What's Changed?

What's Changed?

Summary

摘要

By Jack P. McIntyre, CFA

傑克·P·麥金太爾(Jack P.McIntyre),CFA

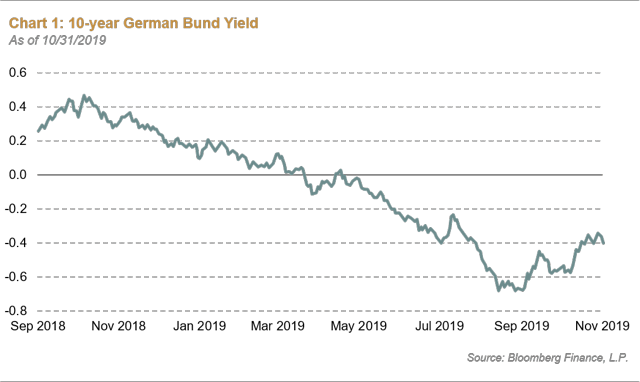

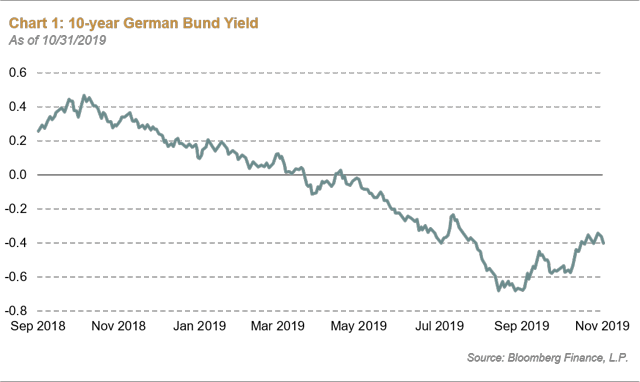

Over the last year, 10-year German Bund yields have gradually declined, while investor sentiment deteriorated over the course of this period as the U.S.-China trade dispute dragged on, taking global growth down with it. Policymakers failed to adequately address the consequences from these events, and German Bund yields partly reflect the lingering effects of this risk-off overhang. However, one year later, information risk is starting to dissipate, which we think may improve the odds for a positive fat-tail risk event in 2020. We think there are six factors that complement each other to potentially produce a surprise to the upside over the next year.

過去一年,10年期德國國債收益率逐漸下降,而在此期間,隨着美中貿易爭端的拖延,投資者情緒惡化,拖累了全球經濟增長。政策制定者未能充分解決這些事件的後果,德國國債收益率在一定程度上反映了這種避險情緒的揮之不去的影響。然而,一年後,信息風險開始消散,我們認為這可能會提高2020年出現正向肥尾風險事件的機率。我們認為,有六個因素相輔相成,有可能在明年給上行帶來驚喜。

1. U.S.-China Trade

1.美中貿易

We'll be continuing to monitor whether any tangible progress is made between the two countries. Although relations have started to thaw, the nuance was enough to catch Federal Reserve (Fed) Chair Jerome Powell's attention and time at his October 30 press conference. Policymakers and investors just need China and the U.S. to keep moving the ball forward, even if progress is incremental. We would expect the risk-on environment to return if the scheduled December tariffs don't go through.

我們將繼續關注兩國之間是否取得了任何切實的進展。儘管兩國關係已經開始解凍,但這種細微差別足以引起美聯儲主席傑羅姆·鮑威爾(Jerome Powell)在10月30日的新聞發佈會上的注意和時間。政策制定者和投資者只需要中國和美國繼續向前推進,即使進展是漸進的。我們預計,如果12月份的關税不能通過,風險環境將會迴歸。

2. Fed Policy

2.美聯儲政策

While we can't call it quantitative easing, the Fed has resumed balance sheet expansion and has left the door open for future rate cuts. Since Powell has insisted that U.S. monetary policy isn't on a preset course, we'll expect more flexibility from the Fed in how it responds to developments in trade, global and domestic growth, and inflation.

