Summary

The Institute for Supply Management published its monthly Manufacturing Report for October.

The latest headline Purchasing Managers Index was 48.3, an increase of 0.5 percent from 47.8 the previous month.

For a diffusion index, the latest reading of 48.3 is its second consecutive month of contraction.

By Jill Mislinski

By Jill Mislinski

Today, the Institute for Supply Management published its monthly Manufacturing Report for October. The latest headline Purchasing Managers Index (PMI) was 48.3, an increase of 0.5 percent from 47.8 the previous month. Today's headline number was below the Investing.com forecast of 48.9 percent.

Here is the key analysis from the report:

"The October PMI registered 48.3 percent, an increase of 0.5 percentage point from the September reading of 47.8 percent. The New Orders Index registered 49.1 percent, an increase of 1.8 percentage points from the September reading of 47.3 percent. The Production Index registered 46.2 percent, down 1.1 percentage points compared to the September reading of 47.3 percent. The Backlog of Orders Index registered 44.1 percent, down 1 percentage point compared to the September reading of 45.1 percent. The Employment Index registered 47.7 percent, a 1.4-percentage point increase from the September reading of 46.3 percent. The Supplier Deliveries Index registered 49.5 percent, a 1.6-percentage point decrease from the September reading of 51.1 percent. The Inventories Index registered 48.9 percent, an increase of 2 percentage points from the September reading of 46.9 percent. The Prices Index registered 45.5 percent, a 4.2-percentage point decrease from the September reading of 49.7 percent. The New Export Orders Index registered 50.4 percent, a 9.4-percentage point increase from the September reading of 41 percent. The Imports Index registered 45.3 percent, a 2.8-percentage point decrease from the September reading of 48.1 percent.

Here is the table of PMI components.

