華倫·巴菲特的投資組合中,近 43% 投資於以下 5 個科技股票:蘋果、TSM、動視暴雪、惠普和瑞信。

因此,對我來說,我將蘋果投資於最大的賬戶,佔我的投資組合的近一半。去年,我增加了 TSM 的持股權,並獲得了一些利潤。但由於某些地緣政治因素,TSM 將失去實力,所以我大約一個月前減少了它。

$蘋果 (AAPL.US)$ $台積電 (TSM.US)$ $動視暴雪 (ATVI.US)$ $惠普 (HPQ.US)$ $威瑞信 (VRSN.US)$

因此,對我來說,我將蘋果投資於最大的賬戶,佔我的投資組合的近一半。去年,我增加了 TSM 的持股權,並獲得了一些利潤。但由於某些地緣政治因素,TSM 將失去實力,所以我大約一個月前減少了它。

$蘋果 (AAPL.US)$ $台積電 (TSM.US)$ $動視暴雪 (ATVI.US)$ $惠普 (HPQ.US)$ $威瑞信 (VRSN.US)$

已翻譯

2

最近,NEV 市場似乎不順利,一些主要 NEV 製造商的股票通常見下跌。

但是,如果您關注中國的 NEV 市場,您可以發現有巨大的增長潛力。對政策的支持,5G 和 AI 的進步,市場需求不斷增長... 所有這些積極元素都將促進該行業的重大增長。

$比亞迪 (002594.SZ)$ $四維圖新 (002405.SZ)$

但是,如果您關注中國的 NEV 市場,您可以發現有巨大的增長潛力。對政策的支持,5G 和 AI 的進步,市場需求不斷增長... 所有這些積極元素都將促進該行業的重大增長。

$比亞迪 (002594.SZ)$ $四維圖新 (002405.SZ)$

已翻譯

1

5

How to adjust the expiration date? Want to illustrate my thoughts with an example

Suppose you bought call options on a stock that expire in three months when the stock was trading at $120 per share. You paid a premium of $5 per share for the options, giving you the right to buy 100 shares of the stock at $125 per share anytime within the next three months. This means that you need the price of the stock to rise above $130 ($125 + $5) before the expiration date to mak...

Suppose you bought call options on a stock that expire in three months when the stock was trading at $120 per share. You paid a premium of $5 per share for the options, giving you the right to buy 100 shares of the stock at $125 per share anytime within the next three months. This means that you need the price of the stock to rise above $130 ($125 + $5) before the expiration date to mak...

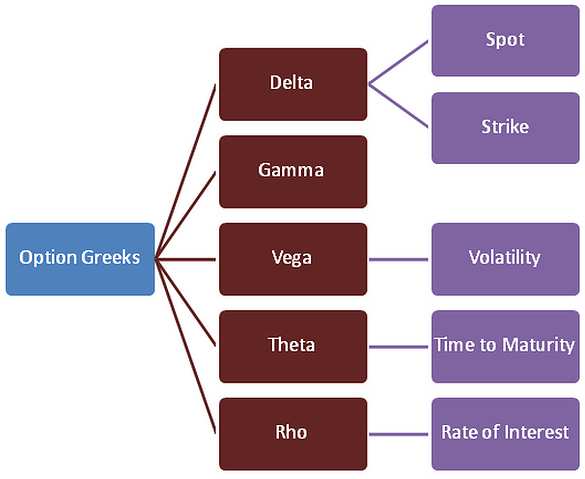

Option Greeks: Delta Gamma Theta Vega

Theta measures the rate of decline in an option's value as time passes. This means that theta can be used to determine how much value an option will lose over time, helping traders decide when to sell an option before it loses too much value.

For example, say you have purchased a call option on a stock with a strike price of $50 and an expiration date of three months from now. If the current market price of the stock is $50, the op...

Theta measures the rate of decline in an option's value as time passes. This means that theta can be used to determine how much value an option will lose over time, helping traders decide when to sell an option before it loses too much value.

For example, say you have purchased a call option on a stock with a strike price of $50 and an expiration date of three months from now. If the current market price of the stock is $50, the op...

3

這是一個多麼困難的問題!![]()

作為一個沒有太多知識的初學者,我認為技術分析更值得信賴。由於技術分析是基於客觀的數學方法。然而,市場情緒可能在某種程度上是主觀的![]() 只是我的直覺

只是我的直覺 ![]()

作為一個沒有太多知識的初學者,我認為技術分析更值得信賴。由於技術分析是基於客觀的數學方法。然而,市場情緒可能在某種程度上是主觀的

已翻譯

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)