雖然我們不能稱之為量化寬鬆,但美聯儲已經恢復了資產負債表的擴張,併為未來的降息敞開了大門。由於鮑威爾堅持認為美國的貨幣政策不是在預設的路線上,我們預計美聯儲在如何應對貿易、全球和國內增長以及通脹的發展方面會有更大的靈活性。

3. Global Monetary Policy

3.全球貨幣政策

Central banks around the world are in the midst of a wave of rate cuts to stimulate economic growth and inflation. While developed market central banks might be running out of runway to ease, emerging markets have the room in terms of real rates and a benign inflation backdrop to continue loosening policy.

全球央行正處於一波降息浪潮中,以刺激經濟增長和通脹。儘管發達市場央行可能已經走出了寬鬆政策的跑道,但新興市場在實際利率和温和的通脹背景方面仍有繼續放鬆政策的空間。

4. Fiscal Stimulus

4.財政刺激

We're increasingly hearing that monetary policy alone won't be enough to cause a rebound in regional and global growth, particularly if enough progress isn't made with respect to the trade dispute. Both the incoming and outgoing European Central Bank presidents have invoked bloc members with twin surpluses to implement fiscal stimulus. Are the odds of Germany delivering a fiscal package increasing? Maybe. Low rates mean that debt servicing costs will be extremely low, but officials will need to think about how either the cost of servicing debt or total debt ratios would look against scenarios of low/contractionary, moderate, or high gross domestic product growth. Regardless, it will be hard for certain countries - like Germany - to justify the extra expenditures.

我們越來越多地聽到,僅靠貨幣政策不足以導致地區和全球經濟增長反彈,特別是如果在貿易爭端方面沒有取得足夠的進展。即將上任的歐洲央行(ECB)行長和即將離任的歐洲央行(ECB)行長都呼籲擁有雙盈餘的歐元區成員國實施財政刺激。德國出台財政一攬子計劃的可能性在增加嗎?也許吧。低利率意味着償債成本將極低,但官員們將需要考慮,無論是償債成本還是總負債率,在國內生產總值(GDP)低/收縮、適度或高增長的情況下,如何看待這一點。無論如何,某些國家--比如德國--很難證明這些額外支出是合理的。

5. Global Consumer Optimism

5.全球消費者樂觀情緒

Fed Chair Powell also highlighted the strength of U.S. households in his recent press conference - a trend that is also globally applicable. Wages are rising for the lower socioeconomic echelons while labor markets tighten. Consumers still have reasons to remain optimistic. Consumer confidence will become particularly salient if a trade deal is reached and the slowdown in global growth reaches an inflection point, because these factors collectively may give businesses a reason to resume investment.

美聯儲主席鮑威爾在最近的新聞發佈會上也強調了美國家庭的實力-這一趨勢也適用於全球。在勞動力市場收緊的同時,較低社會經濟階層的工資正在上漲。消費者仍有理由保持樂觀。如果達成貿易協議,全球增長放緩達到拐點,消費者信心將變得尤為突出,因為這些因素加在一起可能會給企業提供恢復投資的理由。

6. Brexit

6.英國退歐

While the idea of a December snap election may seem like a gamble, Prime Minister Boris Johnson's last-minute negotiations with the European Union and the resulting January 31 "flextension" have significantly reduced the probability of a hard Brexit. For us, a hard Brexit has been one of the more bearish outcomes of this three-year ordeal.

雖然12月提前選舉的想法可能看起來像是一場賭博,但英國首相鮑里斯·約翰遜(Boris Johnson)在最後一刻與歐盟(EU)的談判,以及由此導致的1月31日的“延期”,大大降低了英國硬退歐的可能性。對我們來説,硬退歐是這三年磨難帶來的較為悲觀的結果之一。

These six areas have the opportunity to create some positive catalysts in 2020, either in standalone scenarios or in complement to each other. We'll be watching the 10-year Bund yield closely, because any inflection could suggest that the idea for a positive surprise to the upside may be gaining traction with investors. The recent backup in yields could be an early sign of that upside surprise.

這六個領域有機會在2020年創造一些積極的催化劑,無論是在獨立的情景中,還是在相輔相成的情況下。我們將密切關注10年期德國國債收益率,因為任何轉折都可能表明,給上行帶來積極驚喜的想法可能正在吸引投資者。最近收益率的回升可能是這種上行驚喜的早期跡象。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。

By Jack P. McIntyre, CFA

By Jack P. McIntyre, CFA