As a newbie to investment. I try watch out for stocks with dividend yields. Just in case the stocks I chose drops in value and I can’t dispose it. I will still have some consolation in that. That being said, we still have to do some checks on the companies background and who are the major investors are before we “board the ship”. The summaries provided are helpful and we are able to compare them with our own checks. Patience is always the key to long term investment.

二零二一年十二月二十一日星期二

由達尼洛

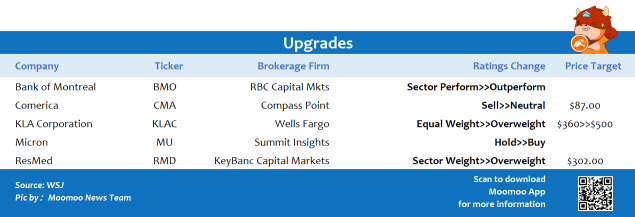

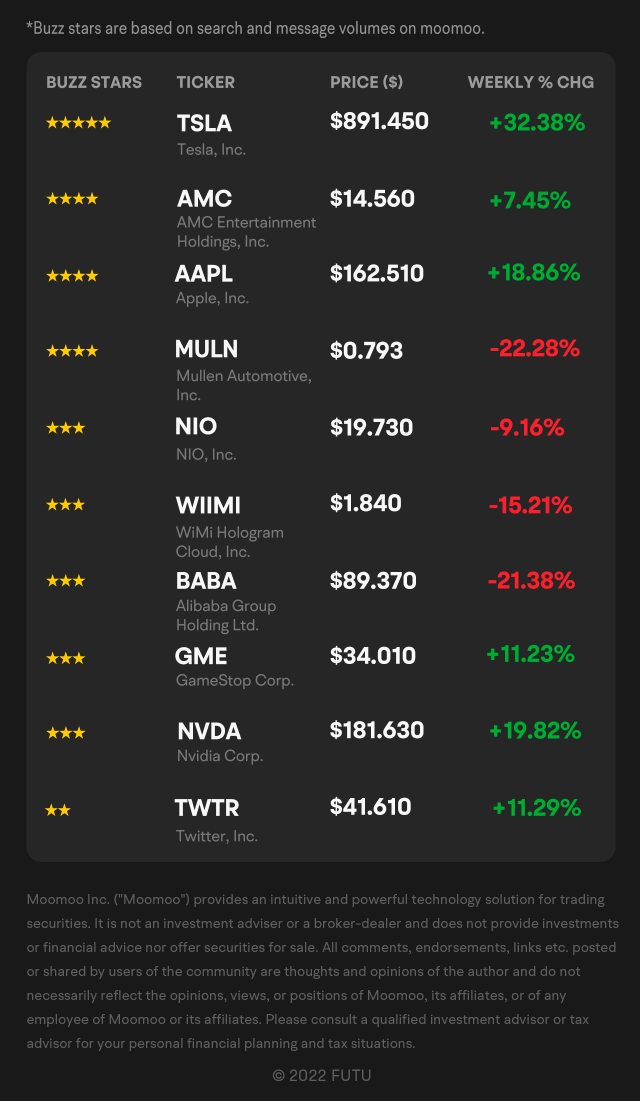

$蒙特利爾銀行(BMO.US$ $美光科技(MU.US$ $阿里巴巴(BABA.US$ $甲骨文(ORCL.US$ $Vuzix(VUZI.US$ $GoodRx(GDRX.US$

由達尼洛

$蒙特利爾銀行(BMO.US$ $美光科技(MU.US$ $阿里巴巴(BABA.US$ $甲骨文(ORCL.US$ $Vuzix(VUZI.US$ $GoodRx(GDRX.US$

已翻譯

+1

74

4

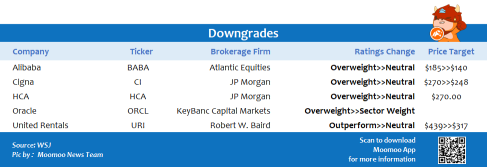

$Moderna(MRNA.US$ 疫苗製造商 Moderna 週一表示,其 COVID-19 增強劑注射在實驗室測試中可以防止快速擴散的奧米克龍菌株。Moderna 還表示,Omicron 疫苗的開發將繼續,並且預計它將在 2022 年初進入臨床試驗。公佈後,莫德納股票在市前交易上漲超過 6.5%。

