YongSoon

讚了

嘿,牛友們!歡迎回來到 moomoo的特色挑戰,在這裡我們幫助您掌握moomoo上強大的工具,並參加問答挑戰贏取獎勵!

在投資和選擇正確的股票的複雜世界中,對新交易者來說可能是令人畏懼的。幸運的是,通過提供股票評級、目標價和頂尖分析師的全面概述,所有都可以輕鬆從單一標籤中輕鬆訪問 分析師...

在投資和選擇正確的股票的複雜世界中,對新交易者來說可能是令人畏懼的。幸運的是,通過提供股票評級、目標價和頂尖分析師的全面概述,所有都可以輕鬆從單一標籤中輕鬆訪問 分析師...

已翻譯

+2

423

249

YongSoon

讚了

已翻譯

16

2

YongSoon

讚了

$Roundhill Ball Metaverse ETF (META.US)$

NEWS PROVIDED BY

Roundhill Investments

Jun 30, 2021, 09:00 ET

NEW YORK, June 30, 2021 /PRNewswire/ -- Roundhill Investments ("Roundhill"), a registered investment advisor and ETF sponsor focused on developing innovative financial products, today announced the launch of the Roundhill Ball Metaverse ETF ("META ETF"). The META ETF is the first exchange traded product globally to provide investors with exposure to the rapidly-growing market of the Metaverse. The Metaverse is broadly understood as a successor-state to today's mobile Internet, but which will involve countless interoperable and persistent virtual worlds, be richly integrated into the physical world as well, thereby creating a new medium and economy for work, leisure, and innovation.

The Roundhill Ball Metaverse ETF ("META ETF") is designed to offer investors exposure to the metaverse by tracking, before fees and expenses, the performance of the Ball Metaverse Index ("BALLMETA Index"). The Index is managed by Ball Metaverse Research Partners, a newly-formed indexing and research firm led by Matthew Ball, a seasoned investor, advisor, and researcher of the Metaverse.

"We consider the emergence of the Metaverse to be as transformative and valuable as the emergence of mobile Internet and the fixed-line Internet that preceded it. It likely will touch every industry and profession, enlarging and/or disrupting today's leaders, and leading to countless new companies and technologies," said Matthew Ball.

The Index has been created to provide investors with an efficient and comprehensive way to invest across all of the major categories and areas of the Metaverse, and proportional to their likely share of revenues. Specifically, the Index was developed and will be maintained by an Expert Council whose backgrounds and specialized knowledge reflects the range of relevant sectors. In addition to Matthew Ball, the Council includes:

Jerry Heinz, VP of Engineering cybersecurity start-up ActZero and former Head of Enterprise Cloud Services at Nvidia, VP Engineering at Tinder, and Senior Manager at Amazon Web Services, where he launched the company's low-latency streaming, app and game virtualization platform;

Jacob Navok, Co-Founder and CEO of Genvid Technologies, an interactive streaming technology firm, and previously lead Square Enix cloud gaming subsidiary Shinra Technologies, and ran business development for Square Enix Holdings;

Jesse Walden, Managing Partner of Variant Fund, and former General Partner of Andreessen Horowitz's crypto fund and founder of Mediachain Labs, a blockchain-based rights platform that was acquired by Spotify; and

Jonathan Glick, former SVP of Product & Technology at The New York Times Electronic Media Company and Director of Research at GLG, the global expert network.

Effective June 29th 2021, the BALLMETA Index also added two new members to its Expert Council, who will advise on all subsequent methodological changes and rebalancing, beginning in Q3 2021. These new experts are:

Anna Sweet, CEO of Bad Robot Games, former Head of Content & Developer Strategy at Facebook's Oculus, and Senior Business Development Manager at Valve, where she led the growth of Steam and several key hardware initiatives

Imran Sarwar, former Director of Design and Co-Producer of Grand Theft Auto V, Grand Theft Auto Online, Red Dead Redemption 2, Red Dead Redemption Online. Grand Theft Auto V was the best-selling title of the seventh and eighth generation of consoles, while Red Dead Redemption 2 was the best-selling title released for the eighth console generation

META holdings include GPU companies, like NVIDIA (7.92% weight), virtual platform providers, like Tencent (5.90% weight) and Roblox (5.13% weight), cloud computing services, like Fastly (3.92% weight), and gaming engines like Unity (3.60% weight).

"We are very excited to work with Matt and his team to offer META, a truly one-of-a-kind ETF that provides investors exposure to a basket of 50 companies that we believe are collectively positioned to drive the future of the internet. Without even including relevant compute, networking and payments companies, Bloomberg Intelligence recently estimated the Metaverse's market size at $800 billion, highlighting the immense opportunity at hand." - Will Hershey, CEO and co-founder at Roundhill Investments.

NEWS PROVIDED BY

Roundhill Investments

Jun 30, 2021, 09:00 ET

NEW YORK, June 30, 2021 /PRNewswire/ -- Roundhill Investments ("Roundhill"), a registered investment advisor and ETF sponsor focused on developing innovative financial products, today announced the launch of the Roundhill Ball Metaverse ETF ("META ETF"). The META ETF is the first exchange traded product globally to provide investors with exposure to the rapidly-growing market of the Metaverse. The Metaverse is broadly understood as a successor-state to today's mobile Internet, but which will involve countless interoperable and persistent virtual worlds, be richly integrated into the physical world as well, thereby creating a new medium and economy for work, leisure, and innovation.

The Roundhill Ball Metaverse ETF ("META ETF") is designed to offer investors exposure to the metaverse by tracking, before fees and expenses, the performance of the Ball Metaverse Index ("BALLMETA Index"). The Index is managed by Ball Metaverse Research Partners, a newly-formed indexing and research firm led by Matthew Ball, a seasoned investor, advisor, and researcher of the Metaverse.

