CalShenYe

讚了

$ZyVersa Therapeutics (ZVSA.US)$ 12/5/23進行了1-35 R/S!現在在4/25/24不到5個月的時間里,一個1-10 R/S即將到來!猜測他們是確保如果FDA批准獲得,價格足夠高,以避免低於一美元的合規性。同時,使價格對更廣泛的投資者更具吸引力!有很多人不喜歡涉及2.00 PS以下的號碼!

已翻譯

2

12

CalShenYe

讚了

已翻譯

3

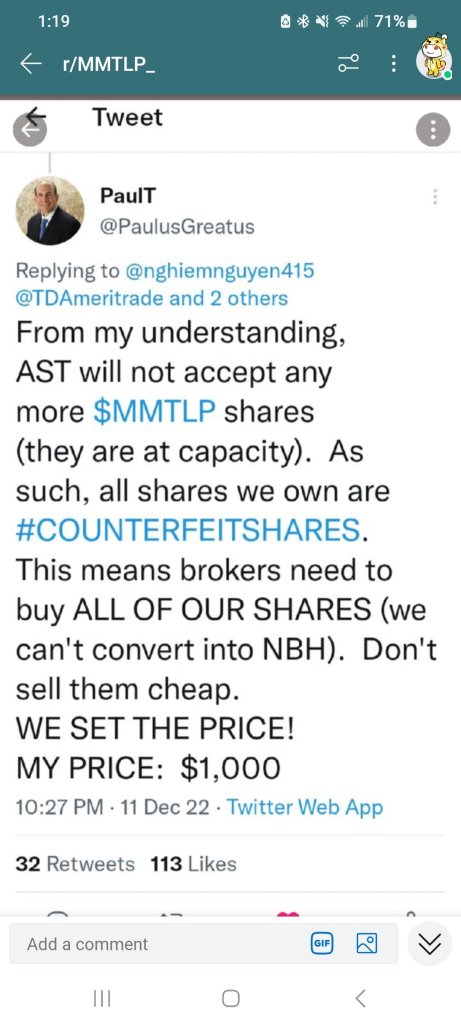

$Meta Materials Inc. Class A Preferred Stock (MMTLP.US)$

我說出於法律目的,以保障自己。

我不同意我的股票兌換市場價值,並將錢自動存入我的帳戶以換取我的 MMTLP 股份。我將在應用程序中自行銷售或通過我決定銷售價格的協議進行銷售。

我說出於法律目的,以保障自己。

我不同意我的股票兌換市場價值,並將錢自動存入我的帳戶以換取我的 MMTLP 股份。我將在應用程序中自行銷售或通過我決定銷售價格的協議進行銷售。

已翻譯

1

CalShenYe

參與了投票

已翻譯

6

1

CalShenYe

讚了

必知資訊

-內部交易背後的事實-

**要點:**

1.) 1988年內部交易及證券欺詐執行法案(ITSFEA)我們行業的誠信需要所有投資者在進行交易決策時都能獲得相同的資訊。

2.) 利用非公開信息謀利或避免損失是行業板塊中最嚴重的違規行為之一,因為這樣做會損害行業板塊的誠信。

3.) 雖然1934年的《證券交易所法案》禁止使用內幕信息進行交易,但《內幕交易與證券欺詐法案》擴大了對內幕交易和證券欺詐的處罰。

4.) 內幕人士是指任何獲取關於一家公司的非公開信息的人。內幕信息是指任何未公開或一般公眾不便獲取的重要信息。

5.) 《法案》禁止內幕人士進行或傳達非公開信息。

6.) 給予內部消息的人(即提供消息的人)和收到內部消息的人(即接受消息的人)都有責任,任何交易此信息且知道或應該知道該信息不是公開的,以及任何對該信息的不當使用具有控制權的人也有責任。

7.) 不需要進行交易就會發生違規行為;即使非金融利益也可能根據規則導致責任。

所以,內幕交易規則下的責任要素如下:

1.) 提供消息的人是否對公司/股東應負有託管職責?他是否違反了該職責?

2.) 這位提供者是否符合個人利益測試(甚至像是增進友誼或聲譽等簡單的事情)?

3.) 提收者是否知道或者應該知道這個資訊是內部的或機密的?

4.) 這個資訊是否屬於重要且非公開的?請注意:即使是公司內部人員的口誤也可能根據這些規則產生責任。

1934年的美國證券交易委員會法案將內部人定義為擁有公司10%以上股權的高管、董事或股東。

如果你看完所有這些重要的信息,我為你感到驕傲:)

$3B家居 (BBBY.US)$ $Lm Funding America (LMFA.US)$ $Ocugen (OCGN.US)$ $BioNano Genomics (BNGO.US)$ $iSpecimen (ISPC.US)$ $Aditxt (ADTX.US)$ $BTC Digital (METX.US)$

-內部交易背後的事實-

**要點:**

1.) 1988年內部交易及證券欺詐執行法案(ITSFEA)我們行業的誠信需要所有投資者在進行交易決策時都能獲得相同的資訊。

2.) 利用非公開信息謀利或避免損失是行業板塊中最嚴重的違規行為之一,因為這樣做會損害行業板塊的誠信。

3.) 雖然1934年的《證券交易所法案》禁止使用內幕信息進行交易,但《內幕交易與證券欺詐法案》擴大了對內幕交易和證券欺詐的處罰。

4.) 內幕人士是指任何獲取關於一家公司的非公開信息的人。內幕信息是指任何未公開或一般公眾不便獲取的重要信息。

5.) 《法案》禁止內幕人士進行或傳達非公開信息。

6.) 給予內部消息的人(即提供消息的人)和收到內部消息的人(即接受消息的人)都有責任,任何交易此信息且知道或應該知道該信息不是公開的,以及任何對該信息的不當使用具有控制權的人也有責任。

7.) 不需要進行交易就會發生違規行為;即使非金融利益也可能根據規則導致責任。

所以,內幕交易規則下的責任要素如下:

1.) 提供消息的人是否對公司/股東應負有託管職責?他是否違反了該職責?

2.) 這位提供者是否符合個人利益測試(甚至像是增進友誼或聲譽等簡單的事情)?

3.) 提收者是否知道或者應該知道這個資訊是內部的或機密的?

4.) 這個資訊是否屬於重要且非公開的?請注意:即使是公司內部人員的口誤也可能根據這些規則產生責任。

1934年的美國證券交易委員會法案將內部人定義為擁有公司10%以上股權的高管、董事或股東。

如果你看完所有這些重要的信息,我為你感到驕傲:)

$3B家居 (BBBY.US)$ $Lm Funding America (LMFA.US)$ $Ocugen (OCGN.US)$ $BioNano Genomics (BNGO.US)$ $iSpecimen (ISPC.US)$ $Aditxt (ADTX.US)$ $BTC Digital (METX.US)$

已翻譯

46

2

4

CalShenYe

評論了

$Meta Materials Inc. Class A Preferred Stock (MMTLP.US)$ YouTube 上的這位女士正在做數學,並說也許是 35 美元的股息。希望她是對的

已翻譯

8

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)