Lululemon第二季預覽:具吸引力的估值遇上謹慎的銷售展望

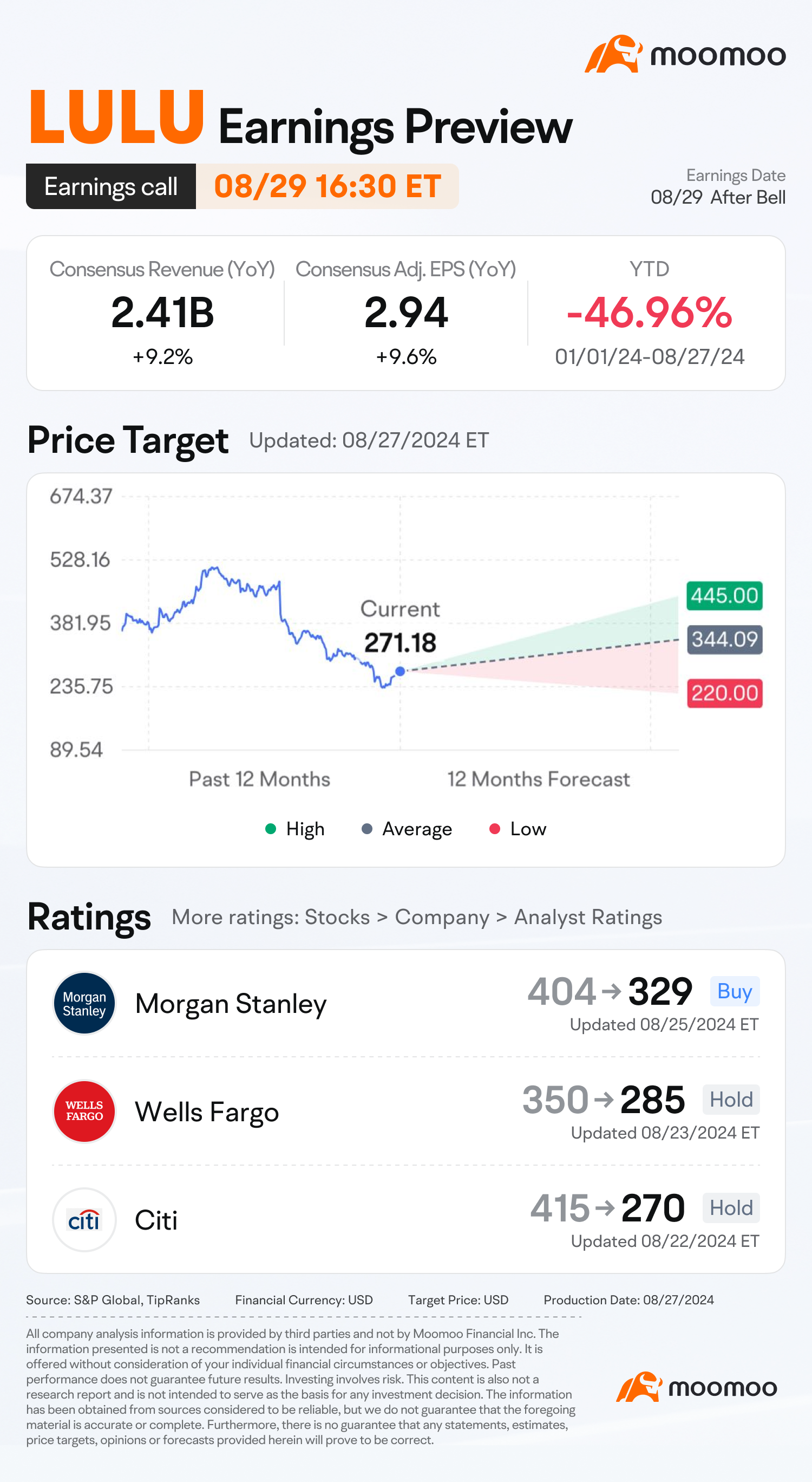

$Lululemon Athletica (LULU.US)$ is set to report the FY25Q2 earnings result on Thursday after the market closes. Analysts hold consensus estimates of a 9.2% revenue growth and a 9.6% adjusted EPS increase compared to the same period last year. Concerns about Lululemon's earnings in a slowing retail environment sent shares to their lowest levels in more than four years, declining 47% from the beginning of the year.

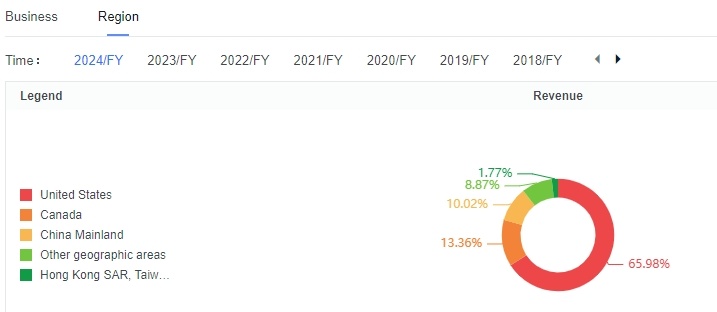

America's Slowing Growth and China's Key Role

Lululemon's revenue growth in the Americas is projected to continue its slowdown, with anticipated increases of 3.3% in the US and 7.45% in Canada. This trend stems from the brand's rapid expansion in the past few years, which peaked during the pandemic as more people stayed home and participated in indoor activities, boosting demand for home workout apparel. Despite the overall retail uplift during the pandemic, where even competitors like $耐克 (NKE.US)$ 和 $ADIDAS AG (ADDDF.US)$ Lululemon的業績在2021年至2023年間在美國出現了增長,分別為40.3%、28.6%和11.9%。然而,隨著疫情的減弱和通脹壓力的上升,消費者對花費變得越來越謹慎,尤其是對中高端服裝的消費。

