The Latest Analyst Ratings for Stronghold Digital Mining

The Latest Analyst Ratings for Stronghold Digital Mining

Stronghold Digital Mining (NASDAQ:SDIG) has observed the following analyst ratings within the last quarter:

Stronghold Digital Mining(納斯達克股票代碼:SDIG)在上個季度觀察到以下分析師評級:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

| 看漲 | 有點看漲 | 冷漠 | 有點看跌 | 看跌 | |

|---|---|---|---|---|---|

| 總收視率 | 5 | 0 | 0 | 0 | 0 |

| 最後 30 天 | 1 | 0 | 0 | 0 | 0 |

| 1 月前 | 1 | 0 | 0 | 0 | 0 |

| 2 萬之前 | 2 | 0 | 0 | 0 | 0 |

| 3 萬之前 | 1 | 0 | 0 | 0 | 0 |

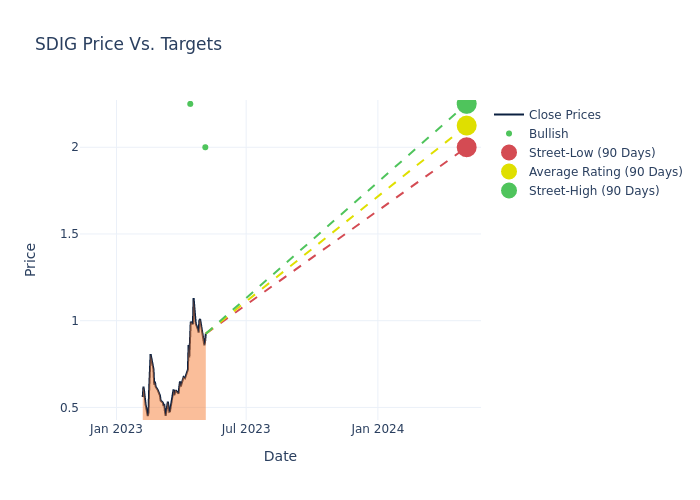

In the last 3 months, 5 analysts have offered 12-month price targets for Stronghold Digital Mining. The company has an average price target of $1.75 with a high of $2.25 and a low of $1.00.

在過去的3個月中,有5位分析師爲Stronghold Digital Mining提供了12個月的目標股價。該公司的平均目標價爲1.75美元,最高爲2.25美元,低點爲1.00美元。

Below is a summary of how these 5 analysts rated Stronghold Digital Mining over the past 3 months. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the number of bearish ratings, the more negative analysts are on the stock

以下是這5位分析師在過去3個月中對Stronghold Digital Mining的評級摘要。看漲評級的數量越多,分析師對該股的看法就越積極,看跌評級的數量越多,分析師對該股的負面評價就越多

This current average has decreased by 4.37% from the previous average price target of $1.83.

目前的平均價格比之前的平均目標價1.83美元下降了4.37%。

Stay up to date on Stronghold Digital Mining analyst ratings.

隨時瞭解Stronghold Digital Mining分析師的最新評級。

If you are interested in following small-cap stock news and performance you can start by tracking it here.

如果你有興趣關注小盤股的新聞和表現,可以先在這裏追蹤。

How Are Analyst Ratings Determined?

分析師評級是如何確定的?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Benzinga追蹤了150家分析公司並報告了他們的股票預期。分析師通常通過預測公司未來(通常是未來五年)將賺多少錢,以及該公司的收入來源的風險或可預測性來得出結論。

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

分析師參加公司電話會議和會議,研究公司財務報表,並與內部人士溝通,公佈他們的股票評級。分析師通常每季度對每隻股票進行一次評級,或者在公司有重大更新時對每隻股票進行一次評級。

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

一些分析師發佈了對增長預期、收益和收入等指標的預測,以爲他們的評級提供更多指導。在使用分析師評級時,重要的是要記住,股票和行業分析師也是人類,只向投資者提供意見。

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

如果您想跟蹤哪些分析師的表現優於其他分析師,可以在Benzinga Pro中查看最新的分析師評級以及分析師成功得分。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。