已翻譯

10

$PayPal(PYPL.US$ $Block(SQ.US$

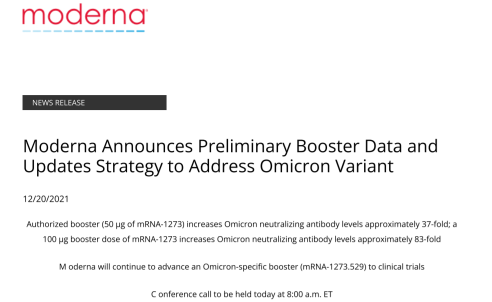

The digital payment industry has been on a steady climb for many years given the e-commerce revolution. The Covid 19 situation, has further led to new users who usually would not have shopped online to come onboard. All these bode well for a good runway for further consistent growth ahead.

With the coming of the new era of Metaverse by Meta, where the future could be split between your virtual and physical world, the need for a digital wallet would be essential. The digital wallet could be used for keeping your digital currency, digital assets (NFTs) and other digital-related items.

Source: Mordor Intelligence

The transaction value of the digital payments market was USD 5.44 trillion in 2020, and it is projected to be worth USD 11.29 trillion by 2026, registering a CAGR of 11.21% from 2021 to 2026

Source: Mordor Intelligence

The global payments market is expected to grow from $466.29 billion in 2020 to $517.68 billion in 2021 at a compound annual growth rate (CAGR) of 11%. The market is expected to reach $735.39 billion in 2025 at a CAGR of 9.2%.

Source: Businesswire.com

The growth as predicted by both Modor Intelligence and Businesswire for the digital payment industry would be in the region of around 11% for the next 5 years. This is consistent growth rather than exceptional growth but one thing is for sure, it is still a sunrise sector. Hence, it is going to be a good place to look for potential investments.

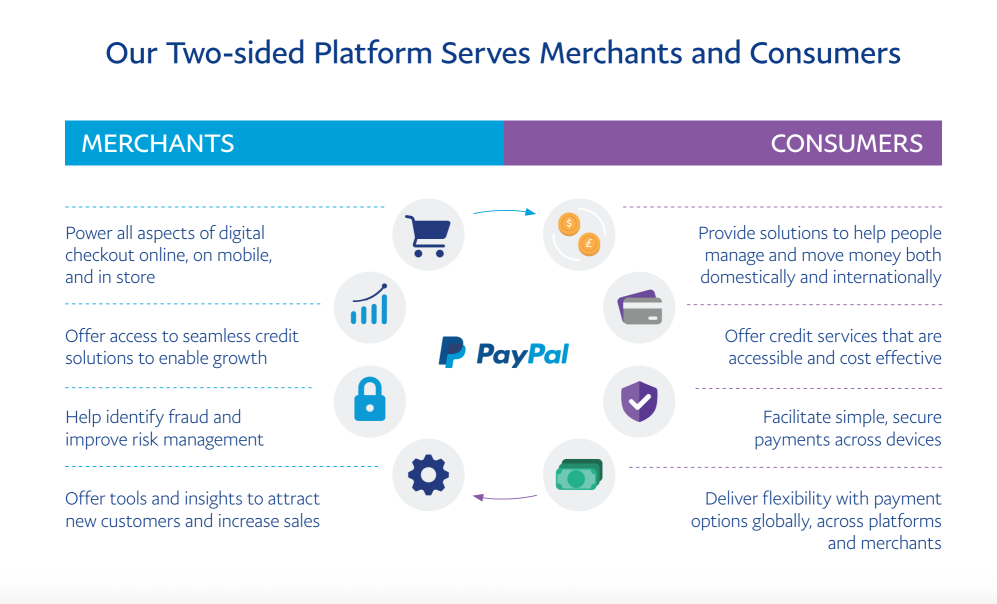

Paypal- The Gateway to Digital Payments

PayPal would need no introduction as it has been around since 1998 where their famous co-founder, Elon Musk, is now the richest man in the world; courtesy of Tesla's stake. It was part of eBay from 2002 till it was hived off in 2015 through an IPO. PayPal is therefore well entrenched internationally and not just in the US.

It has since evolved to include not only a payment mode but also a digital wallet, Venmo. You could use their app to trade cryptocurrencies and they are looking into shares trading too in the future. You are also able to store your digital assets (NFTs).

