Summary

Despite the appearance of the stock market moving higher, most of the stocks that make up the 2800 stocks on the NYSE are well below their all-time and/or YTD highs.

There's plenty of money to be made shorting stocks despite the headline, mainstream media and White House's euphoria over the stock market's performance.

Over the past 52 weeks through November 6th, the S&P 500 has declined 10.5% when measured in terms of gold, i.e., real money.

The major stock indices - the Dow (DIA), SPX (SPY) and Nasdaq (QQQ) - have wafted up to all-time highs on a cloud of central bank printed money. Interestingly, most of the stocks in all three indices are below to well below their all-time highs. The breadth of the move is shockingly thin. Very few stocks are responsible for pushing the indices higher. The Dow's move last Friday, for instance, was primarily attributable to Apple (AAPL) (by far the biggest contributor), Microsoft (MSFT), Home Depot (HD), United Technologies (UTX) and JPMorgan (JPM). Of those, only AAPL, UTX and JPM hit their all-time high on Friday. MSFT and HD were close.

The major stock indices - the Dow (DIA), SPX (SPY) and Nasdaq (QQQ) - have wafted up to all-time highs on a cloud of central bank printed money. Interestingly, most of the stocks in all three indices are below to well below their all-time highs. The breadth of the move is shockingly thin. Very few stocks are responsible for pushing the indices higher. The Dow's move last Friday, for instance, was primarily attributable to Apple (AAPL) (by far the biggest contributor), Microsoft (MSFT), Home Depot (HD), United Technologies (UTX) and JPMorgan (JPM). Of those, only AAPL, UTX and JPM hit their all-time high on Friday. MSFT and HD were close.

Many of the Dow stocks are down significantly this year. If you find this hard to believe, run the 1-year charts of the 30 Dow stocks. I'm certain the same is true for the SPX and Nasdaq.

Despite the appearance of the stock market moving higher, most of the stocks that make up the 2800 stocks on the NYSE are well below their all-time and/or YTD highs. There's plenty of money to be made shorting stocks despite the headline, mainstream media and White House's euphoria over the stock market's performance. Moreover, short interest in the SPY ETF has plunged to a level that has, in the past, led to sharp sell-offs in the stock market.

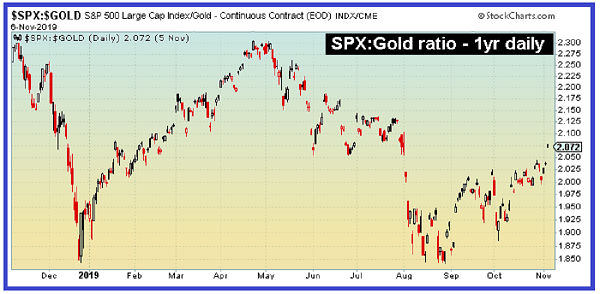

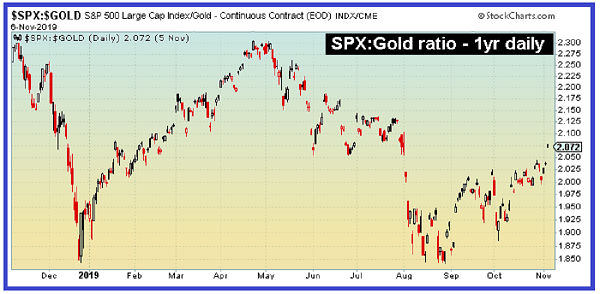

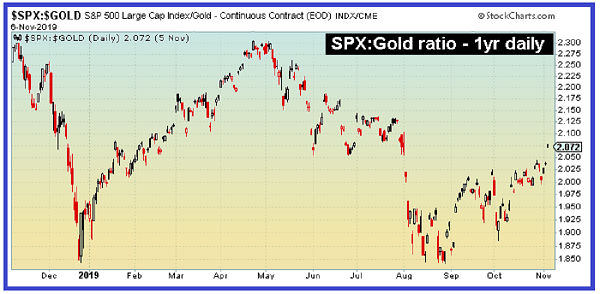

And then there's this, which is the best measure of the real rate of return stocks:

Over the past 52 weeks through November 6th, the S&P 500 has declined 10.5% when measured in terms of gold, i.e., real money. Money printing at a rate in excess of real wealth output diminishes the marginal value of the currency. Because the price of gold moves inversely with the inherent value of the dollar, the chart above reflects the effect of dollar devaluation on financial assets.

