期權市場統計: palantir股份下跌,降級為賣出,伴隨著“前所未有的生成性人工智能熱潮”期權暴漲

資訊亮點

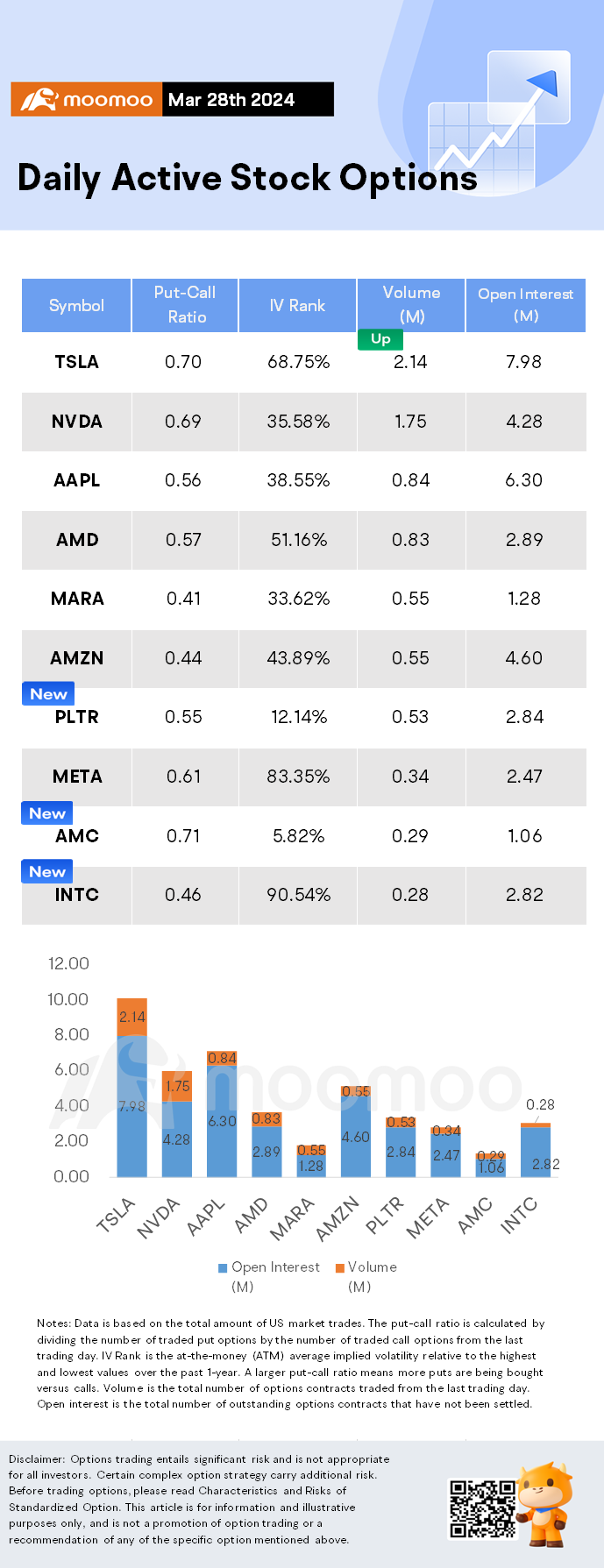

$Palantir (PLTR.US)$ 股份 下跌了6.12%,收盤價為 $23.01。它的 期權交易成交量為53萬. 看漲合約佔64.6% 總交易量中,看漲期權佔63.8% 最常交易的看漲合約是行使價格為25美元,到期日為3月28日的合約馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 總成交量達到21,515,開放利益為17,495馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 最多交易的買權合約是到期日為4月5日的23美元行使價格合約;成交量為7,394張,持倉量為520 成交量為11,037份合約,持倉量為6,602份.

分析師在周四下调了人工智能軟體製造商Palantir Technologies的評級,認為其估值在投資者對生成式人工智能感到興奮之際被誇大。Palantir股票大幅下跌。

Monness,Crespi,Hardt & Co.的分析師Brian White將Palantir股票的評級從中立下調至賣出。他將Palantir股票的目標價定為20美元。

在這個前所未有的生成式人工智能炒作周期的推動下,Palantir在2023年股價暴漲,而該股票的上升軌跡在2024年持續,該公司的估值在我們看來已經處於過高水平。」他在一份報告中表示。

$AMC院線 (AMC.US)$ 股份 跌幅為14.29%,收盤價為 $3.72。它的 期權交易成交量為29萬. 看漲合約占比58.4% 總交易量中,看漲期權佔63.8% 最活躍的看漲期權是到期日為3月28日、行使價為4.5美元的合約。馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 總成交量達到18,354,開放持倉為20,074。馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 最活躍的看跌期權是到期日為4月12日、行使價為4.5美元的合約。;成交量為7,394張,持倉量為520 成交量為2,899合約,開放持倉為699。.

