Investors Give Invitae Corporation (NYSE:NVTA) Shares A 27% Hiding

Investors Give Invitae Corporation (NYSE:NVTA) Shares A 27% Hiding

Invitae Corporation (NYSE:NVTA) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

Invitae 公司 紐約證券交易所代碼:NVTA)等待事情發生的股東受到了打擊,上個月股價下跌了27%。對於股東來說,最近的下跌結束了災難性的十二個月,在此期間,他們的虧損爲60%。

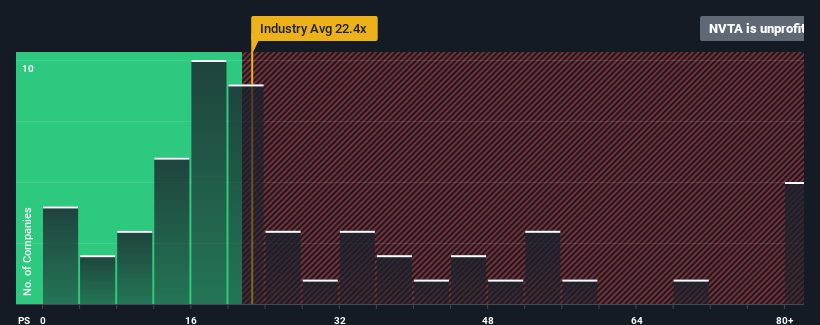

After such a large drop in price, Invitae may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -0.1x, since almost half of all companies in the United States have P/E ratios greater than 16x and even P/E's higher than 31x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

在價格大幅下跌之後,Invitae目前可能會發出非常看漲的信號,其市盈率(或 “市盈率”)爲-0.1倍,因爲美國幾乎有一半的公司的市盈率大於16倍,即使市盈率高於31倍也並不罕見。但是,市盈率可能相當低是有原因的,需要進一步調查以確定其是否合理。

Invitae could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Invitae的表現可能會更好,因爲其收益最近一直在倒退,而大多數其他公司的收益卻出現了正增長。市盈率可能很低,因爲投資者認爲這種糟糕的收益表現不會好轉。如果你還喜歡這家公司,你會希望情況並非如此,這樣你就有可能在股票失寵的時候買入一些股票。

Check out our latest analysis for Invitae

看看我們對 Invitae 的最新分析

How Is Invitae's Growth Trending?

Invitae 的增長趨勢如何?

Invitae's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

對於一家預計增長將非常差甚至收益下降的公司來說,Invitae的市盈率是典型的,而且重要的是,其表現要比市場差得多。

Retrospectively, the last year delivered a frustrating 529% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

回想起來,去年公司的利潤下降了529%,令人沮喪。至少每股收益總體上沒有比三年前完全倒退,這要歸功於早期的增長。因此,可以公平地說,該公司最近的收益增長一直不穩定。

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 24% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

展望未來,報道該公司的11位分析師的估計表明,在未來三年中,收益將每年增長24%。同時,預計其他市場每年僅增長11%,吸引力明顯降低。

In light of this, it's peculiar that Invitae's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有鑑於此,奇怪的是,Invitae的市盈率低於大多數其他公司。看來大多數投資者根本不相信該公司能夠實現未來的增長預期。

The Final Word

最後一句話

Having almost fallen off a cliff, Invitae's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

在差點跌下懸崖之後,Invitae的股價也大幅下跌了市盈率。我們可以說,市盈率的力量主要不在於作爲估值工具,而是衡量當前的投資者情緒和未來預期。

We've established that Invitae currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

我們已經確定,Invitae目前的市盈率遠低於預期,因爲其預測的增長高於整個市場。當我們看到強勁的盈利前景且增長快於市場時,我們認爲潛在風險可能會給市盈率帶來巨大壓力。至少價格風險看起來很低,但投資者似乎認爲未來的收益可能會出現很大的波動。

It is also worth noting that we have found 6 warning signs for Invitae (2 are concerning!) that you need to take into consideration.

還值得注意的是,我們已經發現 Invitae 的 6 個警告標誌 (2 個令人擔憂!)這是你需要考慮的。

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

當然, 通過尋找一些優秀的候選人,你可能會發現一筆不錯的投資。 所以來看看這個 免費的 具有強勁增長記錄、市盈率較低的公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂? 取得聯繫 直接和我們聯繫。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是一般性的。 我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章無意提供財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能未將最新的價格敏感型公司公告或定性材料考慮在內。簡而言之,華爾街對上述任何股票都沒有頭寸。