Inflation Expectations At Record Low As Treasury Forecast Rises

Inflation Expectations At Record Low As Treasury Forecast Rises

Summary

摘要

Confused about the outlook for US inflation? Wednesday's conflicting news on this front isn't helping.

對美國通脹前景感到困惑嗎?週三有關這方面的相互矛盾的消息也沒有幫助。

The New York Fed's monthly survey of consumers in October finds that "short-term inflation expectations have declined to their lowest level since the start of the series in June 2013." The view from Main Street slipped 0.2 percentage points to an annual 2.3% pace. "The decline in one-year ahead inflation expectations was more pronounced for respondents above age 40 and those with household incomes above $50,000."

紐約聯邦儲備銀行的10月份消費者月度調查調查發現,“短期通脹預期已降至2013年6月該系列開始以來的最低水平.”來自主街的觀點下滑了0.2個百分點,按年率計算為2.3%。“對於40歲以上的受訪者和家庭收入在5萬美元以上的受訪者來説,提前一年通脹預期的下降更為明顯。”

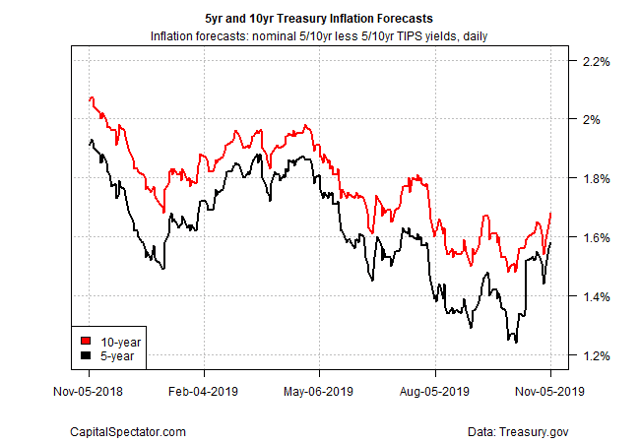

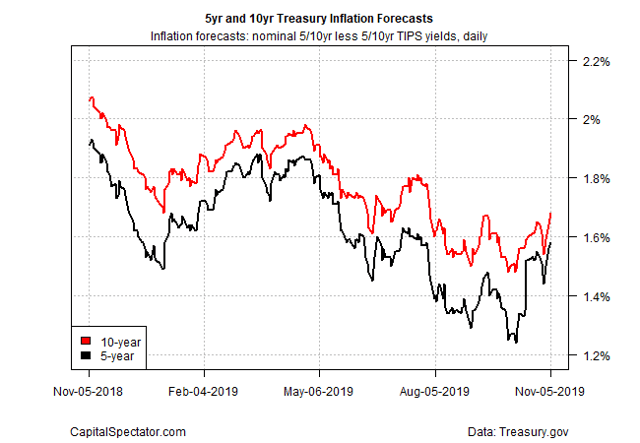

In the Treasury market, however, the crowd is revising inflation expectation up sharply. The implied outlook via the yield spread on the nominal 5-year maturity less its inflation-indexed counterpart, for example, shot up to 1.58% in Wednesday's trading (Nov. 5), a three-month high. That's still well below the Federal Reserve's 2.0% inflation target. Nonetheless, the sudden directional shift is striking, and it implies that the market is rethinking the case for low inflation as far as the eye can see.

然而,在美國國債市場,人們正在大幅上調通脹預期。例如,在週三(11月5日)的交易中,通過名義5年期國債收益率差減去通脹指數的隱含前景飆升至1.58%,為三個月來的最高水平。這仍遠低於美聯儲2.0%的通脹目標。儘管如此,這種突如其來的方向轉變是驚人的,這意味着市場正在重新考慮眼下所能看到的低通脹的理由。

Further complicating inflation analysis and policy prescriptions these days is a new report that rising prices are squeezing low-income folks. "Prices have risen more quickly for people at the bottom of the income distribution than for those at the top-a phenomenon dubbed 'inflation inequality,'" according to report published this month by the Center on Poverty & Social Policy at Columbia University and the Groundwork Collaborative. "An implication of this new finding is that we may be underestimating income inequality and poverty rates in the United States-two national statistics that rely heavily on the annual inflation rate as part of their calculation."

最近,一份新的報告使通脹分析和政策處方變得更加複雜,該報告稱,不斷上漲的物價正在擠壓低收入人羣。“收入分配最底層的人比收入最高的人物價上漲得更快--這種現象被稱為‘通脹不平等’。”根據本月發佈的報告,哥倫比亞大學貧困與社會政策中心和基金會合作。“這一新發現的一個含義是,我們可能低估了美國的收入不平等和貧困率--這兩個國家的統計數據嚴重依賴於年通脹率作為計算的一部分。”

From the vantage of monetary policy, however, the goal is still one of pushing inflation higher. Emphasizing the objective, Neel Kashkari, president of the Minneapolis Fed, told CNBC earlier this week that the Federal Reserve should take a pass on future rate hikes until inflation rises from current levels. "Make an announcement today that we will not raise rates until we get core inflation back to our 2% target," he said. "That's not a commitment to cut rates, that's not a commitment to hold forever, it's simply saying we're not going to raise rates prematurely."