amc院線股票再次參與稀釋遊戲。這家負債累累的電影院鏈和曾經受人喜愛的梗圖股票正前往市場賣出價值2.5億美元的股票,以償還其在covid大流感高峰期間獲得的沉重債務負擔。

$英特爾 (INTC.US)$ 股份 上漲0.91%,收盤價為 $44.17。它的 期權交易成交量為28萬. 看漲合約佔了68.3% 總交易量中,看漲期權佔63.8% 最活躍的期權是到期日為3月28日的43美元行使價的合約馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 總成交量達到4,802,開放利息為8,400馬來西亞股市上漲了17.48點,漲幅為1.11%,收盤點位為1,591.87。這是過去兩天回升了55.39點。 最活躍的賣出是到期日為3月28日的41.5美金行使價的合約;成交量為7,394張,持倉量為520 volume is 6,038 contracts with an open interest of 4,719.

According to a note from one research firm this week, Intel stock could be on the verge of a notable upswing, with the possibility of a 20% to 30% increase, thanks to what they describe as 'significant' catalysts.

Lynx Equity anticipates two major catalysts for Intel. First, they expect Intel's April 2nd event, typically uneventful, to create buzz with the unveiling of its new reportable segments. The event is likely to include a reorganization of business groups and details on the allocation of funds from the CHIPs act, potentially clarifying Intel's financial outlook and 'smart capital' initiative. Second, they project the launch of Intel's Sierra Forest in early 2024, a server chip that has not yet excited investors due to lack of a compelling narrative, unlike $美國超微公司 (AMD.US)$'s similar chip, Bergamo. Lynx Equity believes Sierra Forest has a specific AI application for Meta, and suggests it might ship as early as the second quarter.

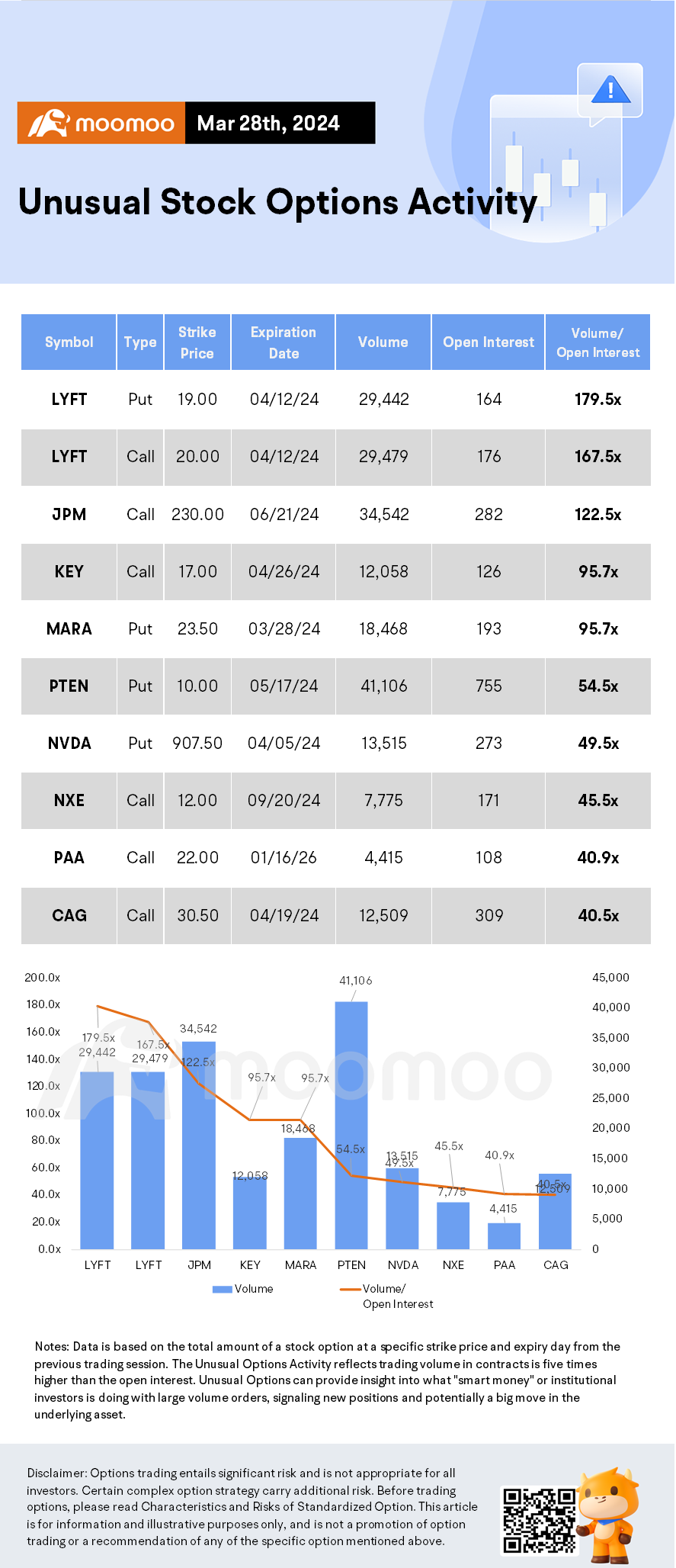

飛凡股票期權活動

對於新加坡所有板塊的mooer們,您現在可以通過我們的新活動降低您的期權佣金。快來查看連結: 美國股票期權.

