5

1

zahigur

參與了投票

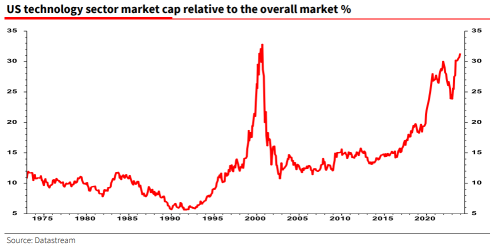

2023 年,ChatGPT 引發的人工智能狂潮激發了美國科技股票,美國科技股市受到未能獲利和 2022 年債券收益率上漲的困擾。FOMO(擔心錯過)情緒多次超越了對經濟衰退和利率水平的擔憂。 雄偉的七人,領導 $英偉達 (NVDA.US)$,取得了顯著的進展,是的...

已翻譯

+3

33

18

zahigur

讚了

宏觀

市場預期美聯儲加息步伐將放緩開始轉變

策略家和交易員表示,在金融市場中正在形成一種叙事,即美聯儲可能很快需要放慢利率加息的步伐。

這種思維轉變的跡象在週四明顯:政策敏感的兩年期國債收益率下跌至兩周低位。此外,聯儲局的金融刺激措施...

市場預期美聯儲加息步伐將放緩開始轉變

策略家和交易員表示,在金融市場中正在形成一種叙事,即美聯儲可能很快需要放慢利率加息的步伐。

這種思維轉變的跡象在週四明顯:政策敏感的兩年期國債收益率下跌至兩周低位。此外,聯儲局的金融刺激措施...

已翻譯

22

2

zahigur

表達了心情

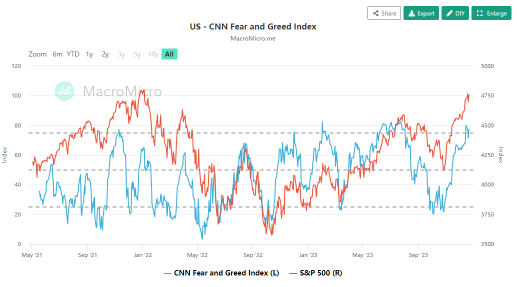

$SPDR 標普500指數ETF (SPY.US)$ I honestly believe, that professional investors (maybe even companies) are playing the novice and FOMO investors.

Investing used to be boring. You got every month your subscription of Value Line, did a bit of reading and decided, nothing to see here and went back to bed.

Since Covid hell broke loose. Novice Investors had nothing to do all day long and invested their stimulus checks in stocks. Since they had no idea, they invested in names they did recognized because the CEO had a loud mouth and in stocks which went up.... it goes up so it must be a good stock... right? And when a majority of investors think that way, the stock INDEED goes up.

This phenomena was not lost on professional investors and they smelled blood.

Usually you had to wait for years to make some money, but now hordes of novice investors walked into the lion's den for slaughter.

Professional investors kept their mouth shut and allow the train to gather even more speed... after all FOMO will get a lot more intense towards the end.

If you on the train, do not expect when you disembark, that you can claim all your luggage at the next station. Over night, when you were sleeping bad things did happen. The $道瓊斯指數 (.DJI.US)$ is about to open 1000 points down... you did not even check your stocks in the morning and around lunch the DOW is down 2000 points and counting. Panic stricken you get your phone and place a market order, which obviously will be executed instantly and you got a whole dollar for all of your life savings.

Towards closing the DOW recovers and you regret that you sold your stock a bit too quickly. To get back on this train you buy, hoping to make up for your mistake earlier in the day.

But next day it is all the same again...

Anyway this how it happen in April 2000.

There are several ways to avoid losing your shirt.

1. Remain poor

2. sell everything now and miss another 6 month of bull market

3. Stay invested and panic as I described above

4. Do nothing stay invested and wait the next 10 years for your investments to recover to a value it had before the crash.

5. become a psychic, sell one day before the crash and sell short (on margin) all the high fliers you did own before.

Take your pick.

Everybody can invest in a bull market... it is easy... but just wait...

Investing used to be boring. You got every month your subscription of Value Line, did a bit of reading and decided, nothing to see here and went back to bed.

Since Covid hell broke loose. Novice Investors had nothing to do all day long and invested their stimulus checks in stocks. Since they had no idea, they invested in names they did recognized because the CEO had a loud mouth and in stocks which went up.... it goes up so it must be a good stock... right? And when a majority of investors think that way, the stock INDEED goes up.

This phenomena was not lost on professional investors and they smelled blood.

Usually you had to wait for years to make some money, but now hordes of novice investors walked into the lion's den for slaughter.

Professional investors kept their mouth shut and allow the train to gather even more speed... after all FOMO will get a lot more intense towards the end.

If you on the train, do not expect when you disembark, that you can claim all your luggage at the next station. Over night, when you were sleeping bad things did happen. The $道瓊斯指數 (.DJI.US)$ is about to open 1000 points down... you did not even check your stocks in the morning and around lunch the DOW is down 2000 points and counting. Panic stricken you get your phone and place a market order, which obviously will be executed instantly and you got a whole dollar for all of your life savings.

Towards closing the DOW recovers and you regret that you sold your stock a bit too quickly. To get back on this train you buy, hoping to make up for your mistake earlier in the day.

But next day it is all the same again...

Anyway this how it happen in April 2000.

There are several ways to avoid losing your shirt.

1. Remain poor

2. sell everything now and miss another 6 month of bull market

3. Stay invested and panic as I described above

4. Do nothing stay invested and wait the next 10 years for your investments to recover to a value it had before the crash.

5. become a psychic, sell one day before the crash and sell short (on margin) all the high fliers you did own before.

Take your pick.

Everybody can invest in a bull market... it is easy... but just wait...

36

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)