Palantir Stock Shows Healthy Consolidation As AI Interest Surges: The Bull, Bear Case

Palantir Stock Shows Healthy Consolidation As AI Interest Surges: The Bull, Bear Case

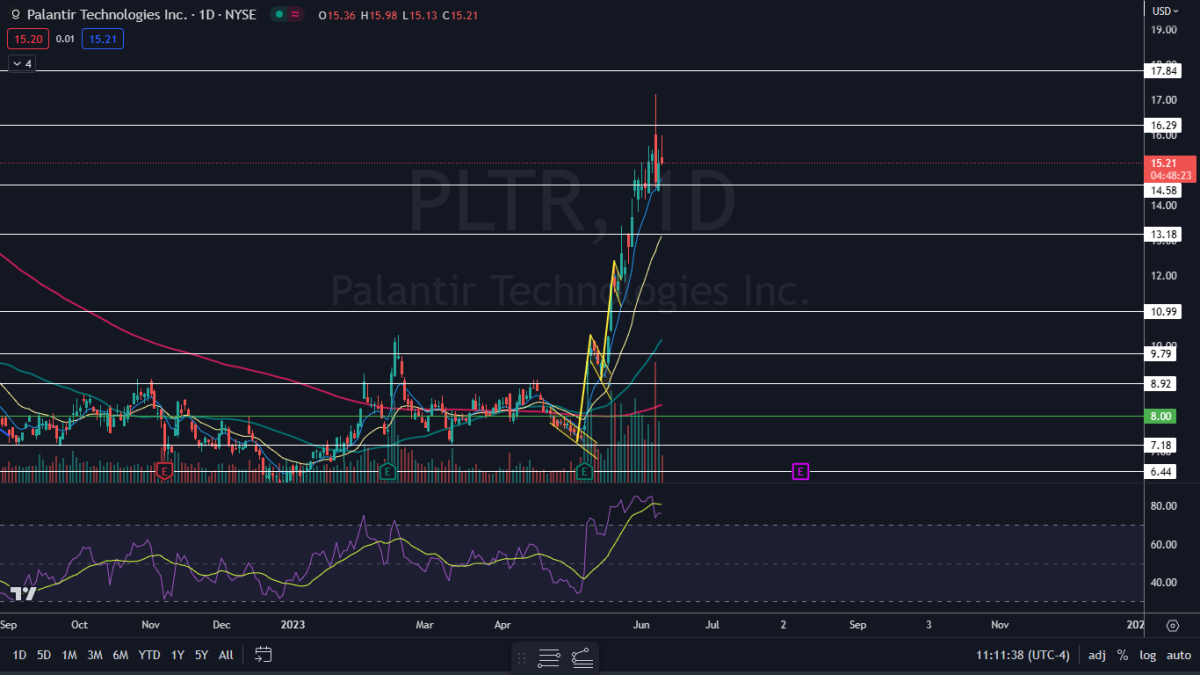

Palantir Technologies, Inc (NYSE:PLTR) is showing continued consolidation Friday after a 134% rise between May 5 and June 7, which was caused by increased interest in the company's AI software.

帕蘭蒂爾科技公司 紐約證券交易所代碼:PLTR)在5月5日至6月7日期間上漲134%之後,週五繼續盤整,這是由於人們對該公司人工智能軟件的興趣增加。

The mostly sideways consolidation, which began on May 30, has allowed the eight-day exponential moving average (EMA) to catch up to the stock's price, which is a good sign for the bulls. The eight-day EMA may continue to guide Palantir higher.

從5月30日開始的大部分橫盤整理使八天指數移動平均線(EMA)趕上了股票的價格,這對多頭來說是個好兆頭。八天均線可能會繼續引導帕蘭蒂爾走高。

Palantir is trading in an uptrend, making a series of higher highs and higher lows. On Friday, the stock may have formed a lower high, which could negate the uptrend, but a downtrend won't be confirmed unless a lower low forms.

Palantir交易呈上升趨勢,創出一系列更高的高點和更高的低點。週五,該股可能已形成較低的高點,這可能會抵消上漲趨勢,但除非出現較低的低點,否則下跌趨勢將無法得到證實。

The sideways consolidation has helped Palantir's relative strength index (RSI) to fall lower. RSI is an indicator technical traders use to measure bullish and bearish price momentum. RSI levels can range between zero and 100, with levels between 30 and 70 generally considered to be healthy.

橫盤整幫助帕蘭蒂爾的相對強弱指數(RSI)走低。RSI 是技術交易者用來衡量看漲和看跌價格動量的指標。RSI 水平可以介於 0 到 100 之間,通常認爲介於 30 到 70 之間的水平是健康的。

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

想要直接分析?在 BZ Pro 休息室找我!點擊此處免費試用。

The Palantir Chart: Palantir may continue to trade sideways for a longer period of time, which would help to drop the stock's RSI down under the 70% level. Although Palantir's RSI has fallen, it's still measuring in at about 76%, which indicates the stock is overbought.

Palantir Chart: Palantir可能會在更長的時間內繼續橫盤整理,這將有助於將該股的RSI降至70%以下。儘管Palantir的RSI已經下降,但仍約爲76%,這表明該股已超買。

- If Palantir trades lower later on Friday or on Monday and drops under $14.39, Friday's high-of-day will serve as a lower high and a downtrend will be confirmed with a lower low. Bullish traders want to see Palantir bounce up off the eight-day EMA, which would confirm the area as support and keep the uptrend intact.

- Bears want to see big bearish volume come in and break Palantir down from the eight-day EMA, which would confirm a new downtrend and could bring in higher-volume selling. If that happens, the stock may find support at the 21-day EMA.

- Palantir has resistance above at $16.29 and $17.84 and support below at $14.58 and $13.18.

- 如果Palantir在週五晚些時候或週一交易價格走低並跌破14.39美元,則週五的高點將作爲較低的高點,下跌趨勢將以較低的低點得到確認。看漲的交易者希望看到Palantir從八天均線反彈,這將確認該區域爲支撐位並保持上漲趨勢不變。

- 空頭希望看到大量看跌交易量進來並將帕蘭蒂爾從八天均線下跌,這將證實新的下跌趨勢,並可能帶來更大的賣出量。如果發生這種情況,該股可能會在21天均線獲得支撐。

- Palantir的阻力位在16.29美元和17.84美元上方,支撐位在14.58美元和13.18美元下方。

Read Next: Amazon Shows Signs Of Strength As The Stock Consolidates: The Bull, Bear Case

Read Next: Amazon Shows Signs Of Strength As The Stock Consolidates: The Bull, Bear Case

繼續閱讀:隨着股票的盤整,亞馬遜顯示出強勢跡象:牛市熊市案