Yee1205

讚了

尋找交易機會

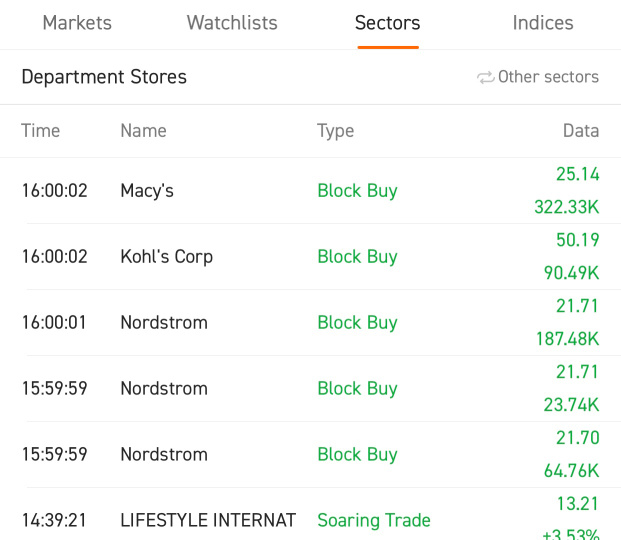

通過檢測不尋常的價格波動或大量交易,moomoo的AI Monitor使我們能夠發現看好或看淡的趨勢,並找到獲利交易的時機窗口。從下面的截圖中,我們可以看到百貨商店Macy's和Nordstrom的大宗買入交易。

這可能是因為聖誕節和新年即將到來,Macy's $梅西百貨 (M.US)$和Nordstrom $諾德斯特龍 (JWN.US)$看到銷售額飆升;也有可能是因為聖誕老人行情。人們可以選擇開倉位以追逐短期看好趨勢。另一方面,如果一支股票明顯走下行趨勢,人們可以選擇做空該股票。

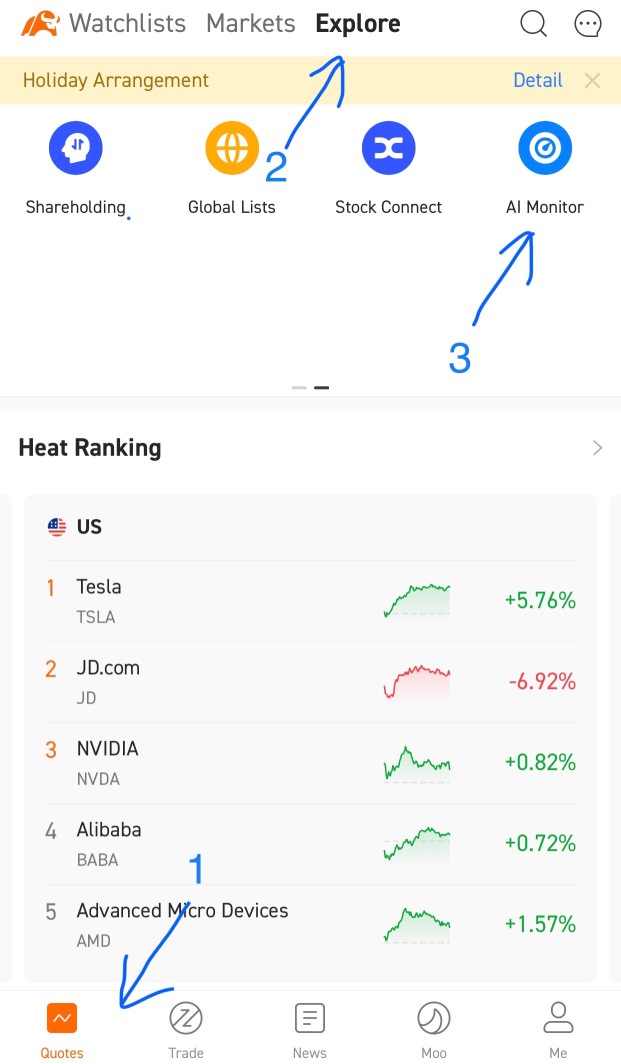

如何進入人工智能監控器

前往 引文 > 探索 > 向右滑動頂部找到 人工智能監控。當選定了所需的股票市場(美國、香港、中國、新加坡、加拿大、澳大利亞)後, 長短分配 以及 價格波動性 分類數據為 市場, 自選 (您自選股票中的股票) 板塊 和 指數 (DJI $道瓊斯指數 (.DJI.US)$,S&P $標普500指數 (.SPX.US)$ $SPDR 標普500指數ETF (SPY.US)$ $標普500ETF-Vanguard (VOO.US)$ , 納斯達克指數 $納斯達克綜合指數 (.IXIC.US)$ )

