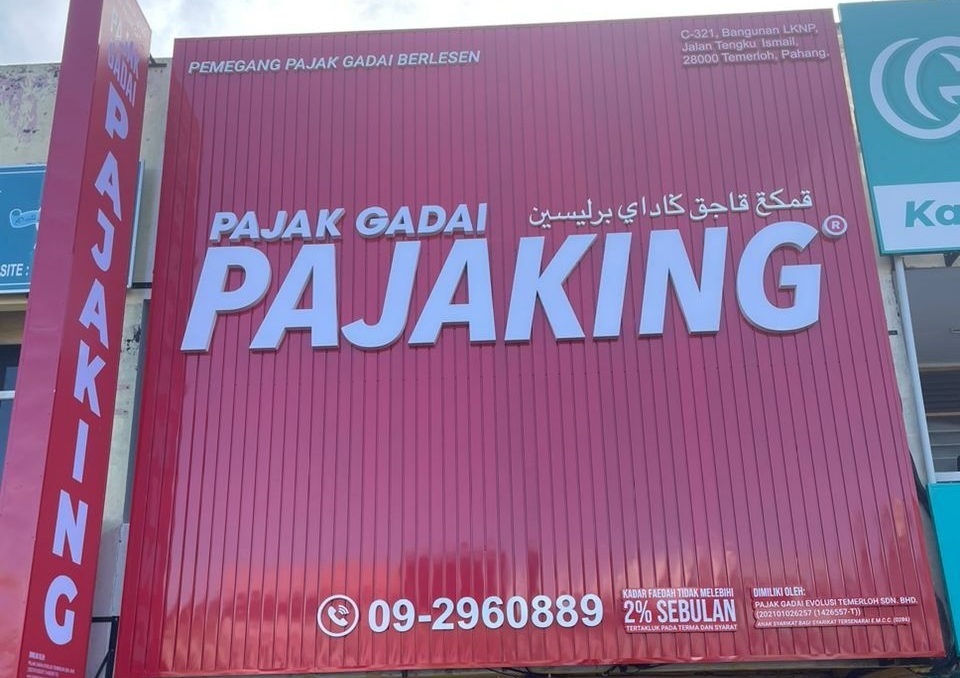

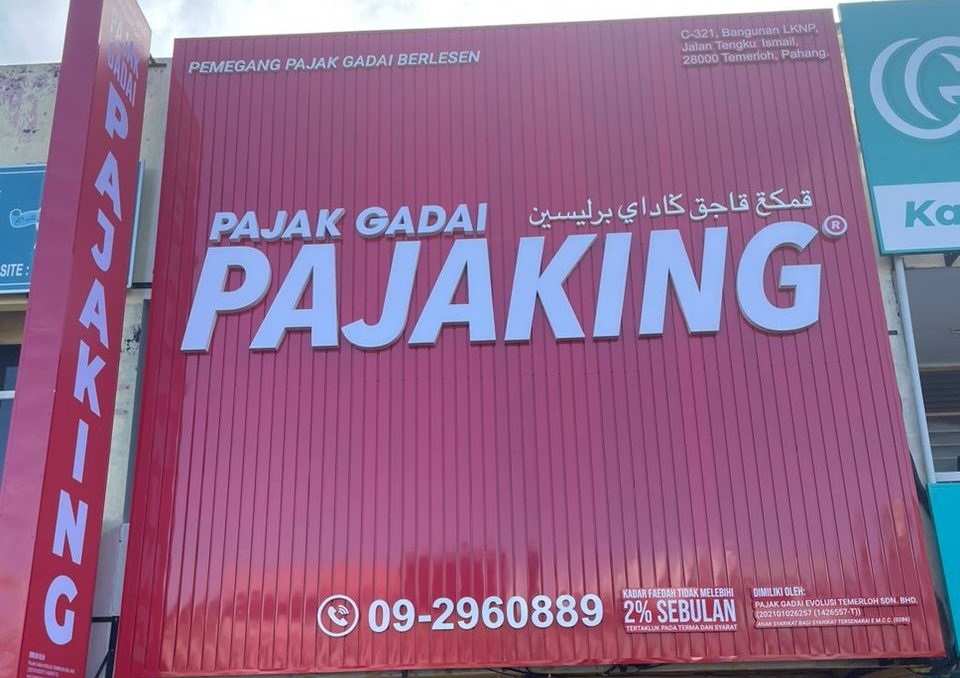

EMCC became only the second pawnbroker to list on Bursa Malaysia's ACE Market, after Pappajack Bhd.

EMCC, which was established in 2012, is also involved in retail and trading of gold and luxury products.

It also offers pawnbroking consultancy and IT solutions services to third-party pawnbrokers who are “not in direct competition with the “Pajaking” pawnshops.

The company saw a 33% premium on its IPO price of 24 sen in September 2023.

The bullishness on the counter is likely due to anticipated higher demand for pawnbroking services amid escalating costs of living.

EMCC executive director Low Kai Loon said the company is looking to grow its market share to 10% in the next few years, from over 3% currently.

The pawnbroking industry in Malaysia is expected to grow at a compounded growth rate (CAGR) of 5.9% between 2022 and 2024, and to reach RM12 billion in 2024, Low said.

To capture the growing slice of pie, EMCC has allocated RM20 million from proceeds raised from its listing exercise to open up five new pawnshops.

It will focus on existing 22 existing “Pajaking” pawnshops in Kuala Lumpur, Selangor, Negeri Sembilan and Pahang.

Among the criteria for setting up new shop includes communities with a significant Bumiputera population since they contribute 70% to 80% to its client base.

It will also focus on the four states where EMCC is already established, particularly in the Klang Valley as there will be more people from other states moving to the Klang Valley.

While pawnbrokers seem be everywhere but the fact is, the entry barrier is high, given the regulatory requirements.

They also need to meet the cash requirement needed to establish the business, as well as good management to run the business, as all transactions are done in cash.

For the first half ended June 30, 2023, EMCC registered a 23% jump in net profit to RM7.21 million from RM5.87 million a year ago.

This was on the back of a 72% rise in revenue to RM52.03 million from RM30.26 million.

The increased financial performance was mainly due to higher pawn loans disbursed.

The company also saw higher sales volume of unredeemed pledged gold items from the pawnbroking business, as well as pre-owned gold products sourced from other third party pawnshops.

Investors should be excited over the prospects of EMCC given its stronghold in the pawnbroking segment as well as escalating gold prices, which should boost its bottomline further.

免責聲明:社區由Moomoo Technologies Inc.提供,僅用於教育目的。

更多信息

評論

登錄發表評論

goldfish2k : 黃金長期看多的,典當生意利潤好高的

104133421 goldfish2k : $EMCC (0286.MY)$ 還沒能上去可能需要更長時間,現在下滑0.445 …