Shandong Chiway Industry Development Co.,Ltd.'s (SZSE:002374) Share Price Not Quite Adding Up

Shandong Chiway Industry Development Co.,Ltd.'s (SZSE:002374) Share Price Not Quite Adding Up

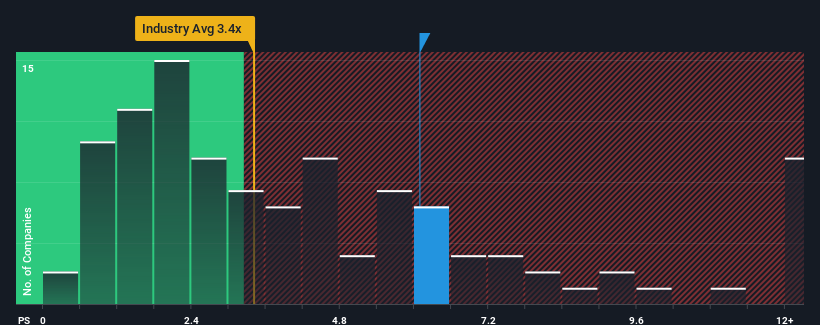

When close to half the companies in the Commercial Services industry in China have price-to-sales ratios (or "P/S") below 3.4x, you may consider Shandong Chiway Industry Development Co.,Ltd. (SZSE:002374) as a stock to avoid entirely with its 6.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

當中國商業服務行業近一半的公司的價格與銷售率(或 “P/S”)低於3.4倍時,你可以考慮 山東中銳實業發展有限公司,有限公司 (SZSE: 002374)作爲一隻值得完全避開的股票,其市盈率爲6.1倍。但是,P/S 之高可能是有原因的,需要進一步調查以確定其是否合理。

View our latest analysis for Shandong Chiway Industry DevelopmentLtd

查看我們對山東中銳實業發展有限公司的最新分析

What Does Shandong Chiway Industry DevelopmentLtd's Recent Performance Look Like?

山東中銳實業發展有限公司最近的業績是甚麼樣子?

The revenue growth achieved at Shandong Chiway Industry DevelopmentLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

對於大多數公司來說,山東中銳工業發展有限公司去年實現的收入增長將是完全可以接受的。也許市場預計,這種不錯的收入表現將在短期內擊敗該行業,這支撐了市盈率。你真的希望如此,否則你將無緣無故地付出相當高的代價。

Is There Enough Revenue Growth Forecasted For Shandong Chiway Industry DevelopmentLtd?

預計山東中銳實業發展有限公司的收入增長是否足夠?

Shandong Chiway Industry DevelopmentLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

對於一家有望實現非常強勁增長的公司來說,山東中銳工業發展有限公司的市盈率將是典型的,而且重要的是,其表現要比行業好得多。

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 18% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

回顧過去,去年的公司收入驚人地增長了16%。但是,這還不夠,因爲在最近三年中,該公司的總收入下降了18%。因此,股東們本來會對中期收入增長率感到悲觀。

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,該行業預計將在未來12個月內實現27%的增長,根據最近的中期收入業績,該公司的下行勢頭髮人深省。

With this in mind, we find it worrying that Shandong Chiway Industry DevelopmentLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

考慮到這一點,我們發現令人擔憂的是,山東中銳實業發展有限公司的市盈率超過了業內同行。顯然,該公司的許多投資者比最近所顯示的要看漲得多,他們不願不惜任何代價放棄股票。如果市盈率跌至與最近的負增長率更加一致的水平,現有股東很有可能爲未來的失望做好準備。

The Bottom Line On Shandong Chiway Industry DevelopmentLtd's P/S

山東中銳實業發展有限公司的公關底線

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常,在做出投資決策時,我們會告誡不要過多地考慮價格與銷售比率,儘管這可以充分揭示其他市場參與者對公司的看法。

We've established that Shandong Chiway Industry DevelopmentLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

我們已經確定,山東中銳工業發展有限公司目前的市盈率遠高於預期,因爲其最近的收入在中期內有所下降。當我們看到收入倒退,表現低於行業預期時,我們認爲股價下跌的可能性是真實存在的,這使市盈率回到了合理性領域。除非最近的中期條件明顯改善,否則投資者將很難接受股價作爲公允價值。

Plus, you should also learn about this 1 warning sign we've spotted with Shandong Chiway Industry DevelopmentLtd.

另外,你還應該瞭解這個 我們在山東中銳實業發展有限公司發現了 1 個警告標誌。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去盈利增長穩健的公司是你的不二之選,你可能希望看到這個 免費的 其他盈利增長強勁且市盈率低的公司集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用不偏不倚的方法根據歷史數據和分析師預測提供評論,我們的文章並非旨在提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。

Shandong Chiway Industry DevelopmentLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Shandong Chiway Industry DevelopmentLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.