然而,從貨幣政策的優勢來看,目標仍然是推高通脹。明尼阿波利斯聯邦儲備銀行(Minneapolis Fed)行長尼爾·卡什卡利(Neel Kashkari)強調了這一目標,告訴CNBC本週早些時候,美聯儲(Federal Reserve)應該放棄未來的加息,直到通貨膨脹率從目前的水平上升。他説:“今天宣佈,在核心通脹率回到2%的目標之前,我們不會加息。”“這不是降息的承諾,也不是永遠保持不變的承諾,只是在説我們不會過早加息。”

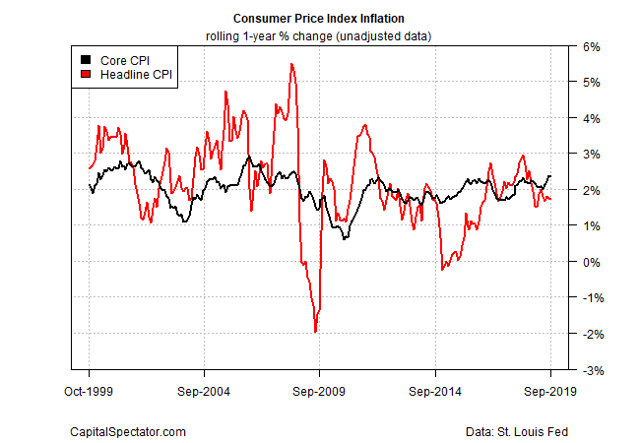

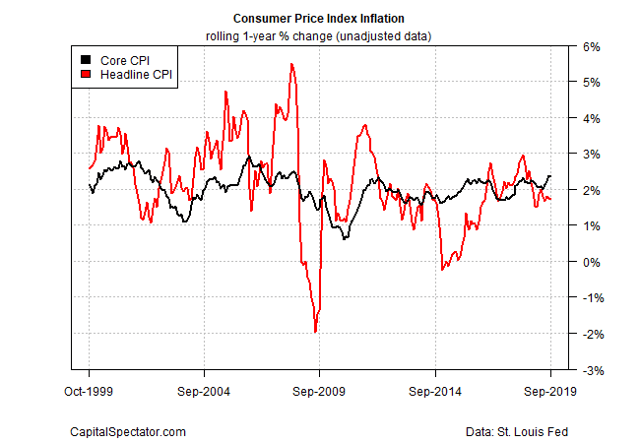

In fact, the core reading of the Consumer Price Index (which strips out energy and food prices for a more reliable measure of the trend) is showing signs of strengthening in recent months. Core CPI (in unadjusted terms) rose at an annual 2.4% rate in August and September, the fastest gains since the recession ended in 2009. The upswing implies that headline inflation will soon follow.

事實上,消費者物價指數(剔除能源和食品價格,以便更可靠地衡量這一趨勢)的核心讀數在近幾個月顯示出走強的跡象。8月和9月核心CPI(未經調整)年增率為2.4%,為2009年衰退結束以來的最快漲幅。上漲意味着整體通脹很快就會接踵而至。

Or will it? Many analysts are befuddled when it comes to analyzing and understanding inflation dynamics of late. But it's getting easier to assume that inflation may have a tough time rebounding in the wake of recent numbers that suggest the macro trend has decelerated. There's still no sign of an imminent recession risk, based on a broad reading of indicators. But there's also mounting evidence that growth will continue to slow.

還是會呢?當談到分析和理解最近的通脹動態時,許多分析師感到困惑。但人們越來越容易認為,在最近的數據顯示宏觀趨勢已經減速後,通脹可能會經歷一段艱難的反彈時期。目前仍沒有跡象表明經濟衰退風險迫在眉睫,基於對指標的廣泛解讀。但也有越來越多的證據表明,經濟增長將繼續放緩。

Wednesday's GDP nowcast for the fourth quarter via the Atlanta Fed's GDPNow model estimated output at a weak 1.0% increase - down from 1.9% in Q3. If that's accurate, the softer trend may put new downward pressure on inflation in the months ahead.

週三通過亞特蘭大聯儲發佈的第四季度GDP現報GDPNow模型預計產出疲軟增長1.0%,低於第三季度的1.9%。如果這是準確的,疲軟的趨勢可能會在未來幾個月給通脹帶來新的下行壓力。

In short, there's still a number of conflicting signals for the inflation outlook. From a policy perspective at the Fed, however, a bias for higher pricing pressure is conspicuous.

簡而言之,通脹前景仍有許多相互矛盾的信號。然而,從美聯儲的政策角度來看,傾向於更高的定價壓力是顯而易見的。

"We need an inflation rate that gives us nominal rates that are high enough and give us more police space," San Francisco Fed President Mary Daly said on Monday.

舊金山聯邦儲備銀行總裁瑪麗·戴利(Mary Daly)表示:“我們需要一個通脹率,讓我們的名義利率足夠高,並給我們更大的警戒空間。”週一表示.

All eyes will be on the November 13 release of October's consumer price index to learn if the hard data aligns with Daly's policy wish list.

所有人的目光都將集中在11月13日公佈的10月消費者物價指數(CPI)上,以瞭解硬數據是否與戴利的政策願望清單一致。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。

Confused about the outlook for US inflation? Wednesday's conflicting news on this front isn't helping.

Confused about the outlook for US inflation? Wednesday's conflicting news on this front isn't helping.