What 5 Analyst Ratings Have To Say About Chimera Investment

What 5 Analyst Ratings Have To Say About Chimera Investment

Chimera Investment (NYSE:CIM) has observed the following analyst ratings within the last quarter:

Chimera Investment(紐約證券交易所代碼:CIM)在上個季度觀察到以下分析師評級:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

| 看漲 | 有點看漲 | 冷漠 | 有點看跌 | 看跌 | |

|---|---|---|---|---|---|

| 總收視率 | 0 | 2 | 3 | 0 | 0 |

| 最後 30 天 | 0 | 1 | 0 | 0 | 0 |

| 1 月前 | 0 | 0 | 2 | 0 | 0 |

| 2 萬之前 | 0 | 0 | 0 | 0 | 0 |

| 3 萬之前 | 0 | 1 | 1 | 0 | 0 |

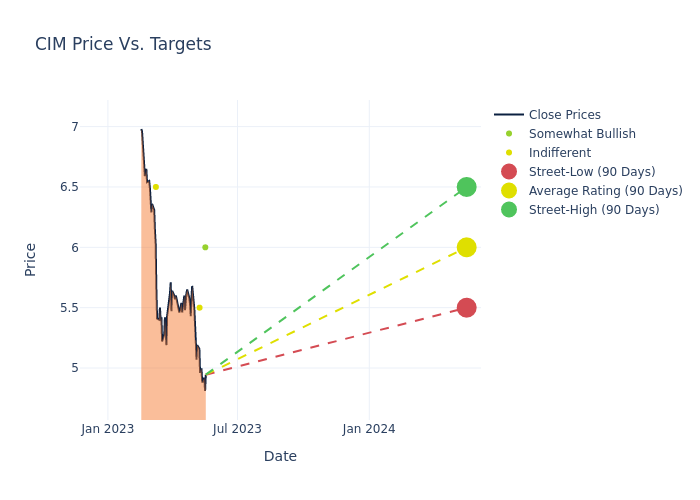

According to 5 analyst offering 12-month price targets in the last 3 months, Chimera Investment has an average price target of $6.25 with a high of $7.00 and a low of $5.50.

根據過去3個月中提供12個月目標股價的5位分析師的數據,Chimera Investment的平均目標股價爲6.25美元,最高爲7.00美元,低點爲5.50美元。

Below is a summary of how these 5 analysts rated Chimera Investment over the past 3 months. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the number of bearish ratings, the more negative analysts are on the stock

以下是這5位分析師在過去3個月中對Chimera Investment的評級摘要。看漲評級的數量越多,分析師對該股票的正面評價就越多,看跌評級的數量越多,分析師對該股的負面評價就越多

This current average represents a 7.41% decrease from the previous average price target of $6.75.

目前的平均價格比之前的平均目標價6.75美元下降了7.41%。

Stay up to date on Chimera Investment analyst ratings.

隨時瞭解Chimera Investment分析師評級的最新情況。

If you are interested in following small-cap stock news and performance you can start by tracking it here.

如果你有興趣關注小盤股的新聞和表現,可以先在這裏追蹤。

How Are Analyst Ratings Determined?

分析師評級是如何確定的?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

評級來自分析師或銀行和金融系統內的專家,他們對特定股票或特定行業進行報告(通常每隻股票每季度報告一次)。分析師通常從公司電話會議和會議、財務報表以及與重要內部人士的對話中獲取信息,以做出決策。

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

一些分析師發佈了對增長預期、收益和收入等指標的預測,以爲他們的評級提供更多指導。在使用分析師評級時,重要的是要記住,股票和行業分析師也是人類,只向投資者提供意見。

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

如果您想跟蹤哪些分析師的表現優於其他分析師,可以在Benzinga Pro中查看最新的分析師評級以及分析師成功得分。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。