Paypal has also recently launched their digital credit card, Venmo Visa, where they have recently announced a collaboration with Amazon. They are also having their own Buy Now Pay Later solution to be up to par with competitors.

The vision for PayPal is to be a super app fighting the likes of Wechat, Alipay, Grab and Sea.

Financial Metrics

Based on the analysis of the Financial Metrics which we compared to their competitor Square which was set up in 2009. Their co-founder is Jack Dorsey who also helm Twitter. Given the earlier industry growth outlook of teens in the next 5 years, a PE of 46 would not be exactly in the bargain zone.

Nonetheless, comparing the average PE since 2016 of 57 (source: YCharts), we might be heading into a reasonable valuation zone based on the historical PE range.

Though they have a debt to equity of 0.36, if we include the cash holdings, it is in a net cash position. This gives PayPal a strong financial position. On the whole, it is a safer bet than Square in the payment sector but Square is growing at a much faster pace, they have also not expanded their base in the international markets yet.

PayPal has been the better capital allocator given its stellar return on equity and invested capital numbers.

Paypal Historical Growth

Source: Reuters

Looking at the revenue growth from 2016 to 2020, the compounded growth rate was 18.6%. The growth in earnings outshoots the revenue growth by growing at a compounding rate of 31.6%. It was more commendable given their gradual loss of eBay business since 2018.

The payment agreement between eBay and PayPal was till June 2020- 5 years after their spin-off. At their spin-off (2015), eBay makes up to 50% of the profits for PayPal. It is just less than 4% of their total revenue and it could go to nil by 2023 as eBay is coming up with their payment solutions.

Why has PayPal fallen almost 37% from the Peak?

Based on the latest Q3 results, their growth quarter on quarter has slowed to around 13% for their revenue- factoring in a reduction of 46% revenue from eBay. Excluding eBay, revenue has grown at around the 25% mark over the past 2 years. Nonetheless, there was a reduction in guidance for Q4.

PayPal expects fourth-quarter adjusted earnings to be about $1.12 per share versus the estimate of $1.27 per share. The company expects fourth-quarter revenue to be in a range of $6.85 billion to $6.95 billion versus the estimate of $7.24 billion.

Also, PayPal expects growth for 2022 to be around 18% which falls short of analysts estimates at 22%. This disappointing outlook has led to the recent share price weakness.

Their recent interest in Pinterest has also gathered mixed reactions with some critics highlighting that PayPal’s growth could be filtering off as they have to acquire non-core business to generate growth. Also, a move into e-commerce when they have spun off from eBay earlier seems to highlight the synergies might not work.

At 45 billion dollars, it is buying growth at a hefty price tag of 20x Price to Sales. Moreover, the co-founder, Evan Sharp, would be leaving Pinterest for LoveForm. Also, Pinterest was listed in April 2019 at just a valuation of 10 billion dollars but the deal would value it at 45 billion dollars.

From another angle, the social media investment could be a good move to capture more customers for their payment app with a whole new demographics. Also, social commerce is up and coming. The acquisition would help PayPal gain a foothold in this lucrative market, hence taking a step closer to the goal of being a super app with numerous features.

On the whole, we find the no-deal on Pinterest would be a net positive for PayPal, as it is not within their core business of digital payments.

Chartist Point of View

Looking at the charts, it is an ugly sight where it has fallen almost 37% from their peak of 310. It has just broken through the psychological 200 level last Friday. This is what catching a falling knife will look like.

Nonetheless, looking at the historical valuation from price to book and price to earnings, a bottom could be established soon as we are near their average and even below-average historical valuation.

Support would be found at firstly the 175–185 region. The next support would be the 145–160 region which coincides with our box method projection- price range of 240–310 forming the box used.

Summing Up

Given the digital payments industry outlook, the sector is still on a secular uptrend. The growth could be in the healthy teens’ region. With so much talk about Metaverse, it will likely lead to more growth if the scenario where virtual and augmented reality takes over a portion of our daily life.

PayPal, with their recent price drop, would be a safer proxy to invest in this sector given their pedigree and great track record.

PayPal is currently trading at forward PE of 36, which is the average mean for the past 5 years. We are therefore getting it at a reasonable valuation based on historical metrics. Moreover, it is in a net cash position and generating healthy positive free cash flow.

