Summary

On October 30th, the Federal Reserve (Fed) reduced short-term interest rates for a third time this year, as expected.A breakdown in the historical relationship between fixed income and equity, and for how long that anomaly persists, could leave investors thirsty for yields.In the equity world, bond proxies like REITs, MLPs and Utilities are among the higher-yielding strategies to consider, and could help income-focused investors meet their mandates.We are at a tricky place with fixed income. On October 30th, the Federal Reserve (Fed) reduced short-term interest rates for a third time this year, as expected. Fed Chairman Jay Powell characterized the 25bp move in the benchmark funds rate to 1.50% from 1.75% as a "midcycle adjustment" in a maturing economic expansion. He also indicated that there would be a higher bar for more easing in the future.

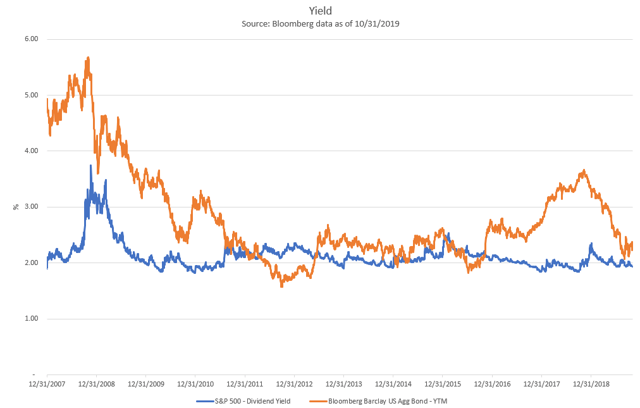

So that leaves us with super-low rates again. Complicating matters is that yields on equities and fixed income are quite close to one another. And when the yield on the S&P 500 Index (1.94%) and the Bloomberg Barclays U.S. Aggregate Bond Index (2.33%) meet, an important question surfaces: Where should investors allocate their "income" bucket?

Fixed income typically offers relative safety and diversification. But this environment's a little different: yields are so low - almost historically low - and principal could be lost when yields eventually rise. In addition, with fixed income and equity yields so close, it's reasonable to wonder if the value of equities and fixed income investments decline in tandem when yields turn higher. A breakdown in the historical relationship between fixed income and equity, and for how long that anomaly persists, could leave investors thirsty for yields.

In the equity world, bond proxies like REITs, MLPs and Utilities are among the higher-yielding strategies to consider, and could help income-focused investors meet their mandates. But performance likely depends on where we are in the business cycle. Then again, the market remains resilient and risks appear to be softening, particularly with signs of a possible trade deal with China forming.

Footnotes:

S&P 500 Total Return Index: The index includes 500 leading U.S. companies and captures approximately 80% coverage of available market capitalization.

Bloomberg Barclays U.S. Aggregate Bond Index: The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through), ABS and CMBS (agency and non-agency).

Carefully consider the Fund's investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund's summary or full prospectuses, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting www.globalxetfs.com. Please read the prospectus carefully before investing.

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or guarantee against a loss. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Information provided by Global X Management Company, LLC (Global X) and SEI Investments Distribution Co. (SIDCO). Global X and SIDCO are not affiliated.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.