Happy O Man

讚並評論了

早上好,摩埃爾們!以下是您需要了解的關於當今的新加坡的事情:

● 新加坡股票週一開盤走低;STI 下跌 1.01%

● 隨著美聯儲焦慮增加,大宗商品面臨艱難的周

● 可觀看的股票及房地產信託基金:辛泰爾, SPH REIT, 阿斯彭

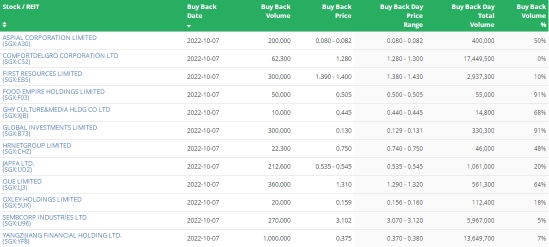

● 最新股份回購成交

-穆穆新聞 SG

市場趨勢

新加坡股市周一走低。該 $富時新加坡海峽指數 (.STI.SG)$ 下跌 1.01% 至 3,114.16...

● 新加坡股票週一開盤走低;STI 下跌 1.01%

● 隨著美聯儲焦慮增加,大宗商品面臨艱難的周

● 可觀看的股票及房地產信託基金:辛泰爾, SPH REIT, 阿斯彭

● 最新股份回購成交

-穆穆新聞 SG

市場趨勢

新加坡股市周一走低。該 $富時新加坡海峽指數 (.STI.SG)$ 下跌 1.01% 至 3,114.16...

已翻譯

1447

1387

189

Happy O Man

讚了

瑞銀資產管理公司最近推出了其名為「全景:2022 年投資」的未來展望,描述了為什麼我們相信 2022 年投資將需要與投資者在過去十年中使用的不同操作手冊。![]()

瑞銀資產管理投資主管 Barry Gill 表示:「隨著新型冠狀病毒爆發後經濟重新正常化,投資者需要為與過去十年的投資環境完全不同的投資環境做好準備。他們需要新的手冊來幫助他們評估可能的結構性通脹、貨幣刺激措施放緩和中國增長前景下降的風險。也有理由保持樂觀;已發達市場的增長很強勁,大多數投資者都在比從全球金融危機中脫離世界金融危機更好的地位開始這個經濟週期。」

我們確定了投資者的六個關鍵考慮因素:

1. 更好的起點

這次,家庭和企業在上一個週期的早期階段面臨的許多障礙並未存在。在大流行引起的衰退後,美國的總薪酬已高於 2020 年 2 月的 6.7%。前所未有的財政和貨幣安排也限制了破產,並促進收益的快速反彈。結果是,全球股票債務與企業價值的比率迅速回復,而美國投資級別公司的全額借貸成本接近創紀錄的低點。這是一套招聘和投資的初始條件,比大流行前的長期擴張期間的開幕階段,更好了。瑞銀市場預測,這已為私營部門帶領的上述趨勢活動時期奠定了基礎。

2. 較高的財政樓層

與上一個週期相比,這個週期的重要區別在於財政政策制定者更採用長期的「不傷害」方法,而且沒有快速轉向嚴重的緊縮措施。根據經濟緩解調整財政定向的措施,意味著發達市場財政政策將在 2023 年以來維持比自 2010 年以來任何時候都更容易。

3. 供應鏈引發通貨膨脹

與供應鏈困擾相關的短缺一直是導致全球上趨勢通脹的重要因素。這些升高的價格壓力與過去十年大部分消通脹的影響,對經濟活動產生了一些負面影響。然而,也有一些銀線:廣泛的通脹也是經濟正在最大化生產能力的徵兆。瑞銀市總局總結說,增加能力以緩解瓶頸和勞動收入強勁增長的結合將大大於價格上漲的影響,導致 2022 年需求延遲,而不是需求破壞

4. 投資預期更強

在某些情況下,上述供應限制是消費者告訴企業增加資本支出的方式。企業的回應:我們是,還有更多未來。自 2020 年 4 月以來的 15 個月內,資本商品出貨的復甦,與 2009 年 6 月後的同期相比,業務投資代表性。銀行正在放寬想要借貸的公司獲得信貸,而對商業和工業貸款的需求正在增加。由於資本支出目前受到供應鏈困擾,因此沒有理由認為動力不會持續。

