當我看到政策刺激時如何根據特朗普勝選交易

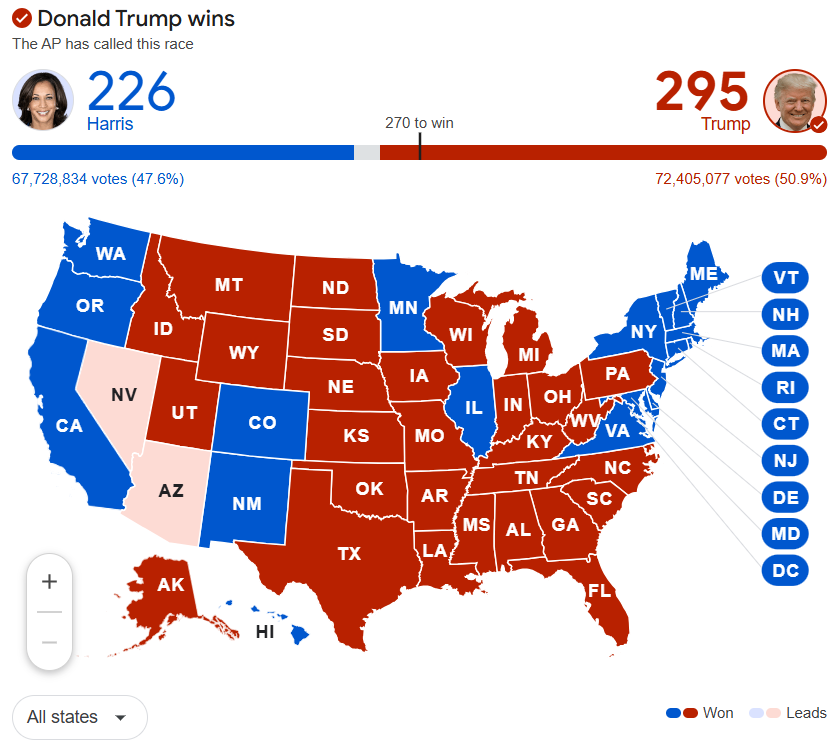

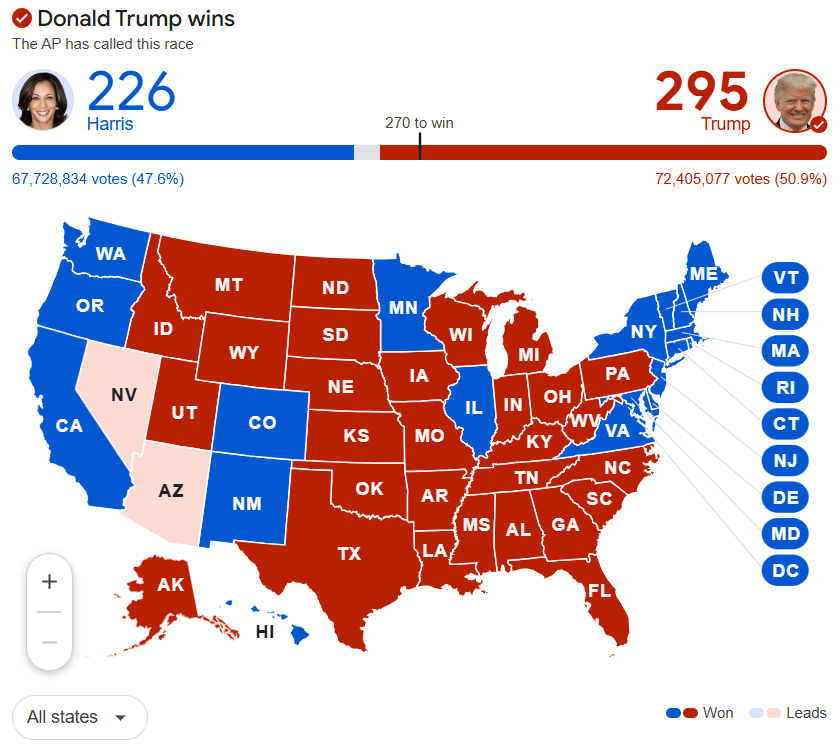

隨著美國選舉揭曉的結果,我實際上不太關心誰將贏得白宮的提名。

我更感興趣的是共和黨在參議院席位數上的勝利,藉著將參議院控制權交給共和黨,作為投資者我們應該如何交易。

股市對選舉結果做出積極反應,預期會有增長。隨著特朗普的勝利和共和黨可能在眾議院和參議院佔多數,主要指數在周三上漲。投資者對選舉不會有爭議感到寬慰,對特朗普降稅和減少監管的計劃充滿樂觀,這可能刺激經濟增長。