另一方面,中國正在成為Lululemon的一個重要增長動力,預計銷售增長將超過45%。即將舉行的業績報告可能會評估國際市場的強勁表現是否能夠抵銷北美市場需求的下降。

激烈的競爭和戰略挑戰

Lululemon面臨著激烈的競爭和定價挑戰,尤其是來自Alo Yoga等品牌。這些品牌通過針對年輕人群體的舒適性和耐用性作為優先考慮目標,明顯侵占了Lululemon在緊身褲市場上的市場份額。Vuori在男士服裝部門也提出了另一個嚴峻的挑戰,Lululemon在第一季度男士商品的增長率為15%,超過了女性商品的10%增長率。這兩個競爭對手將其店鋪戰略地佈局在Lululemon附近,加劇了市場競爭。

產品長官職位的領導層變動可能對未來的創新工作產生影響,尤其是在下半年。Lululemon最近推出的Breezethrough瑜伽褲在Lululemon增長軌跡的關鍵時刻引起了負面關注。由於顧客對設計的投訴,Lululemon在7月將其最新款的Breezethrough瑜伽褲從市場撤下,導致其股價下跌了9%。這一事件可能使Lululemon的競爭對手受益,潛在地吸引了大量的客戶群體。

The firm remains cautious on growing concerns including domestic merchandising issues and accelerating competition. 「三倍力量 x2」策略是Lululemon雄心勃勃的計劃,在生產創新、客戶體驗增強和市場擴張的支持下,到2026年使其2021年的62.5億美元營業收入翻倍至125億美元。

有吸引力的估值和股東價值

自今年初以來,Lululemon的估值已經大幅下跌近50%,現在看起來更具有吸引力。 根據moomoo的資料,Lululemon目前的市盈率僅為20.3,與其五年平均值相比位居第2百分位數。 作為一個高端運動服飾品牌,該品牌在營業收入和每股收益方面持續提供雙位數複合年增長。 而且,Lululemon的價值現在低於Nike和Puma等同行公司,這些公司的增長速度主要停滯不前。

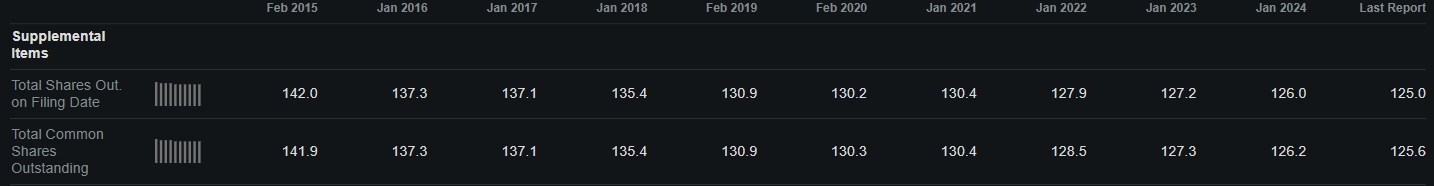

與此同時,該公司展示出了強烈的提升股東價值的承諾,每年投入數億美元用於股票回購。自2021年初以來,Lululemon已經投資超過20億美元用於回購股票。截至6月5日,僅今年一年,公司已回購了超過50000萬美元的股票,其回購授權還剩餘17億美元。在過去的十年中,這些努力已經使公司的股票數量減少了超過12%,強化了Lululemon對回饋股東價值的關注。 這個回購策略,尤其是最近一季公佈的計劃,大大提升了投資者的信心。

隨著Lululemon接近第三季度業績發布,分析師一直在重新評估對該公司的展望。摩根史坦利分析師Alex Straton將Lululemon的目標價格從404美元下調至329美元,並將股票評級保持在超重級別。 Straton指出他認為Q2每股收益將超出預期,並提升整年的指引。

摩根史坦利表示,儘管整體結果並不令人振奮,但這表明美國的趨勢未必變得更糟(季度對季度)。該公司預計中國可能為Lululemon帶來營收上行,而不是造成頭風。總的來說,盡管(第二季度)營收結果可能無法改變更廣泛的故事,但我們認為它們有望優於共識預測。

另一方面,富國銀行分析師Ike Boruchow將Lululemon的目標價格從350美元下調至285美元,並將股票評級保持在等比重級別。 該公司對於國內商品銷售問題和競爭加劇等趨勢持慎重態度。

資料來源: Bloomberg, the Fly, Seeking Alpha

Lululemon 2024 Q2 業績電話會

08/30 04:30

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

Laine Ford : 也許是金錢股票

Laine Ford : 也许是钱和股票