5. 較少的金錢支持

自 9 月中旬以來的短期利率飆升,此後已部分回復,表明許多先進經濟體的加息可能會在 2022 年開始(如果不是較早)。對於美聯儲來說,這意味著在 2009 年經濟衰退結束和隨後的升降之間的超過六年的延遲相比,這意味著收緊政策的轉向更快得多。在表面上,移除中央銀行刺激措施對風險資產看似負面。然而,投資者必須記住,這種撤銷支持與正面的經濟結果有關。在 2022 年,瑞銀市場預測將明顯,移除貨幣安排不僅是由於價格壓力的粘性,而且還是增長的強勢和朝向全就業進展的功能。

6. 中國

儘管具有結構性趨勢,短期內存在一系列催化劑,指出中國的活動穩定,或許微小的回升。來自美國和歐盟的強勁需求正推動中國貿易盈餘創紀錄,以支撐國內生產。在年度結束前的信貸衝動轉變,應該會使另一個樓層進行活動。瑞銀香港預測冬奧會後,中國移動方面的全面復甦將在接下來,以支持重新平衡增長方向消費方向的努力。

瑞銀資產管理多元資產投資組合主管 Nicole Goldberger 表示:「股票市場指標和主權債券收益率表明投資者正在低估高趨勢經濟增長的走勢。我們意識到,這種時期在近期歷史中一直是短暫的,這有助於解釋市場懷疑態度。儘管如此,市場定價表明在恢復平等增長方面存在共識。儘管 Omicron 變體很可能在短期內會影響活動,但與之前的病毒波相比,我們不預計它會對生長造成更深或更長的阻礙。最終,我們相信在此發展之前建立的大部分經濟動力將保留。」

她繼續說:「在這種背景下,我們相信,最受到週期性強勢的風險資產具有良好的位置,可以在經濟上升增長驚喜的世界中表現優勢,這將推動債券收益率更高。投資者亦應考慮直接或透過能源股票投入商品,以協助抵消通脹證明對股票和債券造成破壞性的風險。」

瑞銀資產管理投資主管 Barry Gill 表示:「隨著新型冠狀病毒爆發後經濟重新正常化,投資者需要為與過去十年的投資環境完全不同的投資環境做好準備。他們需要新的手冊來幫助他們評估可能的結構性通脹、貨幣刺激措施放緩和中國增長前景下降的風險。也有理由保持樂觀;已發達市場的增長很強勁,大多數投資者都在比從全球金融危機中脫離世界金融危機更好的地位開始這個經濟週期。」

我們確定了投資者的六個關鍵考慮因素:

1. 更好的起點

這次,家庭和企業在上一個週期的早期階段面臨的許多障礙並未存在。在大流行引起的衰退後,美國的總薪酬已高於 2020 年 2 月的 6.7%。前所未有的財政和貨幣安排也限制了破產,並促進收益的快速反彈。結果是,全球股票債務與企業價值的比率迅速回復,而美國投資級別公司的全額借貸成本接近創紀錄的低點。這是一套招聘和投資的初始條件,比大流行前的長期擴張期間的開幕階段,更好了。瑞銀市場預測,這已為私營部門帶領的上述趨勢活動時期奠定了基礎。

2. 較高的財政樓層

與上一個週期相比,這個週期的重要區別在於財政政策制定者更採用長期的「不傷害」方法,而且沒有快速轉向嚴重的緊縮措施。根據經濟緩解調整財政定向的措施,意味著發達市場財政政策將在 2023 年以來維持比自 2010 年以來任何時候都更容易。

3. 供應鏈引發通貨膨脹

與供應鏈困擾相關的短缺一直是導致全球上趨勢通脹的重要因素。這些升高的價格壓力與過去十年大部分消通脹的影響,對經濟活動產生了一些負面影響。然而,也有一些銀線:廣泛的通脹也是經濟正在最大化生產能力的徵兆。瑞銀市總局總結說,增加能力以緩解瓶頸和勞動收入強勁增長的結合將大大於價格上漲的影響,導致 2022 年需求延遲,而不是需求破壞

4. 投資預期更強

在某些情況下,上述供應限制是消費者告訴企業增加資本支出的方式。企業的回應:我們是,還有更多未來。自 2020 年 4 月以來的 15 個月內,資本商品出貨的復甦,與 2009 年 6 月後的同期相比,業務投資代表性。銀行正在放寬想要借貸的公司獲得信貸,而對商業和工業貸款的需求正在增加。由於資本支出目前受到供應鏈困擾,因此沒有理由認為動力不會持續。