With eBay making up just less than 4% of their revenue, they are embarking and ready for an eBay-less form going into 2022. Without an agreement with eBay, they could have more latitude to tie up with other e-commerce platforms. This was shown through their recent collaboration with Amazon announced in the Q3 results briefing.

However, the chart is akin to a falling knife now. Potential attractive entry region would be firstly the 175–185 region followed by 145–160 region based on our charting analysis.

From a fundamental angle, if valuation drops below forward PE of 30, that could be another indicator that we will be investing in this established payment provider at a good price.

The fall in PayPal price could be seen as an optimal opportunity to pick up a great consistent growth stock at a reasonable valuation.

The digital payment industry has been on a steady climb for many years given the e-commerce revolution. The Covid 19 situation, has further led to new users who usually would not have shopped online to come onboard. All these bode well for a good runway for further consistent growth ahead.

With the coming of the new era of Metaverse by Meta, where the future could be split between your virtual and physical world, the need for a digital wallet would be essential. The digital wallet could be used for keeping your digital currency, digital assets (NFTs) and other digital-related items.

Source: Mordor Intelligence

The transaction value of the digital payments market was USD 5.44 trillion in 2020, and it is projected to be worth USD 11.29 trillion by 2026, registering a CAGR of 11.21% from 2021 to 2026

Source: Mordor Intelligence

The global payments market is expected to grow from $466.29 billion in 2020 to $517.68 billion in 2021 at a compound annual growth rate (CAGR) of 11%. The market is expected to reach $735.39 billion in 2025 at a CAGR of 9.2%.

Source: Businesswire.com

The growth as predicted by both Modor Intelligence and Businesswire for the digital payment industry would be in the region of around 11% for the next 5 years. This is consistent growth rather than exceptional growth but one thing is for sure, it is still a sunrise sector. Hence, it is going to be a good place to look for potential investments.

Paypal- The Gateway to Digital Payments

PayPal would need no introduction as it has been around since 1998 where their famous co-founder, Elon Musk, is now the richest man in the world; courtesy of Tesla's stake. It was part of eBay from 2002 till it was hived off in 2015 through an IPO. PayPal is therefore well entrenched internationally and not just in the US.

It has since evolved to include not only a payment mode but also a digital wallet, Venmo. You could use their app to trade cryptocurrencies and they are looking into shares trading too in the future. You are also able to store your digital assets (NFTs).

Paypal has also recently launched their digital credit card, Venmo Visa, where they have recently announced a collaboration with Amazon. They are also having their own Buy Now Pay Later solution to be up to par with competitors.

The vision for PayPal is to be a super app fighting the likes of Wechat, Alipay, Grab and Sea.

Financial Metrics

Based on the analysis of the Financial Metrics which we compared to their competitor Square which was set up in 2009. Their co-founder is Jack Dorsey who also helm Twitter. Given the earlier industry growth outlook of teens in the next 5 years, a PE of 46 would not be exactly in the bargain zone.

Nonetheless, comparing the average PE since 2016 of 57 (source: YCharts), we might be heading into a reasonable valuation zone based on the historical PE range.

Though they have a debt to equity of 0.36, if we include the cash holdings, it is in a net cash position. This gives PayPal a strong financial position. On the whole, it is a safer bet than Square in the payment sector but Square is growing at a much faster pace, they have also not expanded their base in the international markets yet.

PayPal has been the better capital allocator given its stellar return on equity and invested capital numbers.

Paypal Historical Growth

Source: Reuters

Looking at the revenue growth from 2016 to 2020, the compounded growth rate was 18.6%. The growth in earnings outshoots the revenue growth by growing at a compounding rate of 31.6%. It was more commendable given their gradual loss of eBay business since 2018.

The payment agreement between eBay and PayPal was till June 2020- 5 years after their spin-off. At their spin-off (2015), eBay makes up to 50% of the profits for PayPal. It is just less than 4% of their total revenue and it could go to nil by 2023 as eBay is coming up with their payment solutions.

Why has PayPal fallen almost 37% from the Peak?

Based on the latest Q3 results, their growth quarter on quarter has slowed to around 13% for their revenue- factoring in a reduction of 46% revenue from eBay. Excluding eBay, revenue has grown at around the 25% mark over the past 2 years. Nonetheless, there was a reduction in guidance for Q4.

