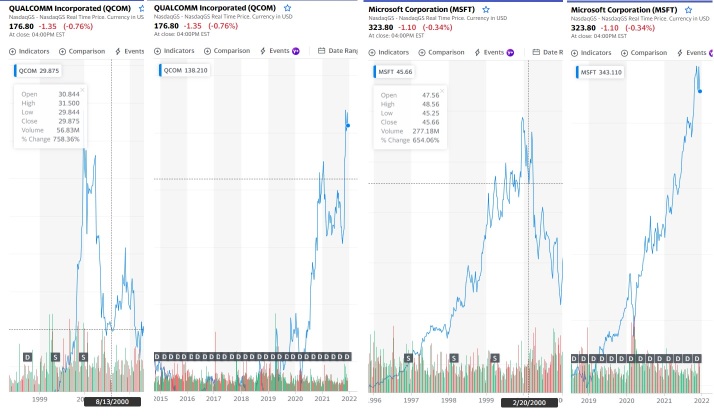

$高通 (QCOM.US)$ $微軟 (MSFT.US)$

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $可口可樂 (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $可口可樂 (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

30

2

Trader10169406O

評論了

比特幣沒有基礎價值,也沒有相關資產。比特幣不是一家可以恢復投資的公司。比特幣沒有人們需要的基礎資產,例如銀、黃金、橙子或豬腹等。比特幣只是「真錢」的轉賬系統。然而,這個系統具有巨大的維護成本,最終的系統在沒有真正的退貨情況下花費很多錢。

已翻譯

2

十一月十五日 $摩根大通 (JPM.US)$ 已起訴 $特斯拉 (TSLA.US)$ 為了 一億六千二百萬元,指控埃隆馬斯克的電動汽車公司 「顯然」違反合同 兩家企業巨頭於 2014 年同意有關 擔保 特斯拉賣給銀行

2014 年,特斯拉將認股權證出售給摩根大通,如果認股權證於 2021 年 6 月和 7 月到期時,他們的「行使」價低於特斯拉股價,將會得到回報。

馬斯克 2018 年 8 月 7 日的推文表示他可能 將特斯拉私使用 420 美元 該銀行表示,每股並獲得「資金安全」,17 天後他隨後宣布他放棄該計劃,導致股價引起了顯著波動。

在兩種情況下,摩根大通 調整行使價「以維持相同的公平市值」 就像推文之前一樣。

在今年認股權證到期時,特斯拉的股價上漲約 10 倍,摩根大通表示,這要求特斯拉根據其合同交出其股票或現金。銀行說 特斯拉未能做到這一點即代表違約。

有什麼想法嗎?或者也許有人可以解釋這個案件發生了什麼?

來源:

摩根在馬斯克推文推文認股證交易惡化後起訴特斯拉 162 億美元

2014 年,特斯拉將認股權證出售給摩根大通,如果認股權證於 2021 年 6 月和 7 月到期時,他們的「行使」價低於特斯拉股價,將會得到回報。

馬斯克 2018 年 8 月 7 日的推文表示他可能 將特斯拉私使用 420 美元 該銀行表示,每股並獲得「資金安全」,17 天後他隨後宣布他放棄該計劃,導致股價引起了顯著波動。

在兩種情況下,摩根大通 調整行使價「以維持相同的公平市值」 就像推文之前一樣。

在今年認股權證到期時,特斯拉的股價上漲約 10 倍,摩根大通表示,這要求特斯拉根據其合同交出其股票或現金。銀行說 特斯拉未能做到這一點即代表違約。

有什麼想法嗎?或者也許有人可以解釋這個案件發生了什麼?

來源:

摩根在馬斯克推文推文認股證交易惡化後起訴特斯拉 162 億美元

已翻譯

56

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)