Jiangxi JDL Environmental Protection Co., Ltd.'s (SHSE:688057) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Jiangxi JDL Environmental Protection Co., Ltd.'s (SHSE:688057) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

With its stock down 9.7% over the past week, it is easy to disregard Jiangxi JDL Environmental Protection (SHSE:688057). However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study Jiangxi JDL Environmental Protection's ROE in this article.

過去一週,江西京東環保的股價下跌了9.7%,人們很容易忽視江西京東環保(上證號:688057)。然而,該公司的基本面看起來相當不錯,長期財務狀況通常與未來的市場價格走勢保持一致。具體地說,我們決定在本文中研究江西京東環保的淨資產收益率。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

股本回報率或淨資產收益率是股東要考慮的一個重要因素,因為它告訴他們他們的資本再投資的效率。簡而言之,它是用來評估一家公司相對於其權益資本的盈利能力。

See our latest analysis for Jiangxi JDL Environmental Protection

請看我們對江西京東環保的最新分析

How Is ROE Calculated?

淨資產收益率是如何計算的?

The formula for return on equity is:

這個股本回報率公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回報率=(持續經營的)淨利潤?股東權益

So, based on the above formula, the ROE for Jiangxi JDL Environmental Protection is:

因此,根據上述公式,江西京東環保的淨資產收益率為:

8.1% = CN¥255m ÷ CN¥3.1b (Based on the trailing twelve months to September 2022).

8.1%=CN元2.55億×CN元31億元(基於截至2022年9月的12個月)。

The 'return' is the yearly profit. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.08 in profit.

“回報”就是年度利潤。這意味著,股東權益每增加1元,公司就會產生0.08元的利潤。

What Is The Relationship Between ROE And Earnings Growth?

淨資產收益率與盈利增長之間有什麼關係?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前為止,我們已經瞭解到淨資產收益率衡量的是一家公司創造利潤的效率。我們現在需要評估公司將多少利潤再投資或“保留”用於未來的增長,這就讓我們對公司的增長潛力有了一個瞭解。假設其他條件不變,淨資產收益率和利潤保留率越高,與不一定具有這些特徵的公司相比,公司的增長率就越高。

Jiangxi JDL Environmental Protection's Earnings Growth And 8.1% ROE

江西京東環保盈利增長8.1%淨資產收益率

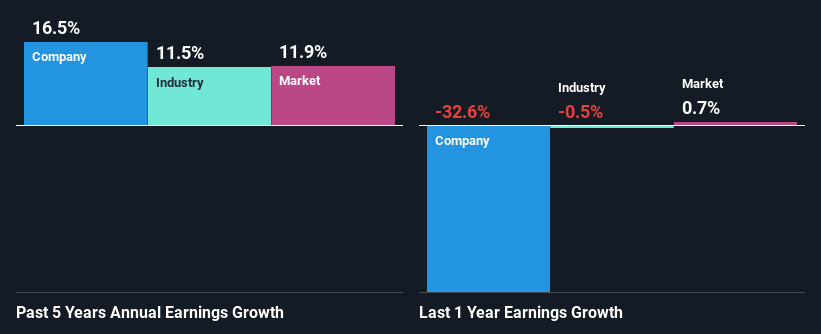

When you first look at it, Jiangxi JDL Environmental Protection's ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 7.9%. Having said that, Jiangxi JDL Environmental Protection has shown a modest net income growth of 16% over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

乍一看,江西京東環保的淨資產收益率看起來並沒有那麼誘人。然而,一項更仔細的研究表明,該公司的淨資產收益率與7.9%的行業平均水準相似。話雖如此,江西京東環保在過去五年中呈現出16%的溫和淨收入增長。考慮到淨資產收益率不是特別高,我們認為也可能有其他因素在發揮作用,可能正在影響公司的增長。例如-高收益留存或有效的管理到位。

We then compared Jiangxi JDL Environmental Protection's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 12% in the same period.

然後,我們將江西京東環保的淨收入增長與行業進行了比較,我們很高興地看到,與同期12%的行業增長率相比,該公司的增長數位更高。

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Jiangxi JDL Environmental Protection's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

賦予一家公司價值的基礎在很大程度上與其盈利增長掛鉤。投資者應該嘗試確定預期的收益增長或下降是否已計入價格,無論是哪種情況。通過這樣做,他們將知道股票是將進入清澈的藍色水域,還是等待沼澤水域。如果你想知道江西京東環保的估值,看看這個本益比指標,看看它與行業的對比。

Is Jiangxi JDL Environmental Protection Using Its Retained Earnings Effectively?

江西京東環保有效利用留存收益嗎?

The high three-year median payout ratio of 59% (or a retention ratio of 41%) for Jiangxi JDL Environmental Protection suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

江西京東環保高達59%的三年中值派息率(或41%的留存比率)表明,儘管該公司將大部分收入返還給股東,但該公司的增長並未受到真正的阻礙。

While Jiangxi JDL Environmental Protection has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

儘管江西京東環保的盈利一直在增長,但它最近才開始分紅,這可能意味著該公司決定用分紅給新股東和現有股東留下深刻印象。

Summary

摘要

In total, it does look like Jiangxi JDL Environmental Protection has some positive aspects to its business. Namely, its high earnings growth. We do however feel that the earnings growth number could have been even higher, had the company been reinvesting more of its earnings and paid out less dividends. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Jiangxi JDL Environmental Protection's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

總體而言,看起來江西京東環保確實有一些積極的方面。也就是說,它的高收益增長。然而,我們確實認為,如果該公司將更多的收益進行再投資,減少派息,收益增長數位可能會更高。到目前為止,我們只對該公司的增長數據進行了簡短的研究。所以也許有必要檢查一下免費 詳細圖表瞭解江西京東環保過去的收益,以及收入和現金流,以更深入地洞察公司的業績。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。