PayPal expects fourth-quarter adjusted earnings to be about $1.12 per share versus the estimate of $1.27 per share. The company expects fourth-quarter revenue to be in a range of $6.85 billion to $6.95 billion versus the estimate of $7.24 billion.

Also, PayPal expects growth for 2022 to be around 18% which falls short of analysts estimates at 22%. This disappointing outlook has led to the recent share price weakness.

Their recent interest in Pinterest has also gathered mixed reactions with some critics highlighting that PayPal’s growth could be filtering off as they have to acquire non-core business to generate growth. Also, a move into e-commerce when they have spun off from eBay earlier seems to highlight the synergies might not work.

At 45 billion dollars, it is buying growth at a hefty price tag of 20x Price to Sales. Moreover, the co-founder, Evan Sharp, would be leaving Pinterest for LoveForm. Also, Pinterest was listed in April 2019 at just a valuation of 10 billion dollars but the deal would value it at 45 billion dollars.

From another angle, the social media investment could be a good move to capture more customers for their payment app with a whole new demographics. Also, social commerce is up and coming. The acquisition would help PayPal gain a foothold in this lucrative market, hence taking a step closer to the goal of being a super app with numerous features.

On the whole, we find the no-deal on Pinterest would be a net positive for PayPal, as it is not within their core business of digital payments.

Chartist Point of View

Looking at the charts, it is an ugly sight where it has fallen almost 37% from their peak of 310. It has just broken through the psychological 200 level last Friday. This is what catching a falling knife will look like.

Nonetheless, looking at the historical valuation from price to book and price to earnings, a bottom could be established soon as we are near their average and even below-average historical valuation.

Support would be found at firstly the 175–185 region. The next support would be the 145–160 region which coincides with our box method projection- price range of 240–310 forming the box used.

Summing Up

Given the digital payments industry outlook, the sector is still on a secular uptrend. The growth could be in the healthy teens’ region. With so much talk about Metaverse, it will likely lead to more growth if the scenario where virtual and augmented reality takes over a portion of our daily life.

PayPal, with their recent price drop, would be a safer proxy to invest in this sector given their pedigree and great track record.

PayPal is currently trading at forward PE of 36, which is the average mean for the past 5 years. We are therefore getting it at a reasonable valuation based on historical metrics. Moreover, it is in a net cash position and generating healthy positive free cash flow.

With eBay making up just less than 4% of their revenue, they are embarking and ready for an eBay-less form going into 2022. Without an agreement with eBay, they could have more latitude to tie up with other e-commerce platforms. This was shown through their recent collaboration with Amazon announced in the Q3 results briefing.

However, the chart is akin to a falling knife now. Potential attractive entry region would be firstly the 175–185 region followed by 145–160 region based on our charting analysis.

From a fundamental angle, if valuation drops below forward PE of 30, that could be another indicator that we will be investing in this established payment provider at a good price.

The fall in PayPal price could be seen as an optimal opportunity to pick up a great consistent growth stock at a reasonable valuation.

+4

10

$蘋果(AAPL.US$ 它會達到 210 美元的目標嗎?

已翻譯

2

4

來自新加坡/香港的零售商-對我們來說,這是夜間,因此在日內(夜間)很困難,尤其是如果您是兼職工作,因此我建議不要這樣做。

我寧願建議投資基本上強勁的股票,並使用技術分析作為入口點

但是有些股票在一晚上賺了大筆錢

例子 $Moderna(MRNA.US$ $Longeveron(LGVN.US$ $Rivian Automotive(RIVN.US$ $Sono Group(SEV.US$以及許多其他例子

類似的股票 $Longeveron(LGVN.US$在夜間或 3-5 天內,有些倍增加了 5-10 倍...

許多股票,例如 $Moderna(MRNA.US$和 $Rivian Automotive(RIVN.US$在一晚上獲得高達 30% 甚至更多的收入-因此,請始終在您的帳戶中保留一些備用的錢.. 您可以用於日內交易。

在美國市場-實際上沒有上線路。股票可以盡可能高...

不要設定限價訂單,如果達到限額或追尾止損,請在睡眠之前放市...