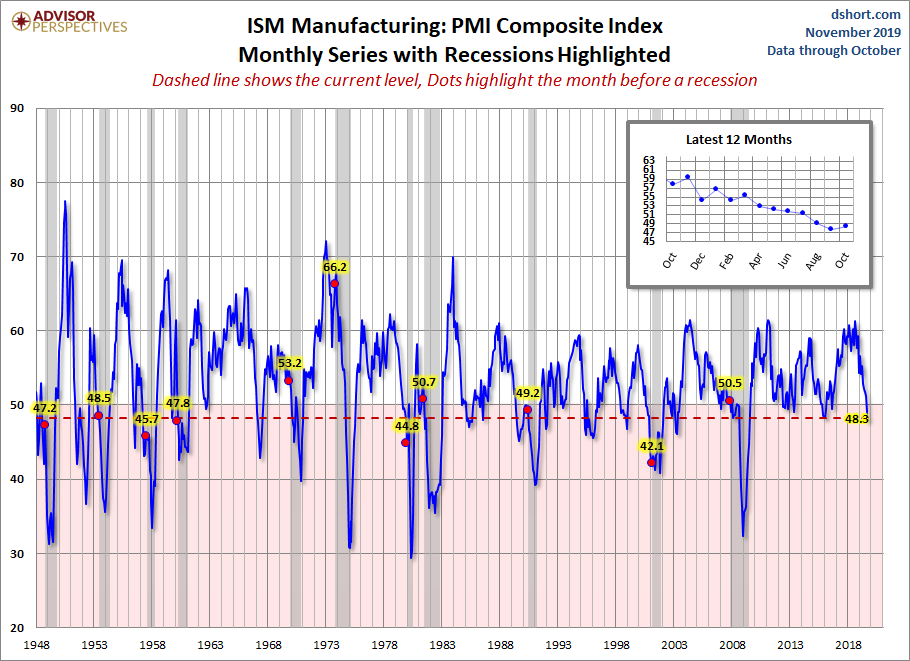

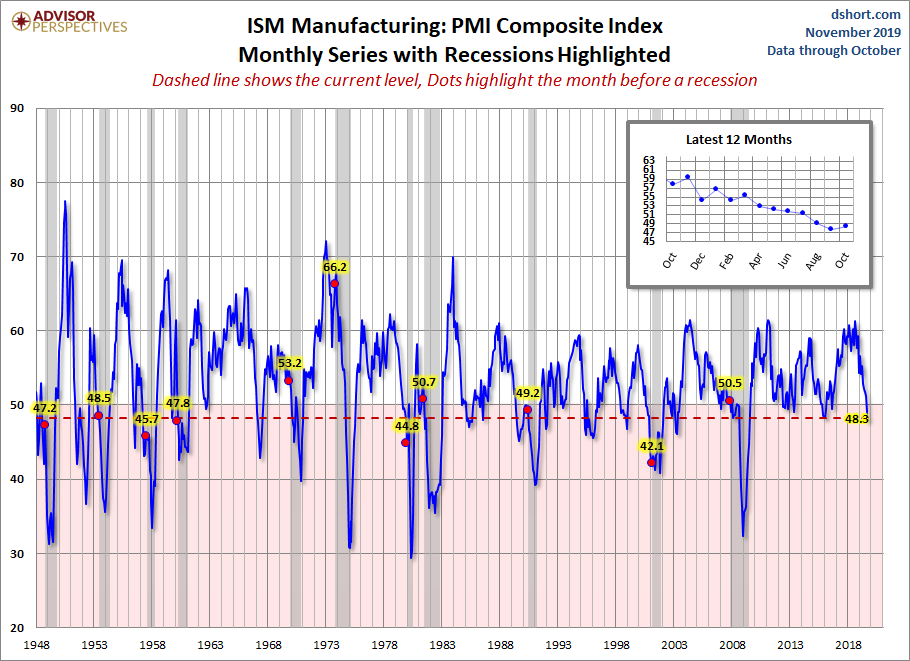

The chart below shows the Manufacturing Composite series, which stretches back to 1948. The eleven recessions during this time frame are indicated along with the index value the month before the recession starts.

For a diffusion index, the latest reading of 48.3 is its second consecutive month of contraction. What sort of correlation does that have with the months before the start of recessions? Check out the red dots in the chart above.

Here is a closer look at the series beginning at the turn of the century.

![Since 2000]()

Note: This commentary used the FRED USRECP series (Peak through the Period preceding the Trough) to highlight the recessions in the charts above. For example, the NBER dates the last cycle peak as December 2007, the trough as June 2009 and the duration as 18 months. The USRECP series thus flags December 2007 as the start of the recession and May 2009 as the last month of the recession, giving us the 18-month duration. The dot for the last recession in the charts above is thus for November 2007. The "Peak through the Period preceding the Trough" series is the one FRED uses in its monthly charts, as illustrated here.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

The Institute for Supply Management published its monthly Manufacturing Report for October.

供應管理協會(Institute For Supply Management)發佈了10月份的月度製造業報告。

The latest headline Purchasing Managers Index was 48.3, an increase of 0.5 percent from 47.8 the previous month.

最新的整體採購經理人指數為48.3,比前一個月的47.8上升了0.5%。

For a diffusion index, the latest reading of 48.3 is its second consecutive month of contraction.

對於擴散指數而言,最新讀數為48.3,這是該指數連續第二個月收縮。

吉爾·米斯林斯基(Jill Mislinski)著

Today, the Institute for Supply Management published its monthly Manufacturing Report for October. The latest headline Purchasing Managers Index (PMI) was 48.3, an increase of 0.5 percent from 47.8 the previous month. Today's headline number was below the Investing.com forecast of 48.9 percent.