5. 較少的金錢支持

自 9 月中旬以來的短期利率飆升,此後已部分回復,表明許多先進經濟體的加息可能會在 2022 年開始(如果不是較早)。對於美聯儲來說,這意味著在 2009 年經濟衰退結束和隨後的升降之間的超過六年的延遲相比,這意味著收緊政策的轉向更快得多。在表面上,移除中央銀行刺激措施對風險資產看似負面。然而,投資者必須記住,這種撤銷支持與正面的經濟結果有關。在 2022 年,瑞銀市場預測將明顯,移除貨幣安排不僅是由於價格壓力的粘性,而且還是增長的強勢和朝向全就業進展的功能。

6. 中國

儘管具有結構性趨勢,短期內存在一系列催化劑,指出中國的活動穩定,或許微小的回升。來自美國和歐盟的強勁需求正推動中國貿易盈餘創紀錄,以支撐國內生產。在年度結束前的信貸衝動轉變,應該會使另一個樓層進行活動。瑞銀香港預測冬奧會後,中國移動方面的全面復甦將在接下來,以支持重新平衡增長方向消費方向的努力。

瑞銀資產管理多元資產投資組合主管 Nicole Goldberger 表示:「股票市場指標和主權債券收益率表明投資者正在低估高趨勢經濟增長的走勢。我們意識到,這種時期在近期歷史中一直是短暫的,這有助於解釋市場懷疑態度。儘管如此,市場定價表明在恢復平等增長方面存在共識。儘管 Omicron 變體很可能在短期內會影響活動,但與之前的病毒波相比,我們不預計它會對生長造成更深或更長的阻礙。最終,我們相信在此發展之前建立的大部分經濟動力將保留。」

她繼續說:「在這種背景下,我們相信,最受到週期性強勢的風險資產具有良好的位置,可以在經濟上升增長驚喜的世界中表現優勢,這將推動債券收益率更高。投資者亦應考慮直接或透過能源股票投入商品,以協助抵消通脹證明對股票和債券造成破壞性的風險。」

已翻譯

33

2

6

Happy O Man

表達了心情

這個星期,我打的週期 $Biora Therapeutics (PROG.US)$,雖然似乎世界上大多數人已經陷入了電話的誘惑( $Phunware (PHUN.US)$ $Digital World Acquisition Corp (DWAC.US)$)在一些快速容易賺錢的機會。第五回合將把前進正確的那裡 $AMC院線 (AMC.US)$ & $遊戲驛站 (GME.US)$為了我。我認為這非常好,我只需要耐心。

如果有人對你撒謊:

沒有,很容易。錢。

所以,請不要分心!T 股是華爾街投注股票 2.0 版,

唯一的區別是 NOW 他們已經將政治情緒附加到了您已經糟糕的投資習慣上。而且似乎你們都在不知不覺中取得雙方(他媽的王牌,去 amc 類型的狗屎),這絕對令我厭惡。你們都讓他們繼續分裂我們太容易了無論您的投資選擇,政治,宗教,顏色,性別或其他任何東西如何,您都是我的盟友!

我說我們開始學習並適應他們不斷發展的非法遊戲(媒體操縱,PFOF,CB)一起。然後,我們都會弄清楚如何服用奶酪-而不會被困住。它只需要一點團隊合作和防禦工事。據我所知,我們仍然擁有兩個地方的強大力量-這就是參與和消費。

如果我們都決定立即停止參與,會發生什麼?沒有任何規定我們必須參與的法律。那麼,如果操縱的市場崩潰怎麼辦...然後它很容易,因為我們沒有魚留在池塘裡趕上,他們的比賽將很快結束。要求真實而透明的變化,直到我們甚至想到 EVER 再次觸及股市為止。還是我只是在做夢?讓我知道你的立場如果你沒有一個,拿一個!不要成為一個胖子。

無論我們最終想出什麼(這只是一個想法,我有很多),我希望我們可以將我們的集體狗屎放在一起並快速完成。在更多的新手和紙追逐者失去之前,他們將面臨著。厭倦了每天看這場比賽。

最後,我認為你們都會通過切換到加密貨幣來做得更好。他們才剛剛開始嘗試在那裡實現他們的操縱工具,而且它仍然非常早。再加上我瘋狂的 % 返回,那裡不能騙你。10x 曾經是一個管道夢,現在它的期望。在加密貨幣中,您只需設置它並忘記它。最困難的部分就是獨自離開它。

或者,你可以繼續追著那些 PR 驅動的動量袋來保持。就我個人而言,我不太喜歡它們,特別是如果我沒有誠實地贏得它們!

