US Treasury Yields: Has the Peak Been Reached? Insights from Historical Trends

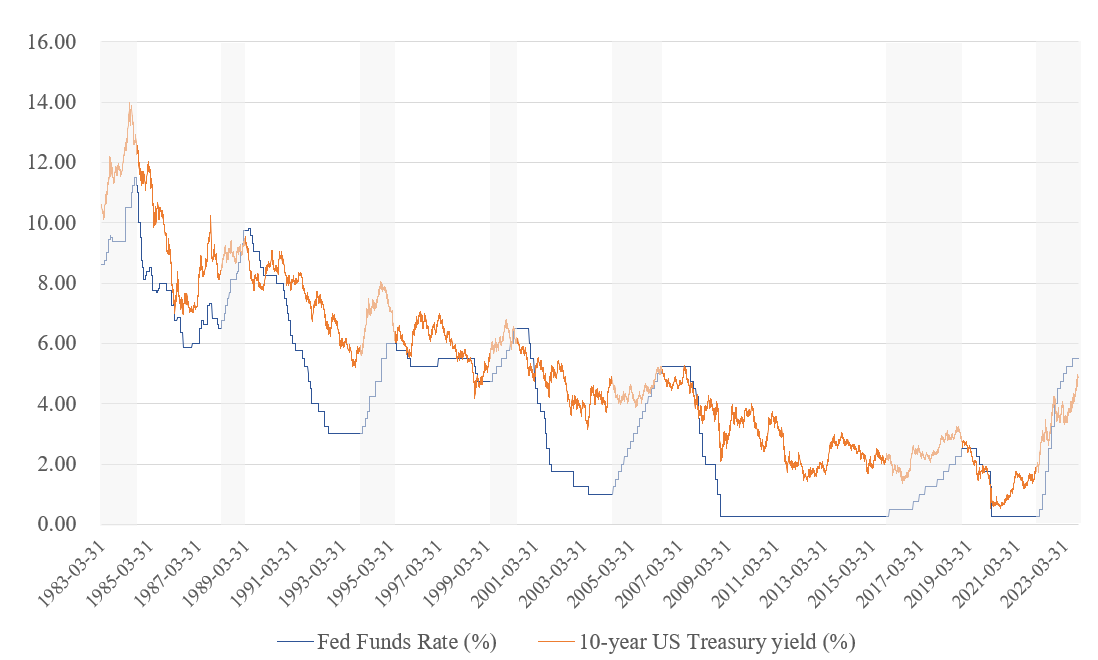

Reviewing the seven rate-hike cycles from 1983 to 2023, data shows that in most cases (except for the period from March 1988 to June 1989), the peak of $美國10年期國債收益率 (US10Y.BD)$ is higher than the Federal funds rate at the time of the last rate hike. The $美國10年期國債收益率 (US10Y.BD)$ typically peaks 1 to 3 months ahead of the final rate hike.

Looking at the economic data, there were two rate-hike cycles where the economic growth showed a counter-trend upward movement: from Mar 1983 to Aug 1984 and from Mar 2022 to the present. Moreover, the current cycle is the only one where there has been a significant decrease in inflation and a slight increase in the unemployment rate.

While four out of the seven cycles experienced an inverted yield curve, the current cycle is relatively unique in terms of both the duration and extent of the inversion when compared to historical data.

Source: U.S. Bureau of Labor Statistics, Fred

免責聲明:此内容由Moomoo Technologies Inc.提供,僅用於信息交流和教育目的。

更多信息

評論

登錄發表評論

sociable Sheep_7248 : 看起來是支持

Mr Travis : 我見過的最奇怪的市場

Bakster : 10 年至 6.20 年