今天,美國供應管理協會(Institute For Supply Management)發佈了月度報告製造業報告十月份的。最新的整體採購經理人指數(PMI)為48.3,比上月的47.8上升了0.5%。今天的頭條數字低於Investing.com預測為48.9%。

Here is the key analysis from the report:

"The October PMI registered 48.3 percent, an increase of 0.5 percentage point from the September reading of 47.8 percent. The New Orders Index registered 49.1 percent, an increase of 1.8 percentage points from the September reading of 47.3 percent. The Production Index registered 46.2 percent, down 1.1 percentage points compared to the September reading of 47.3 percent. The Backlog of Orders Index registered 44.1 percent, down 1 percentage point compared to the September reading of 45.1 percent. The Employment Index registered 47.7 percent, a 1.4-percentage point increase from the September reading of 46.3 percent. The Supplier Deliveries Index registered 49.5 percent, a 1.6-percentage point decrease from the September reading of 51.1 percent. The Inventories Index registered 48.9 percent, an increase of 2 percentage points from the September reading of 46.9 percent. The Prices Index registered 45.5 percent, a 4.2-percentage point decrease from the September reading of 49.7 percent. The New Export Orders Index registered 50.4 percent, a 9.4-percentage point increase from the September reading of 41 percent. The Imports Index registered 45.3 percent, a 2.8-percentage point decrease from the September reading of 48.1 percent.

“10月份的採購經理人指數為48.3%,比9月份的47.8%上升了0.5個百分點。新訂單指數為49.1%,比9月份的47.3%上升了1.8個百分點。生產指數為46.2%,比9月份的47.3%下降了1.1個百分點。積壓訂單指數為44.1%,比9月份的45.1%下降了1個百分點。就業指數為47.7%,比9月份的46.3%上升了1.4個百分點。供應商交貨指數為49.5%,比9月份的51.1%下降了1.6個百分點。庫存指數為48.9%,比9月份的46.9%上升了2個百分點。價格指數為45.5%,比9月份的49.7%下降了4.2個百分點。新出口訂單指數為50.4%,比9月份的41%上升了9.4個百分點。進口指數為45.3%,比9月份的48.1%下降了2.8個百分點。

Here is the table of PMI components.

The chart below shows the Manufacturing Composite series, which stretches back to 1948. The eleven recessions during this time frame are indicated along with the index value the month before the recession starts.

下圖顯示了追溯至1948年的製造業綜合指數系列。這段時間內的11次衰退與衰退開始前一個月的指數值一起顯示。

For a diffusion index, the latest reading of 48.3 is its second consecutive month of contraction. What sort of correlation does that have with the months before the start of recessions? Check out the red dots in the chart above.

對於擴散指數而言,最新讀數為48.3,這是該指數連續第二個月收縮。這與衰退開始前的幾個月有什麼關聯呢?看看上面圖表中的紅點。

Here is a closer look at the series beginning at the turn of the century.

Note: This commentary used the FRED USRECP series (Peak through the Period preceding the Trough) to highlight the recessions in the charts above. For example, the NBER dates the last cycle peak as December 2007, the trough as June 2009 and the duration as 18 months. The USRECP series thus flags December 2007 as the start of the recession and May 2009 as the last month of the recession, giving us the 18-month duration. The dot for the last recession in the charts above is thus for November 2007. The "Peak through the Period preceding the Trough" series is the one FRED uses in its monthly charts, as illustrated here.

注:本評論使用了FredUSRECP系列(在低谷之前的一段時間內達到峯值),以突出顯示上圖中的衰退。例如,NBER將上一個週期的高峯期定為2007年12月,低谷定為2009年6月,持續時間定為18個月。因此,USRECP系列將2007年12月標記為衰退的開始,將2009年5月標記為衰退的最後一個月,這給了我們18個月的持續時間。因此,上圖中最後一次衰退的圓點是2007年11月。如圖所示,弗雷德在其月線圖中使用的是“低谷前一段時間的峯值”系列。這裏.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者按:本文的摘要項目符號是由尋求Alpha編輯選擇的。

By Jill Mislinski

By Jill Mislinski