Shenzhen Feima International Supply Chain Co., Ltd.'s (SZSE:002210) Share Price Could Signal Some Risk

Shenzhen Feima International Supply Chain Co., Ltd.'s (SZSE:002210) Share Price Could Signal Some Risk

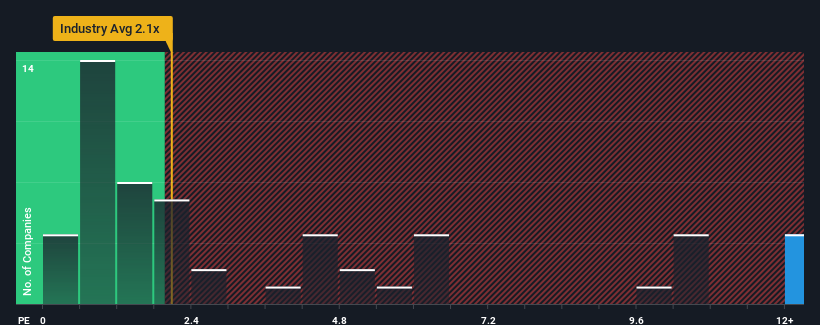

When close to half the companies in the Renewable Energy industry in China have price-to-sales ratios (or "P/S") below 2.1x, you may consider Shenzhen Feima International Supply Chain Co., Ltd. (SZSE:002210) as a stock to avoid entirely with its 13.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

當中國可再生能源行業中近一半的公司的市銷率(P/S)低於2.1倍時,你可以考慮深圳市飛馬國際供應鏈有限公司。(SZSE:002210)作為一隻股票,完全避免與其13.5倍的本益比/S比率。儘管如此,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此之高。

See our latest analysis for Shenzhen Feima International Supply Chain

查看我們對深圳飛馬國際供應鏈的最新分析

How Shenzhen Feima International Supply Chain Has Been Performing

深圳飛馬國際供應鏈表現如何

Shenzhen Feima International Supply Chain certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

深圳飛馬國際供應鏈最近確實做得很好,因為它的收入一直在以非常快的速度增長。或許市場預計未來的收入表現將好於大盤,這似乎讓人們對該股感興趣。然而,如果情況並非如此,投資者可能會被髮現為該股支付過高的價格。

Do Revenue Forecasts Match The High P/S Ratio?

收入預測是否與高本益比相匹配?

Shenzhen Feima International Supply Chain's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

深圳飛馬國際供應鏈的P/S比率對於一家預計將實現非常強勁增長的公司來說是典型的,而且重要的是,它的表現遠遠好於行業。

Taking a look back first, we see that the company grew revenue by an impressive 43% last year. Revenue has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

首先回顧一下,我們看到該公司去年的收入增長了令人印象深刻的43%。與三年前相比,收入總計增長了28%,這主要得益於過去12個月的增長。因此,股東可能會對中期營收增長率感到滿意。

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

與預計在未來12個月內實現24%增長的行業相比,根據最近的中期年化收入結果,該公司的增長勢頭較弱。

With this information, we find it concerning that Shenzhen Feima International Supply Chain is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

有了這些資訊,我們發現深圳飛馬國際供應鏈的本益比高於行業水準。顯然,該公司的許多投資者比最近的情況所顯示的要樂觀得多,不願以任何價格拋售他們的股票。如果本益比與S的本益比跌至更接近近期增速的水準,現有股東很有可能會對未來的表現感到失望。

What We Can Learn From Shenzhen Feima International Supply Chain's P/S?

我們可以從深圳飛馬國際供應鏈的P/S那裡學到什麼?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

我們會說,市銷率的力量主要不是作為一種估值工具,而是衡量當前投資者的情緒和未來預期。

Our examination of Shenzhen Feima International Supply Chain revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

我們對深圳飛馬國際供應鏈的調查顯示,其糟糕的三年營收趨勢並沒有像我們所說的那樣對本益比造成那麼大的影響,因為它們看起來比當前行業預期的要差。當我們觀察到收入增長慢於行業,同時本益比較高時,我們假設存在顯著的股價下跌風險,這將導致較低的本益比/S比率。除非最近的中期狀況明顯改善,否則很難接受這些股價是合理的。

Having said that, be aware Shenzhen Feima International Supply Chain is showing 2 warning signs in our investment analysis, you should know about.

話雖如此,但請注意深圳飛馬國際供應鏈出現2個警示信號在我們的投資分析中,你應該知道。

If these risks are making you reconsider your opinion on Shenzhen Feima International Supply Chain, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓您重新考慮對深圳飛馬國際供應鏈的看法,探索我們的高質量股票互動列表,以瞭解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫。或者,也可以給編輯組發電子郵件,地址是implywallst.com。

本文由Simply Wall St.撰寫,具有概括性。我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議。它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況。我們的目標是為您帶來由基本面數據驅動的長期重點分析。請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內。Simply Wall St.對上述任何一隻股票都沒有持倉。