一般而言,白天鵝是一個可以預見且相當肯定的事件,其影響可以估計,而灰天鵝則是一個可以預見且影響顯著的事件,但概率被認為相對較低。另一個極端是黑天鵝,這是不可能想象或預測的。因此,我認為價格波動的白天鵝表示較低的波動性。

點擊後可選擇多種不同的行業。 其他行業如果我選擇“娛樂”,我將獲得如下結果 $AMC院線 (AMC.US)$ $遊戲驛站 (GME.US)$ $迪士尼 (DIS.US)$ $Roku Inc (ROKU.US)$ $喜滿客影城 (CNK.US)$ $康卡斯特 (CMCSA.US)$ $奈飛 (NFLX.US)$等等。

點擊右上角的三個點(參見圖片上的紅箭頭)可顯示自訂選項清單。CN代表“A”股。

限制

要意識到熟練的投資者可以操縱他們的交易以對零售投資者有利,並且並不總是可能辨認出他們的真正意圖。謹慎審查並謹慎交易。AI監控是快速檢測市場變化的有用工具,但始終記住要管理風險並將其與其他信息和工具結合使用以支持你的交易策略。

$特斯拉 (TSLA.US)$ $蘋果 (AAPL.US)$ $谷歌-A (GOOGL.US)$ $谷歌-C (GOOG.US)$ $亞馬遜 (AMZN.US)$ $ $Meta Platforms (FB.US)$ $SNDL Inc (SNDL.US)$ $諾德斯特龍 (JWN.US)$ $梅西百貨 (M.US)$ $微軟 (MSFT.US)$

如果您喜欢这篇文章,请点击

免責聲明以上分享僅為我個人意見,不構成金融建議或投資建議。請在做出任何投資決策之前請教財務顧問並考慮您的投資目標、財務需求、財務狀況和風險承受能力。

看一下 2021年回顧 https://www.moomoo.com/community/feed/107513145720838?lang_code=2

已翻譯

+4

10

1

Yee1205

讚了

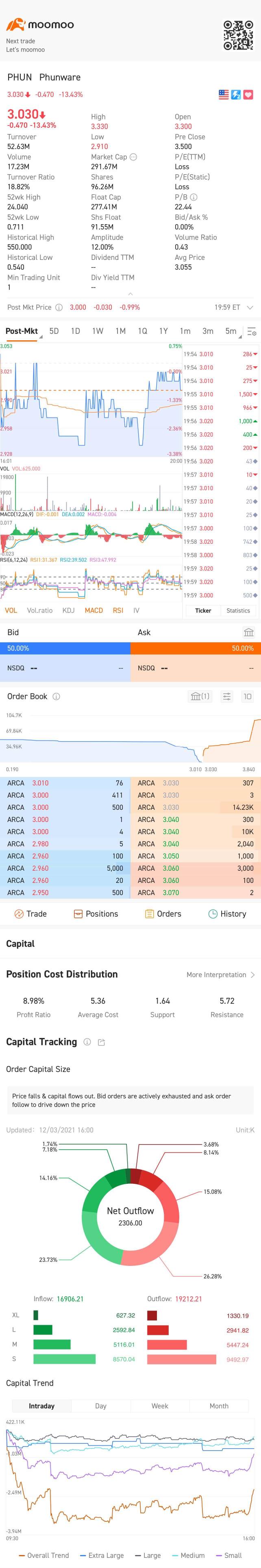

$Phunware (PHUN.US)$ Guy, this stock BVXV have news abt convid 19. Grab some profit. Good luck. Wish you can get some x'mas present.

7

Yee1205

讚了

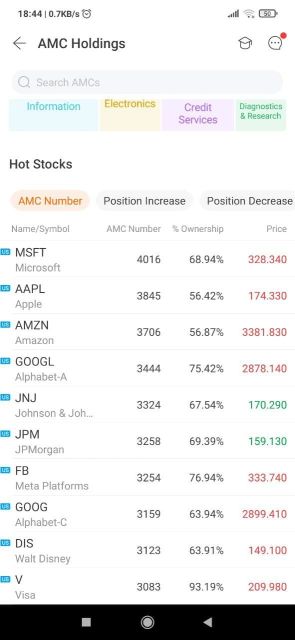

科創板機構尤其實用,尤其如果你想像機構一樣進行交易或投資。如果你是像我這樣的Wyckoff技術分析師,當你將成交量解讀為機構的足跡時,這功能將更為有用。最終,有了科創板機構功能,你就可以確切知道機構當前擁有哪些股票,或者當他們開始增持或出脫股票等等...