Thus, the real upward movement of the stock market is highly deceptive in terms of both the number of stocks in the NYSE participating in move higher and in terms of using real money to measure the price of stocks.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

Despite the appearance of the stock market moving higher, most of the stocks that make up the 2800 stocks on the NYSE are well below their all-time and/or YTD highs.

儘管股市看似走高,但組成紐約證交所2,800只股票的多數股票遠低於歷史和/或年初高點。

There's plenty of money to be made shorting stocks despite the headline, mainstream media and White House's euphoria over the stock market's performance.

儘管有頭條新聞、主流媒體和白宮對股市表現的樂觀情緒,做空股票還是有很多錢可以賺的。

Over the past 52 weeks through November 6th, the S&P 500 has declined 10.5% when measured in terms of gold, i.e., real money.

在截至11月6日的過去52周裏,標準普爾500指數以黃金(即真正的貨幣)衡量,下跌了10.5%。

The major stock indices - the Dow (DIA), SPX (SPY) and Nasdaq (QQQ) - have wafted up to all-time highs on a cloud of central bank printed money. Interestingly, most of the stocks in all three indices are below to well below their all-time highs. The breadth of the move is shockingly thin. Very few stocks are responsible for pushing the indices higher. The Dow's move last Friday, for instance, was primarily attributable to Apple (AAPL) (by far the biggest contributor), Microsoft (MSFT), Home Depot (HD), United Technologies (UTX) and JPMorgan (JPM). Of those, only AAPL, UTX and JPM hit their all-time high on Friday. MSFT and HD were close.

主要股指-道瓊斯工業平均指數(Dow)直徑)、SPX(標普500ETF)和納斯達克(Nasdaq:行情)QQQ(路透社)-在央行印製的鈔票雲層上,人民幣匯率創下歷史新高。有趣的是,所有三個指數中的大多數股票都低於或遠遠低於歷史高點。這一舉措的範圍之廣令人震驚。推動股指走高的股票寥寥無幾。例如,道指上週五的走勢主要歸因於蘋果(AAPL.O:行情)(AAPL.O:行情)AAPL(到目前為止最大的貢獻者),微軟(MSFT)、家得寶(Home Depot)(高清)、聯合技術公司(United Technologies)(UTX)和摩根大通(JPMorgan)(JPM)。其中,只有蘋果(AAPL)、UTX和摩根大通(JPM)在上週五創下歷史新高。MSFT和HD關係密切。

Many of the Dow stocks are down significantly this year. If you find this hard to believe, run the 1-year charts of the 30 Dow stocks. I'm certain the same is true for the SPX and Nasdaq.

許多道瓊斯指數今年都大幅下跌。如果你覺得這很難相信,那就運行一下道瓊斯指數30只股票的1年圖表吧。我敢肯定,SPX和納斯達克也是如此。

Despite the appearance of the stock market moving higher, most of the stocks that make up the 2800 stocks on the NYSE are well below their all-time and/or YTD highs. There's plenty of money to be made shorting stocks despite the headline, mainstream media and White House's euphoria over the stock market's performance. Moreover, short interest in the SPY ETF has plunged to a level that has, in the past, led to sharp sell-offs in the stock market.

儘管股市看似走高,但組成紐約證交所2,800只股票的多數股票遠低於歷史和/或年初高點。儘管有頭條新聞、主流媒體和白宮對股市表現的樂觀情緒,做空股票還是有很多錢可以賺的。此外,標普500ETF ETF的空頭興趣已驟降至過去曾導致股市大幅拋售的水平。

And then there's this, which is the best measure of the real rate of return stocks:

Over the past 52 weeks through November 6th, the S&P 500 has declined 10.5% when measured in terms of gold, i.e., real money. Money printing at a rate in excess of real wealth output diminishes the marginal value of the currency. Because the price of gold moves inversely with the inherent value of the dollar, the chart above reflects the effect of dollar devaluation on financial assets.

在截至11月6日的過去52周裏,標準普爾500指數以黃金(即真正的貨幣)衡量,下跌了10.5%。超過實際財富產出的印鈔速度會降低貨幣的邊際價值。由於黃金價格與美元內在價值走勢相反,上圖反映了美元貶值對金融資產的影響。

Thus, the real upward movement of the stock market is highly deceptive in terms of both the number of stocks in the NYSE participating in move higher and in terms of using real money to measure the price of stocks.

因此,無論是紐約證交所參與股市上漲的股票數量,還是使用真實貨幣衡量股票價格,股市的真正上行都具有很強的欺騙性。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。

The major stock indices - the Dow (

The major stock indices - the Dow (