Options Market Statistics: Affirm Stock Surges On Earnings Beat; Options Pop

News Highlights

$英偉達 (NVDA.US)$ shares fell 6.38% Thursday to close at $117.59. Its options trading volume was 7.34 million. Call contracts account for 62.6% of the total trading volume. The $130 calls expiring Aug. 30 were traded most actively.

Nvidia shares fell over 6% on Thursday as its fiscal second-quarter gross margin slightly dipped despite surpassing revenue expectations. The company reported over $30 billion in revenue for the July quarter, up 122% year-on-year, marking the fourth consecutive quarter of triple-digit growth. However, the rapid expansion makes annual comparisons tougher. Nvidia's guidance for its fiscal third quarter projects $32.5 billion in revenue, implying an 80% year-on-year increase but a slowdown from the previous quarter.

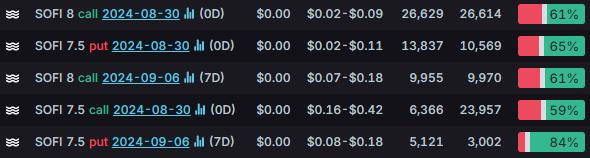

$SoFi Technologies (SOFI.US)$ shares rose 7.21% Thursday to close at $8.03. Its options trading volume was 0.61 million. Call contracts account for 73.8% of the total trading volume. The $8 calls expiring Aug. 30 were traded most actively.

SoFi Technologies shares rose on Thursday after the U.S. Supreme Court declined to revive the Biden administration's student debt relief plan. The court's decision is seen as positive for SoFi, which could have lost revenue from interest payments and loan origination fees if student loan forgiveness or deferment had been implemented under the SAVE plan. The Supreme Court denied an emergency request to lift a nationwide injunction on the plan.

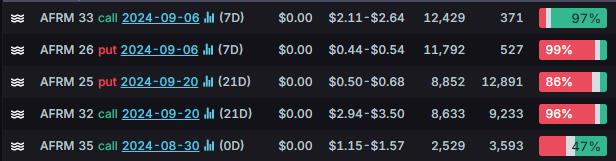

$Affirm Holdings (AFRM.US)$ shares surged 31.92% Thursday to close at $41.66. Its options trading volume was 0.46 million. Call contracts account for 71.0% of the total trading volume. The $33 calls expiring Sep. 6 were traded most actively.

Affirm Holdings reported a smaller-than-expected loss for its fiscal fourth quarter, with revenue and other financial metrics surpassing Wall Street expectations. The company's stock surged due to strong guidance and a new partnership with Apple. Affirm expects to achieve GAAP operating income profitability by fiscal Q4 2025. For the June quarter, Affirm reported a loss of 14 cents per share, better than the expected 48 cents, and a significant improvement from the 69 cents loss a year earlier. Revenue increased by 48% to $659 million, and gross merchandise volume rose 31% to $7.2 billion, both exceeding estimates.

Unusual Stock Options Activity

There was a noteworthy activity in $Affirm Holdings (AFRM.US)$, where $43 CALLs have topped volume to open interest ranking. The highest volume over open interest ratio reaches 103.9x with 10,909 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

103916021 : 好的

CornpopBadDude : 嗯嗯嗯