灵秀的科克

評論了

上一個亮點

在上週五期權到期前,科技股市使股市在波動交易時段中創下創紀錄。上週五是月期和每週期權的到期日。

$蘋果(AAPL.US$ Gurman 指出 Apple Watch 軟件主管 Kevin Lynch 在近幾週領導該公司的汽車工作,以及他致力加快電動汽車的開發。Gurman 在他的每週通訊中寫道:「現在,他正在推動該項目背後的團隊加速其發展,並考慮早在 2025 年推出汽車。」

$美光科技(MU.US$ 隨著 Citi 和 Evercore/ISI 的分析師對半導體公司和內存芯片市場發表了一些樂觀的評論,上週週五上漲近 8%。

如何閱讀圖表

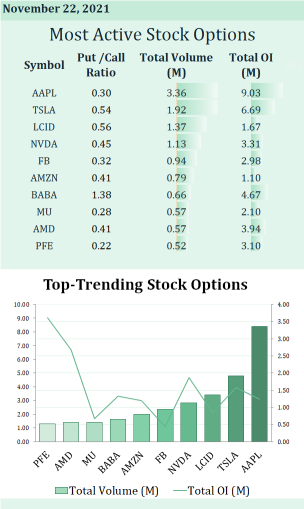

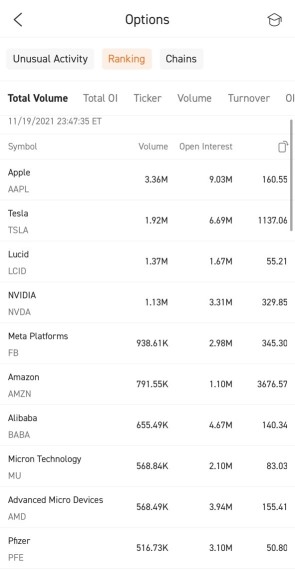

· 圖表顯示具有股票 大多數選項活動 上一個交易日的。

· 輸入/呼叫比率 > 0.7 意味著更多股票吸引 更多的熊比牛市.![]()

![]()

![]() 推入/通話比率 <0.7 意味著股票吸引 多於熊市的牛市.

推入/通話比率 <0.7 意味著股票吸引 多於熊市的牛市.![]()

![]()

![]()

· 期權交易量表示當天交易的合約股份。

· 開放利息表示目前已開倉的期權合約總數-這意味著它們是 尚未行動或抵銷。![]()

![]()

![]()

想了解更多關於趨勢選項的信息?

可以通過選擇」找到此功能報價 — 市場 — 期權」。您需要訪問 「期權即時報價」 存取此功能。

通過以下方式探索期權交易的世界: 選項簡介.

提高您的期權交易知識: 桌子上的關鍵要素

您是否曾經在選項過期之前翻閱過期? $美國超微公司(AMD.US$ $輝瑞(PFE.US$ $Lucid Group(LCID.US$

在上週五期權到期前,科技股市使股市在波動交易時段中創下創紀錄。上週五是月期和每週期權的到期日。

$蘋果(AAPL.US$ Gurman 指出 Apple Watch 軟件主管 Kevin Lynch 在近幾週領導該公司的汽車工作,以及他致力加快電動汽車的開發。Gurman 在他的每週通訊中寫道:「現在,他正在推動該項目背後的團隊加速其發展,並考慮早在 2025 年推出汽車。」

$美光科技(MU.US$ 隨著 Citi 和 Evercore/ISI 的分析師對半導體公司和內存芯片市場發表了一些樂觀的評論,上週週五上漲近 8%。

如何閱讀圖表

· 圖表顯示具有股票 大多數選項活動 上一個交易日的。

· 輸入/呼叫比率 > 0.7 意味著更多股票吸引 更多的熊比牛市.

· 期權交易量表示當天交易的合約股份。

· 開放利息表示目前已開倉的期權合約總數-這意味著它們是 尚未行動或抵銷。

想了解更多關於趨勢選項的信息?

可以通過選擇」找到此功能報價 — 市場 — 期權」。您需要訪問 「期權即時報價」 存取此功能。

通過以下方式探索期權交易的世界: 選項簡介.