* 不是財務建議 *... 但是請考慮一下,對嗎?

如果有人對你撒謊:

沒有,很容易。錢。

所以,請不要分心!T 股是華爾街投注股票 2.0 版,

唯一的區別是 NOW 他們已經將政治情緒附加到了您已經糟糕的投資習慣上。而且似乎你們都在不知不覺中取得雙方(他媽的王牌,去 amc 類型的狗屎),這絕對令我厭惡。你們都讓他們繼續分裂我們太容易了無論您的投資選擇,政治,宗教,顏色,性別或其他任何東西如何,您都是我的盟友!

我說我們開始學習並適應他們不斷發展的非法遊戲(媒體操縱,PFOF,CB)一起。然後,我們都會弄清楚如何服用奶酪-而不會被困住。它只需要一點團隊合作和防禦工事。據我所知,我們仍然擁有兩個地方的強大力量-這就是參與和消費。

如果我們都決定立即停止參與,會發生什麼?沒有任何規定我們必須參與的法律。那麼,如果操縱的市場崩潰怎麼辦...然後它很容易,因為我們沒有魚留在池塘裡趕上,他們的比賽將很快結束。要求真實而透明的變化,直到我們甚至想到 EVER 再次觸及股市為止。還是我只是在做夢?讓我知道你的立場如果你沒有一個,拿一個!不要成為一個胖子。

無論我們最終想出什麼(這只是一個想法,我有很多),我希望我們可以將我們的集體狗屎放在一起並快速完成。在更多的新手和紙追逐者失去之前,他們將面臨著。厭倦了每天看這場比賽。

最後,我認為你們都會通過切換到加密貨幣來做得更好。他們才剛剛開始嘗試在那裡實現他們的操縱工具,而且它仍然非常早。再加上我瘋狂的 % 返回,那裡不能騙你。10x 曾經是一個管道夢,現在它的期望。在加密貨幣中,您只需設置它並忘記它。最困難的部分就是獨自離開它。

或者,你可以繼續追著那些 PR 驅動的動量袋來保持。就我個人而言,我不太喜歡它們,特別是如果我沒有誠實地贏得它們!

* 不是財務建議 *... 但是請考慮一下,對嗎?

已翻譯

11

12

1

Happy O Man

讚了

$元宇宙概念 (LIST2567.US)$ $FOUNT METAVERSE ETF (MTVR.US)$ 最近我一直在研究如何投資元宇宙。這對我來說並不有希望,但自從 Facebook 開始賭博以來,這是整個未來,我一直在尋找投資 etf 的理由。

已翻譯

4

Happy O Man

讚了

已翻譯

20

1

Happy O Man

讚了

$Lendlease Reit (JYEU.SG)$

當你聽到lendlease reit的負債成本僅為0.9%時,沒聽錯。

這是因為他們有取得歐盟貸款的管道,即使在covid之前,這些貸款的利率也很低。

因此,LL具有非常強大和穩定的財務狀況。

$利安-辉立新加坡房地产投资信托ETF (CLR.SG)$ $新加坡交易所 (S68.SG)$ $富時新加坡海峽指數 (.STI.SG)$ $First Trust FTSE EPRA/NAREIT Developed Markets Real Estate (FFR.US)$

當你聽到lendlease reit的負債成本僅為0.9%時,沒聽錯。

這是因為他們有取得歐盟貸款的管道,即使在covid之前,這些貸款的利率也很低。

因此,LL具有非常強大和穩定的財務狀況。

$利安-辉立新加坡房地产投资信托ETF (CLR.SG)$ $新加坡交易所 (S68.SG)$ $富時新加坡海峽指數 (.STI.SG)$ $First Trust FTSE EPRA/NAREIT Developed Markets Real Estate (FFR.US)$

已翻譯

28

2

1

Happy O Man

讚了

Happy O Man

讚了

$比亞迪電子 (00285.HK)$ 許多人認為比亞迪電動只是在製造電子煙。請讀一讀摘要啦,哈哈哈

已翻譯

20

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Happy O Man : K