"We consider the emergence of the Metaverse to be as transformative and valuable as the emergence of mobile Internet and the fixed-line Internet that preceded it. It likely will touch every industry and profession, enlarging and/or disrupting today's leaders, and leading to countless new companies and technologies," said Matthew Ball.

The Index has been created to provide investors with an efficient and comprehensive way to invest across all of the major categories and areas of the Metaverse, and proportional to their likely share of revenues. Specifically, the Index was developed and will be maintained by an Expert Council whose backgrounds and specialized knowledge reflects the range of relevant sectors. In addition to Matthew Ball, the Council includes:

Jerry Heinz, VP of Engineering cybersecurity start-up ActZero and former Head of Enterprise Cloud Services at Nvidia, VP Engineering at Tinder, and Senior Manager at Amazon Web Services, where he launched the company's low-latency streaming, app and game virtualization platform;

Jacob Navok, Co-Founder and CEO of Genvid Technologies, an interactive streaming technology firm, and previously lead Square Enix cloud gaming subsidiary Shinra Technologies, and ran business development for Square Enix Holdings;

Jesse Walden, Managing Partner of Variant Fund, and former General Partner of Andreessen Horowitz's crypto fund and founder of Mediachain Labs, a blockchain-based rights platform that was acquired by Spotify; and

Jonathan Glick, former SVP of Product & Technology at The New York Times Electronic Media Company and Director of Research at GLG, the global expert network.

Effective June 29th 2021, the BALLMETA Index also added two new members to its Expert Council, who will advise on all subsequent methodological changes and rebalancing, beginning in Q3 2021. These new experts are:

Anna Sweet, CEO of Bad Robot Games, former Head of Content & Developer Strategy at Facebook's Oculus, and Senior Business Development Manager at Valve, where she led the growth of Steam and several key hardware initiatives

Imran Sarwar, former Director of Design and Co-Producer of Grand Theft Auto V, Grand Theft Auto Online, Red Dead Redemption 2, Red Dead Redemption Online. Grand Theft Auto V was the best-selling title of the seventh and eighth generation of consoles, while Red Dead Redemption 2 was the best-selling title released for the eighth console generation

META holdings include GPU companies, like NVIDIA (7.92% weight), virtual platform providers, like Tencent (5.90% weight) and Roblox (5.13% weight), cloud computing services, like Fastly (3.92% weight), and gaming engines like Unity (3.60% weight).

"We are very excited to work with Matt and his team to offer META, a truly one-of-a-kind ETF that provides investors exposure to a basket of 50 companies that we believe are collectively positioned to drive the future of the internet. Without even including relevant compute, networking and payments companies, Bloomberg Intelligence recently estimated the Metaverse's market size at $800 billion, highlighting the immense opportunity at hand." - Will Hershey, CEO and co-founder at Roundhill Investments.

13

YongSoon

讚了

行政長官 $Twitter (Delisted) (TWTR.US)$ 和 $Block (SQ.US)$ 跳入價格上漲的辯論。

「超通貨膨脹將改變一切。這正在發生,」傑克·多西推文。

「這很快就會發生在美國,世界也會發生,」多西回應。

對另一個答案,他說,這不是一個願望。我也不認為它根本是積極的。」

通脹是經濟復甦和股市最大的擔憂之一。美聯儲已改變其策略,讓更高的通貨膨脹更長時間恢復(靈活的平均通脹目標或 FAIT)。

聯邦公開市場委員會認為,最近的激增,核心消費物價指數同比為 4%,是暫時性的,但美聯儲主席傑伊·鮑威爾本週表示,它們可能會持續到明年。

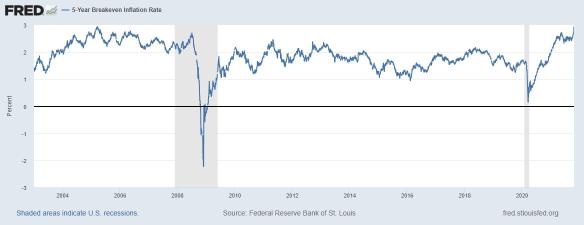

五年平衡通脹預期是最接近美聯儲基金利率的預期,現在接近歷史新高 2.91%。

但是,儘管對價格上漲的所有擔憂,沒有人談論發達市場的超通貨膨脹。

「超通貨膨脹將改變一切。這正在發生,」傑克·多西推文。

「這很快就會發生在美國,世界也會發生,」多西回應。

對另一個答案,他說,這不是一個願望。我也不認為它根本是積極的。」

通脹是經濟復甦和股市最大的擔憂之一。美聯儲已改變其策略,讓更高的通貨膨脹更長時間恢復(靈活的平均通脹目標或 FAIT)。

聯邦公開市場委員會認為,最近的激增,核心消費物價指數同比為 4%,是暫時性的,但美聯儲主席傑伊·鮑威爾本週表示,它們可能會持續到明年。

五年平衡通脹預期是最接近美聯儲基金利率的預期,現在接近歷史新高 2.91%。

但是,儘管對價格上漲的所有擔憂,沒有人談論發達市場的超通貨膨脹。

已翻譯

10

YongSoon

讚了

$阿里巴巴 (BABA.US)$ 該股價目前非常低估,其 PE 比率為 20.7,低於美國在線零售行業平均值超過 50%。在過去 5 年,BABA 的收入每年顯著增長 30.4%。即使被罰款 15 億美元,他們仍處於良好的財務狀況。他們的短期資產是短期負債的兩倍,而他們的長期資產比長期負債高 4 倍。他們還很好地償還債務,BABA 的債務對權益比率在過去 5 年從 30.6% 下降至 13.6%。

已翻譯

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)