提高您的期權交易知識: 桌子上的關鍵要素

您是否曾經在選項過期之前翻閱過期? $美國超微公司(AMD.US$ $輝瑞(PFE.US$ $Lucid Group(LCID.US$

已翻譯

62

12

灵秀的科克

表達了心情

When it comes to stopping loss, I think it's more important than taking profit. If you don't take profit, the worst thing is the restoration of the profit account.![]() However, not stopping the loss is equivalent to cutting the meat with a blunt knife, sooner or later will bleed down.

However, not stopping the loss is equivalent to cutting the meat with a blunt knife, sooner or later will bleed down.

Almost all losses are related to two points: "not seeing the trend, not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

1. for companies that understand the fundamentals

My stop-loss strategy for holding positions is based on the fundamentals of the company. As for marvelous company, we don't need to stop loss due to familiar enough. For company which has a certain degree of understanding and more floating profits, we can moderately relax the stop-loss points, such as the 120 moving average; if it's not ripe enough, the 20-day moving average may trigger the stop-loss. $特斯拉(TSLA.US$

2. The operation of short-term betting

For an unfamiliar company, the stock price will rise as soon as I sell it. Gambling operation is not supported by long-term logic, so stopping loss can avoid making big mistakes. But it also depends on execution, sometimes I will get trapped.![]() Anyway, it matters with my ability circle. Many newbies look back and think they could have made a profit if not stop-loss, but such hindsight mentality is not allowed in the stock market.

Anyway, it matters with my ability circle. Many newbies look back and think they could have made a profit if not stop-loss, but such hindsight mentality is not allowed in the stock market.

3. Buy bottom with Long Call

In a slumping market, if you feel the bottom with no scientific basis for judgment, you'd better not to buy the bottom directly. Figure out how much you want to buy and use long Call to get the bottom at that time.

Usually option is the price of 1/10 of the underlying stock. Buying it properly, you can make a profit equivalent to a certain percentage of the underlying stock. Otherwise, it at most let the option float (maybe 10% loss). $納斯達克綜合指數(.IXIC.US$

Therefore, you must make a quota that you can afford at first, the expiration date depends on your confidence. If you lack confidence, set the expiry date longer.![]()

4. Why should funds need to be fixed invest?

Human greed, not only lies in the high more than win, but also lies in the low dare not to buy, always waiting for the lower position.

To sum up, I'm not afraid of losing a good stock and generally don't chase high. I will not touch an unsure stock. If I encounter a judgment error, I will stop the loss unconditionally. $Camber Energy(CEI.US$

@HopeAlways @ATS A trade sniper

Almost all losses are related to two points: "not seeing the trend, not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

1. for companies that understand the fundamentals

My stop-loss strategy for holding positions is based on the fundamentals of the company. As for marvelous company, we don't need to stop loss due to familiar enough. For company which has a certain degree of understanding and more floating profits, we can moderately relax the stop-loss points, such as the 120 moving average; if it's not ripe enough, the 20-day moving average may trigger the stop-loss. $特斯拉(TSLA.US$

2. The operation of short-term betting

For an unfamiliar company, the stock price will rise as soon as I sell it. Gambling operation is not supported by long-term logic, so stopping loss can avoid making big mistakes. But it also depends on execution, sometimes I will get trapped.

3. Buy bottom with Long Call

In a slumping market, if you feel the bottom with no scientific basis for judgment, you'd better not to buy the bottom directly. Figure out how much you want to buy and use long Call to get the bottom at that time.

Usually option is the price of 1/10 of the underlying stock. Buying it properly, you can make a profit equivalent to a certain percentage of the underlying stock. Otherwise, it at most let the option float (maybe 10% loss). $納斯達克綜合指數(.IXIC.US$

Therefore, you must make a quota that you can afford at first, the expiration date depends on your confidence. If you lack confidence, set the expiry date longer.

4. Why should funds need to be fixed invest?

Human greed, not only lies in the high more than win, but also lies in the low dare not to buy, always waiting for the lower position.

To sum up, I'm not afraid of losing a good stock and generally don't chase high. I will not touch an unsure stock. If I encounter a judgment error, I will stop the loss unconditionally. $Camber Energy(CEI.US$

@HopeAlways @ATS A trade sniper

15

2

$Spotify Technology(SPOT.US$ 看到良好的成長機會

已翻譯

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

灵秀的科克 : 但是 Moomoo 不支持翻滾了嗎?