您可以輕鬆地從這些股票上賺錢

美國市場在 2-3 天的時間範圍內在新聞股市開始下跌之前反彈。

您可以在上漲時和下跌時(通過賣空)賺錢。有時 Futu 不允許您賣空-這就是為什麼您需要在多個經紀人擁有多個帳戶的原因。

我寧願建議投資基本上強勁的股票,並使用技術分析作為入口點

但是有些股票在一晚上賺了大筆錢

例子 $Moderna(MRNA.US$ $Longeveron(LGVN.US$ $Rivian Automotive(RIVN.US$ $Sono Group(SEV.US$以及許多其他例子

類似的股票 $Longeveron(LGVN.US$在夜間或 3-5 天內,有些倍增加了 5-10 倍...

許多股票,例如 $Moderna(MRNA.US$和 $Rivian Automotive(RIVN.US$在一晚上獲得高達 30% 甚至更多的收入-因此,請始終在您的帳戶中保留一些備用的錢.. 您可以用於日內交易。

在美國市場-實際上沒有上線路。股票可以盡可能高...

不要設定限價訂單,如果達到限額或追尾止損,請在睡眠之前放市...

您可以輕鬆地從這些股票上賺錢

美國市場在 2-3 天的時間範圍內在新聞股市開始下跌之前反彈。

您可以在上漲時和下跌時(通過賣空)賺錢。有時 Futu 不允許您賣空-這就是為什麼您需要在多個經紀人擁有多個帳戶的原因。

已翻譯

36

1

有許多不同類型的交易者:日間交易者,搖擺交易者,長期交易者等。每種交易者類型都有不同的策略,適合他們。我將一般討論良好的交易習慣...

您可以閱讀許多書籍,文章等,以建立良好的交易習慣。許多人會提供你應該如何去交易和他們的經驗(失敗或成功)。關鍵是,這對他們很好。他們知道他們的戰略的內在運作。但是,如果您嘗試為自己複製它可能不適合您。所以,你是做什麼的?找別人跟蹤,爭奪,放棄?

好吧,您可能不必放棄,因為那是您想要做的最後一件事。你需要向自己證明你可以做到這一點。希望以下是一些可以提供幫助的提示:

1.建立計劃

2.做你的盡職調查(研究,文章,新聞等)

3.以積極的態度進行交易

4.不要衝動行動或做出反應

5.使用止損來限制虧損交易

6.從您的損失中學習

7.不要貪婪並獲利

根據我的理解,這就是我在我的帳戶中發揮作用的是繼續投資少量(稱為複利的力量)。現在,您將看不到太多回報,但是假設從現在開始 10 年,它將急劇增長。然後,如果你回顧 10 年,你就會意識到複利的力量。要在這一部分取得成功,您必須投資於眾所周知和成功的股票,例如 $蘋果(AAPL.US$, $亞馬遜(AMZN.US$, $微軟(MSFT.US$, $谷歌-A(GOOGL.US$, $奈飛(NFLX.US$, $可口可樂(KO.US$,等等。如今,您無需購買全部股票,因為許多經紀人允許您購買切片(這是一股)。現在,如果您以這種方式自動購買,最終這將開始快速增長。此外,如果股票派發股息,那麼您應該重新投資購買一張股票,而不是將其套現出去。這也有助於作為複利興趣的一部分。

要記住的一個注意事項是不氣餒,如果你的時間,一天,一周或一個月不好。繼續投資,因為每一天都是不同的。每個人都有一個策略,並為他們工作.您應該查看他們的想法,看看它是否適合您。如果沒有,則必須進行調整,以使其適合您。多做一些盡職調查(研究,文章,新聞等)。試著弄清楚你的執行中出了什麼問題。請進行必要的變更,再試一次。如果它不再起作用,請繼續嘗試進行更改,直到它適用於您。你會看到,事情會改變,你會成功.但是你需要繼續嘗試,而不是在第一,第二,第三等失敗時感到氣餒。

好吧,所以我不想讓任何人感到厭煩。簡而言之,建立良好交易習慣的最佳方法是對您的投資進行研究,選擇適合您的策略,執行它,然後嘗試使用複利興趣方法。作為一個保守的投資者,這在我的情況下效果很好。我非常認為每個人都可以從這個策略中受益。不要試圖複製別人的想法,因為這對他們有用。您需要深入了解它並自行嘗試。這就是使您成功的原因。實踐使得完美,這就是你過去可能聽到過的話。這是絕對真實的。希望這可以幫助你。

請隨時留下您對此主題的任何意見或建議。我也非常樂意幫助任何可能想要談論更多關於這個問題或需要任何幫助的人。

祝您在投資中取得巨大成功。

您可以閱讀許多書籍,文章等,以建立良好的交易習慣。許多人會提供你應該如何去交易和他們的經驗(失敗或成功)。關鍵是,這對他們很好。他們知道他們的戰略的內在運作。但是,如果您嘗試為自己複製它可能不適合您。所以,你是做什麼的?找別人跟蹤,爭奪,放棄?