股票龍頭擁有最多機構持股。

如上所示,前5檔機構持有的股票數量眾多, $微軟 (MSFT.US)$ , $蘋果 (AAPL.US)$ , $亞馬遜 (AMZN.US)$ $谷歌-A (GOOGL.US)$ , $強生 (JNJ.US)$ 均顯示1個 關鍵特點 - 表現優異!

These are the stocks still near all time high because the institutions have not given them up. In fact, some of other institutions actually rotate their funds into these "outperforming stocks" during the correction since Nov 2021.

That's why the market breadth is getting worse while the $標普500指數 (.SPX.US)$ $納斯達克綜合指數 (.IXIC.US)$ $道瓊斯指數 (.DJI.US)$ just slightly below all time high level. Check out the post --> on divergence between market breadth and SPX is you haven't.

Having said that, it is essential to pay attention to the volume of these stocks because these are the stocks that are moved by institutions. It will be a lot clearer and obvious when the results (price) are in sync with the effort (Volume).

Simply checking out the top stocks based on the the AMC number will allow you to have unlimited trading or investing ideas where you know will be moved by the big whales. All you need to do is to interpret the price and volume.

Another way to use it is to find out what stands out from the institutional portfolio. For example, Warren Buffett's Berkshire Hathaway holdings are interesting because $蘋果 (AAPL.US)$ 占其投資組合46%的股票,如果與其他機構相比,這顯得過度和飛凡。像Berkshire Hathaway這樣的巨頭機構,對於AAPL的重賭超過40%並持續增加頭寸,他們一定知道其他人不知道的事情。

如果你只追踪前10位機構並監控他們的重大持股,並自行進行研究,你可能會發現像AAPL這樣的寶石。

玩得開心,並讓我知道你如何使用科創板機構。

股票龍頭擁有最多機構持股。

如上所示,前5檔機構持有的股票數量眾多, $微軟 (MSFT.US)$ , $蘋果 (AAPL.US)$ , $亞馬遜 (AMZN.US)$ $谷歌-A (GOOGL.US)$ , $強生 (JNJ.US)$ 均顯示1個 關鍵特點 - 表現優異!

These are the stocks still near all time high because the institutions have not given them up. In fact, some of other institutions actually rotate their funds into these "outperforming stocks" during the correction since Nov 2021.

That's why the market breadth is getting worse while the $標普500指數 (.SPX.US)$ $納斯達克綜合指數 (.IXIC.US)$ $道瓊斯指數 (.DJI.US)$ just slightly below all time high level. Check out the post --> on divergence between market breadth and SPX is you haven't.

Having said that, it is essential to pay attention to the volume of these stocks because these are the stocks that are moved by institutions. It will be a lot clearer and obvious when the results (price) are in sync with the effort (Volume).

Simply checking out the top stocks based on the the AMC number will allow you to have unlimited trading or investing ideas where you know will be moved by the big whales. All you need to do is to interpret the price and volume.

Another way to use it is to find out what stands out from the institutional portfolio. For example, Warren Buffett's Berkshire Hathaway holdings are interesting because $蘋果 (AAPL.US)$ 占其投資組合46%的股票,如果與其他機構相比,這顯得過度和飛凡。像Berkshire Hathaway這樣的巨頭機構,對於AAPL的重賭超過40%並持續增加頭寸,他們一定知道其他人不知道的事情。

如果你只追踪前10位機構並監控他們的重大持股,並自行進行研究,你可能會發現像AAPL這樣的寶石。

玩得開心,並讓我知道你如何使用科創板機構。

已翻譯

23

1

Yee1205

讚了

$Roku Inc (ROKU.US)$ Roku is currently hovering around $220 and has dropped $60 in the past month. With news over Google staying on the platform, the stock spiked, but nothing stuck.

Roku has seen prices of $400+, but what is stopping it from staying there?

According to Wolfram Alpha, Roku doesn't get the majority of its profits from actually selling Roku devices, but from ADs on the platform.

"Roku generates 14.3% of revenues from Player segment (Devices sold) while the rest comes from Platform Segment (Ads: 65% of profit)"

People are going to be getting these devices for Christmas, because of how low they are dropping their prices (You can get a 4k ROKU Device for $25 right now).

I'm expecting this stock to jump once the new year hits due to the influx of people opening Roku devices on Christmas.

Roku has seen prices of $400+, but what is stopping it from staying there?

According to Wolfram Alpha, Roku doesn't get the majority of its profits from actually selling Roku devices, but from ADs on the platform.

"Roku generates 14.3% of revenues from Player segment (Devices sold) while the rest comes from Platform Segment (Ads: 65% of profit)"

People are going to be getting these devices for Christmas, because of how low they are dropping their prices (You can get a 4k ROKU Device for $25 right now).

I'm expecting this stock to jump once the new year hits due to the influx of people opening Roku devices on Christmas.

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)