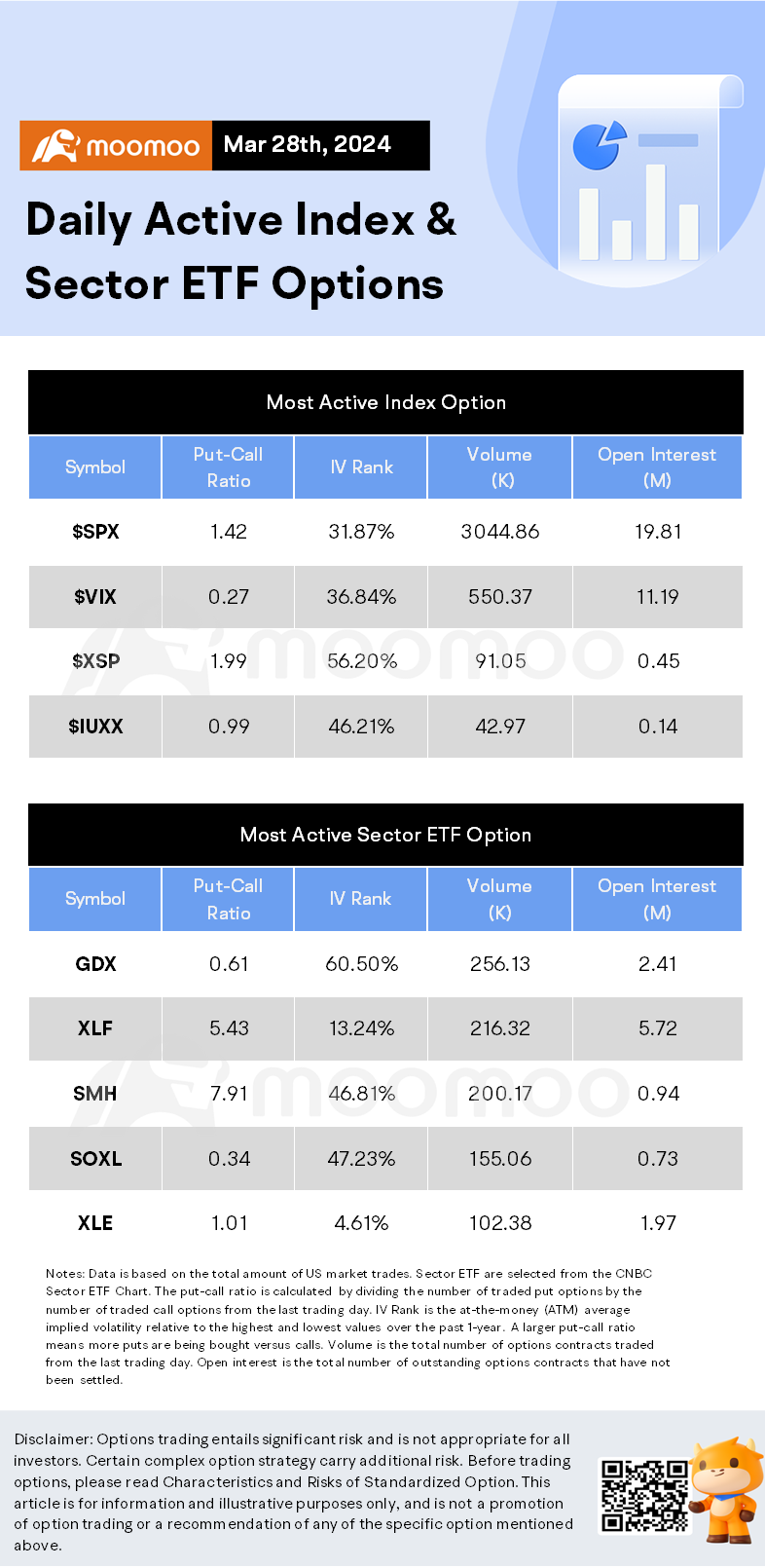

每日活躍指數與板塊etf期權

資訊來源:Barchart、飛凡、巴倫、愚人節

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

Tun Lwin7 : 你好先生

Tun Lwin7 : 接受帳戶先生

Tonyco : 是啊大家都知道政府合約總是死亡之聲 $Palantir (PLTR.US)$ ...

billlovesivy : 哈哈