好吧,您可能不必放棄,因為那是您想要做的最後一件事。你需要向自己證明你可以做到這一點。希望以下是一些可以提供幫助的提示:

1.建立計劃

2.做你的盡職調查(研究,文章,新聞等)

3.以積極的態度進行交易

4.不要衝動行動或做出反應

5.使用止損來限制虧損交易

6.從您的損失中學習

7.不要貪婪並獲利

根據我的理解,這就是我在我的帳戶中發揮作用的是繼續投資少量(稱為複利的力量)。現在,您將看不到太多回報,但是假設從現在開始 10 年,它將急劇增長。然後,如果你回顧 10 年,你就會意識到複利的力量。要在這一部分取得成功,您必須投資於眾所周知和成功的股票,例如 $蘋果(AAPL.US$, $亞馬遜(AMZN.US$, $微軟(MSFT.US$, $谷歌-A(GOOGL.US$, $奈飛(NFLX.US$, $可口可樂(KO.US$,等等。如今,您無需購買全部股票,因為許多經紀人允許您購買切片(這是一股)。現在,如果您以這種方式自動購買,最終這將開始快速增長。此外,如果股票派發股息,那麼您應該重新投資購買一張股票,而不是將其套現出去。這也有助於作為複利興趣的一部分。

要記住的一個注意事項是不氣餒,如果你的時間,一天,一周或一個月不好。繼續投資,因為每一天都是不同的。每個人都有一個策略,並為他們工作.您應該查看他們的想法,看看它是否適合您。如果沒有,則必須進行調整,以使其適合您。多做一些盡職調查(研究,文章,新聞等)。試著弄清楚你的執行中出了什麼問題。請進行必要的變更,再試一次。如果它不再起作用,請繼續嘗試進行更改,直到它適用於您。你會看到,事情會改變,你會成功.但是你需要繼續嘗試,而不是在第一,第二,第三等失敗時感到氣餒。

好吧,所以我不想讓任何人感到厭煩。簡而言之,建立良好交易習慣的最佳方法是對您的投資進行研究,選擇適合您的策略,執行它,然後嘗試使用複利興趣方法。作為一個保守的投資者,這在我的情況下效果很好。我非常認為每個人都可以從這個策略中受益。不要試圖複製別人的想法,因為這對他們有用。您需要深入了解它並自行嘗試。這就是使您成功的原因。實踐使得完美,這就是你過去可能聽到過的話。這是絕對真實的。希望這可以幫助你。

請隨時留下您對此主題的任何意見或建議。我也非常樂意幫助任何可能想要談論更多關於這個問題或需要任何幫助的人。

祝您在投資中取得巨大成功。

已翻譯

39

4

你好 Mooer們,歡迎回來。 ![]()

在這次討論中,我想分享一些我在幫助我進行更好的交易方面的習慣。

當我打開我的 $富途控股(FUTU.US$ MooMoo 應用程序,我做的第一件事是檢查我感興趣的股票的報價。

我將點擊「評論」部分,了解 Mooer們對股票的看法。(例子: $AMC院線(AMC.US$ 摩爾們幾乎每天都在與對沖基金作戰。猴子與海盜之間的強烈聯繫,對其他猴子而言。在一起,猴子強大。![]() )

)

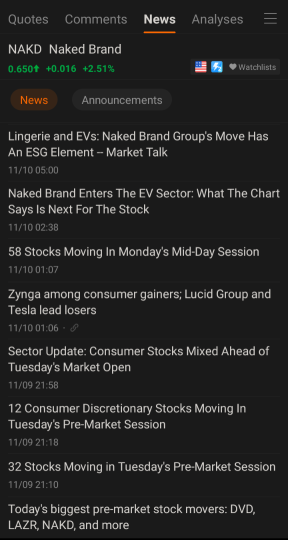

接下來,我將單擊「新聞」部分以獲取有關股票的最新消息。這將幫助我衡量股票是否具有增長潛力,例如新的創新產品和服務即將推出。(例如: $Naked Brand(NAKD.US$ 進入電動車領域。)

