Market Might Still Lack Some Conviction On Dr. Peng Telecom & Media Group Co., Ltd. (SHSE:600804) Even After 28% Share Price Boost

Market Might Still Lack Some Conviction On Dr. Peng Telecom & Media Group Co., Ltd. (SHSE:600804) Even After 28% Share Price Boost

Dr. Peng Telecom & Media Group Co., Ltd. (SHSE:600804) shares have continued their recent momentum with a 28% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

彭博士電信傳媒集團有限公司 (SHSE: 600804) 股價延續了最近的勢頭,僅在上個月就上漲了28%。不幸的是,上個月的漲勢並沒有彌補去年的損失,在此期間,該股仍下跌了16%。

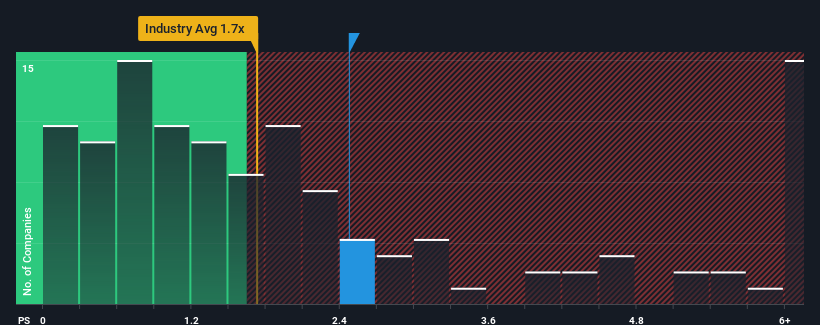

Although its price has surged higher, when close to half the companies operating in China's Telecom industry have price-to-sales ratios (or "P/S") above 4.8x, you may still consider Dr. Peng Telecom & Media Group as an enticing stock to check out with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

儘管其價格已飆升,但當近一半在中國電信行業運營的公司的市銷率(或 “市盈率”)超過4.8倍時,您仍可能認爲彭博士 Telecom & Media Group是其2.5倍市盈率的誘人股票。儘管如此,我們需要更深入地挖掘以確定降低P/S是否有合理的基礎。

See our latest analysis for Dr. Peng Telecom & Media Group

查看我們對彭博士電信傳媒集團的最新分析

What Does Dr. Peng Telecom & Media Group's Recent Performance Look Like?

彭博士電信傳媒集團最近的表現如何?

With revenue that's retreating more than the industry's average of late, Dr. Peng Telecom & Media Group has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

最近,彭博士電信和傳媒集團的收入下降幅度超過了行業平均水平,表現非常低迷。也許市場預計未來的收入表現不會改善,這抑制了市盈率。如果你還喜歡這家公司,你會希望在做出任何決定之前扭轉其收入軌跡。或者至少,如果你的計劃是在失寵的情況下收購一些股票,你會希望收入下滑不會變得更糟。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

關於低市盈率,收入增長指標告訴我們甚麼?

The only time you'd be truly comfortable seeing a P/S as low as Dr. Peng Telecom & Media Group's is when the company's growth is on track to lag the industry.

看到像彭博士電信和媒體集團這樣低的市盈率只有在該公司的增長有望落後於行業的時候,你才會真正感到滿意。

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 48% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

回想起來,去年公司的收入下降了27%,令人沮喪。過去三年看起來也不太好,因爲該公司的總收入減少了48%。因此,股東們本來會對中期收入增長率感到悲觀。

Looking ahead now, revenue is anticipated to climb by 44% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.9%, which is noticeably less attractive.

關注該公司的唯一分析師表示,展望未來,預計明年收入將增長44%。同時,預計該行業的其他部門將僅增長5.9%,吸引力明顯降低。

With this in consideration, we find it intriguing that Dr. Peng Telecom & Media Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

考慮到這一點,我們發現有趣的是,彭博士電信和傳媒集團的公共服務落後於大多數行業同行。顯然,一些股東對預測持懷疑態度,並接受了大幅降低的銷售價格。

The Final Word

最後一句話

The latest share price surge wasn't enough to lift Dr. Peng Telecom & Media Group's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

最近的股價上漲不足以使彭博士電信和傳媒集團的市盈率接近行業中位數。雖然價格與銷售比率不應該是決定你是否買入股票的決定性因素,但它是衡量收入預期的有力晴雨表。

A look at Dr. Peng Telecom & Media Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

縱觀彭博士電信和傳媒集團的收入,可以看出,儘管對未來增長的預期令人鼓舞,但其市盈率遠低於我們的預期。當我們看到這樣的強勁增長預測時,我們只能假設潛在風險可能會給市盈率帶來巨大壓力。儘管由於預計公司將實現高增長,股價暴跌的可能性似乎不大,但市場似乎確實有些猶豫。

Having said that, be aware Dr. Peng Telecom & Media Group is showing 1 warning sign in our investment analysis, you should know about.

話雖如此,請注意 彭博士電信傳媒集團出現 1 個警告標誌 在我們的投資分析中,你應該知道。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去盈利增長穩健的公司是你的不二之選,你可能希望看到這個 免費的 其他盈利增長強勁且市盈率低的公司集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用不偏不倚的方法根據歷史數據和分析師預測提供評論,我們的文章並非旨在提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。