活躍的買盤推高了道瓊斯工業平均指數、納斯達克綜合指數、標普500指數和標普400指數至創歷史新高。羅素2000指數上漲了5.8%,領跑各指數。

特朗普勝選後值得觀察的標普500金融板塊

受到監管審核減少和資本市場活動增加預期的影響,標普500金融板塊上漲了6.2%。值得注意的上漲個股包括高盛、keycorp和發現金融。

但如果我們打算看看特朗普獲勝後我們可以交易的金融股,預期金融解監管或監管減少。

我認為這兩家股票是我們可以考慮的: 摩根大通 和 $美國銀行 (BAC.US)$ 過去幾年,我們看到金融機構受到財務監管(非必要的監管)的打擊,現在我們可能會看到這種情況減少,特別是那些更大更知名的銀行應該會受益。

以Tesla為引擎的消費者自由選擇板块

與金融股(+3.9%)、工業股(+3.9%)和能源股(+3.5%)一起,消費者自由選擇板塊增加了3.6%。由於市場利率上升,房地產板塊下跌了2.6%,公用事業下跌了1.0%。消費雜貨板塊因美元走強和潛在的關稅報復而下滑了1.6%。

我預計亞馬遜可能會有更多上行,因為Lina Khan可能會離開,針對亞馬遜的案件可能會減少,這將有助於亞馬遜,因為現在是亞馬遜再次與美國政府接觸的時候,支出應該會隨著新政府上升。

如果我們從MACD和MTF的技術面來看,可以清楚看到AMZN正在上漲趨勢,這支股票可能會採取防禦策略,以應對任何可能的聯邦利率決定逆轉。

隨著比特幣價格顯著上升,加密挖礦股票上漲。

小市值股和金融股飆漲。美元對其他主要貨幣升值。比特幣價格顯著上漲。

循環板塊表現優於市場。國債出售,導致收益率上升。如果我們觀察這一趨勢,我們可能會看到投資者轉入加密貨幣作為避險,因為在過渡的第一年可能會有一些波動。

在市場波動中,特朗普在會議期間還支持比特幣,因此我們應該關注加密挖礦股票。我認為我們可以看看那些持有相當大量比特幣的人,以及即將推出的挖礦股票,比如 MicroStrategy ,持有相當大量比特幣的人,以及即將推出的挖礦股票,例如 $MARA Holdings (MARA.US)$

如果您一直關注MARA,過去一周以來波動很大,MARA跌破短期和長期MA,現在我們看到MARA在下周(11月12日)盈利前出現在這些水平之上交易。

所以現在可能是我們考慮MARA的時候了,因為特朗普的勝選將推動加密挖礦股,其中一個重要名字將是MARA。

目前我持有MARA的持股位置,期待下周(11月12日)的盈利結果。我預期如果他們的礦業支出因比特幣價格上漲而降低,MARA有機會突破20美元。

國防支出將增加,Palantir軟體可能受益。

如果我們看看與美國政府簽訂的合同數量,尤其是在軍事和國防方面。我預計在未來四年內,隨著人工智能採用開始發展,Palantir將獲得更多合同。 $Palantir (PLTR.US)$ Palantir一直是我的最佳股票之一,依然存在高估值和超額股價,但我希望我們能花點時間考慮人工智能在軟件發展方面未來幾年將如何發展。

對我來說,Palantir在人工智能軟件平台方面相當於英偉達或Alphabet。另一個重要的注意事項是,如果通脹再次回升,那麼美聯儲可能會再次開始加息,那麼Palantir可能成為我們可以持有來承擔風險的防禦性股票之一。

這可能解釋了為什麼Palantir股價會上漲。如果我們用MTF(多時段)技術來看,我們正看到一個強烈的上升趨勢。

Palantir的交易價格超過短期和長期MA,並且MACD剛剛表現出顯著的看漲交叉上升。這可能意味著我們可能看到Palantir調整到新高。

Palantir的交易價格超過短期和長期MA,並且MACD剛剛表現出顯著的看漲交叉上升。這可能意味著我們可能看到Palantir調整到新高。

我仍然持有Palantir的頭寸,因為這應該成為我的防禦策略的一部分,以防通脹卷土重來,聯邦儲備系統決定加息。

國債收益率和經濟數據

國債面臨賣壓,2年期票息率達到4.29%,10年期票息率達到4.48%。250億美元的30年期債券拍賣受到強勢需求,稍微緩解了票息率壓力。2年期票息率定格在4.27%,10年期票息率定格在4.43%。

預計聯邦公開市場委員會(FOMC)將宣布政策決定,可能將聯邦基金利率下調25個基點至4.50-4.75%。

總結

如果我們觀察特朗普的政策如何可能影響股票,如果通脹再度卷土重來,還有可能加息。所以我認為我們需要調整我們的策略,同時涵蓋防守和成長。

如果您願意在評論區分享您的想法,是否認為這些股票值得您關注,將不勝感激。

免責聲明:所呈現的分析和結果並不建議或暗示任何投資該股票。僅供分析之用。

免責聲明:社區由Moomoo Technologies Inc.提供,僅用於教育目的。

更多信息

評論

登錄發表評論