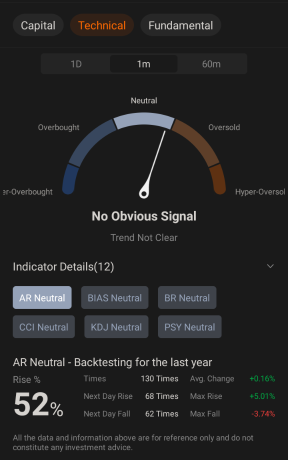

之後,我將轉到「分析」部分,了解股票的趨勢如何。這有助於我了解股票是否超賣或超買,以及看漲還是看跌。(例如:新冠概念股, $Moderna(MRNA.US$ 由於新的 COVID 變種「收益」,在 2021 年 11 月 26 日黑色星期五看漲並上漲 20.57%。)

這將通過轉到「財務」部分查看財務分析師估計的收入。如果至少 25 名財務分析師支持較高的收入估計,則估算的準確性就越高。(例如: $美國超微公司(AMD.US$ 有 29 位財務分析師為他們的收入估計。)

最後,我將轉到「摘要」部分,查看有多少機構持有該股票,以及是否有更多機構獲得股票。(例如: $蘋果(AAPL.US$ 截至二零二一年十一月二十五日為止,已有 4816 間機構持有此

這些習慣幫助我獲得有關我感興趣的股票的有用見解,並幫助我進行投資組合重新平衡的決策。我很感激 $富途控股(FUTU.US$ 與這些真棒功能來了,並在未來尋找更多。

我希望 Mooer們在您的股票交易中發現我的分享有用。![]()

在我們結束討論之前,我希望您對哪些部分進行投票,您將對其進行檢查並增加您的交易習慣。

這就是這個討論的全部內容。請顯示您的支持,如果你喜歡這篇文章。![]()

謝謝大家,很快見到你們。![]()

在這次討論中,我想分享一些我在幫助我進行更好的交易方面的習慣。

當我打開我的 $富途控股(FUTU.US$ MooMoo 應用程序,我做的第一件事是檢查我感興趣的股票的報價。

我將點擊「評論」部分,了解 Mooer們對股票的看法。(例子: $AMC院線(AMC.US$ 摩爾們幾乎每天都在與對沖基金作戰。猴子與海盜之間的強烈聯繫,對其他猴子而言。在一起,猴子強大。

接下來,我將單擊「新聞」部分以獲取有關股票的最新消息。這將幫助我衡量股票是否具有增長潛力,例如新的創新產品和服務即將推出。(例如: $Naked Brand(NAKD.US$ 進入電動車領域。)

之後,我將轉到「分析」部分,了解股票的趨勢如何。這有助於我了解股票是否超賣或超買,以及看漲還是看跌。(例如:新冠概念股, $Moderna(MRNA.US$ 由於新的 COVID 變種「收益」,在 2021 年 11 月 26 日黑色星期五看漲並上漲 20.57%。)

這將通過轉到「財務」部分查看財務分析師估計的收入。如果至少 25 名財務分析師支持較高的收入估計,則估算的準確性就越高。(例如: $美國超微公司(AMD.US$ 有 29 位財務分析師為他們的收入估計。)

最後,我將轉到「摘要」部分,查看有多少機構持有該股票,以及是否有更多機構獲得股票。(例如: $蘋果(AAPL.US$ 截至二零二一年十一月二十五日為止,已有 4816 間機構持有此

這些習慣幫助我獲得有關我感興趣的股票的有用見解,並幫助我進行投資組合重新平衡的決策。我很感激 $富途控股(FUTU.US$ 與這些真棒功能來了,並在未來尋找更多。

我希望 Mooer們在您的股票交易中發現我的分享有用。

在我們結束討論之前,我希望您對哪些部分進行投票,您將對其進行檢查並增加您的交易習慣。

這就是這個討論的全部內容。請顯示您的支持,如果你喜歡這篇文章。

謝謝大家,很快見到你們。

已翻譯

+3

55

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)