Summary

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors.

Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets.

Yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level.

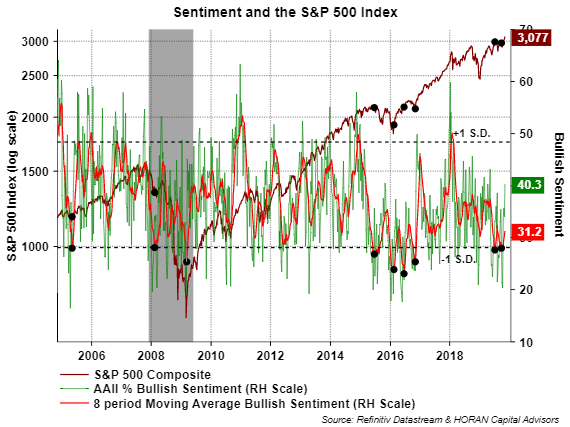

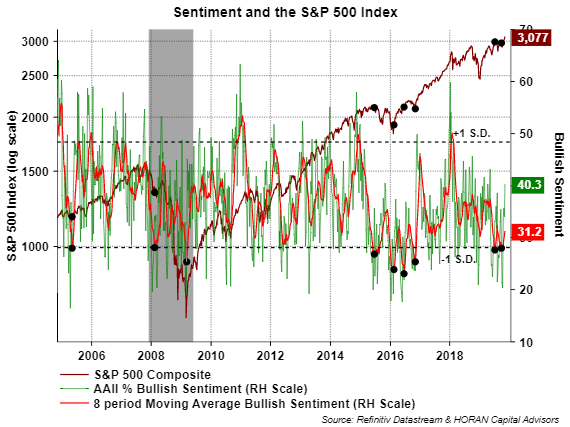

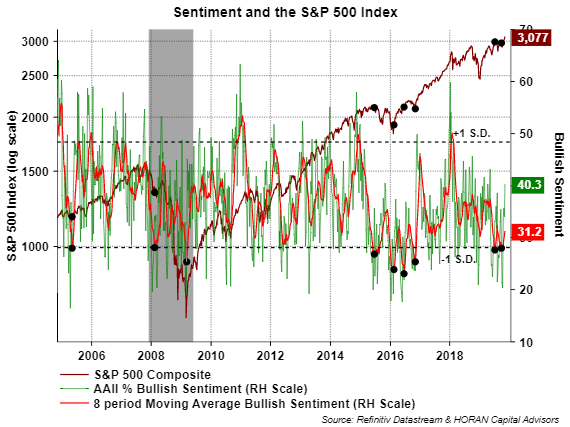

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors. This is the highest bullishness level since the May 9 reading of 43.1%. Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets, yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level. Due to the fact the weekly readings can be volatile, one should evaluate a moving average of the bullishness level, and in this case, the eight-period moving average. This eight-period average remains at a low 31.2%.

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors. This is the highest bullishness level since the May 9 reading of 43.1%. Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets, yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level. Due to the fact the weekly readings can be volatile, one should evaluate a moving average of the bullishness level, and in this case, the eight-period moving average. This eight-period average remains at a low 31.2%.

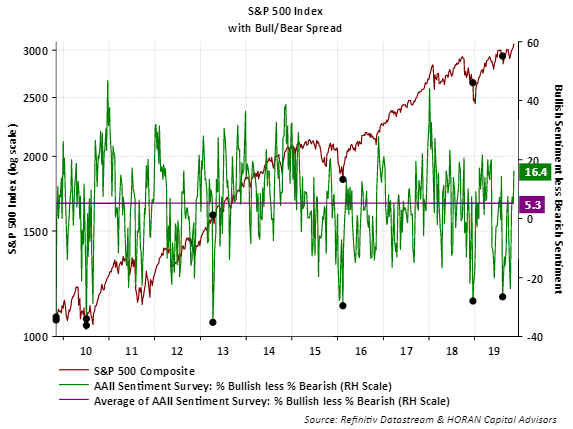

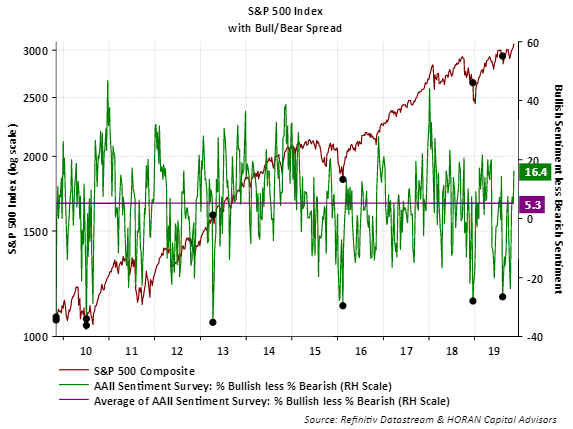

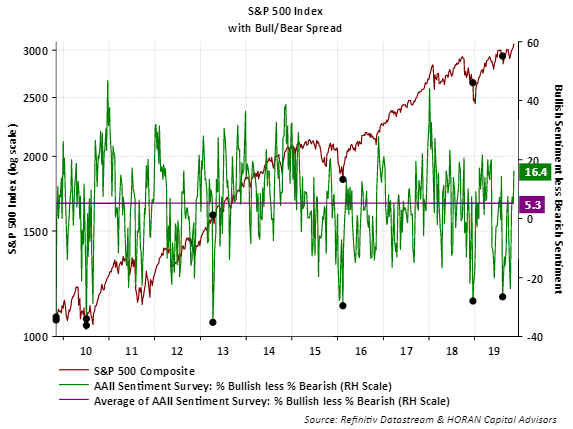

The jump higher in the bullishness level is also impacting the bull/bear spread which equals 16.4 in this week's reading. The long-term average for the bull/bear spread is 5.3 percentage points.

The sentiment measures are contrarian ones and tend to be most actionable at their extremes. With this noted, the current bullish sentiment level is not at an extreme; however, investors will want to keep an eye on individual investor sentiment as the recent equity market move seems to be having a favorable impact on individual investors.

Original post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors.

美國個人投資者協會(American Association Of Personal Investors)指出,看漲的投資者情緒比前一週報告的水平提高了6.3個百分點,達到40.3%。

Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets.

個人投資者的情緒肯定對股市的上升趨勢做出了積極的反應。

Yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level.

然而,目前的看漲水平僅落在平均看漲水平的正負一個標準差區間的中間。

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors. This is the highest bullishness level since the May 9 reading of 43.1%. Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets, yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level. Due to the fact the weekly readings can be volatile, one should evaluate a moving average of the bullishness level, and in this case, the eight-period moving average. This eight-period average remains at a low 31.2%.

看漲的投資者情緒比前一週報告的水平提高了6.3個百分點,達到40.3%,這是由美國個人投資者協會。這是5月9日讀數43.1%以來的最高看漲水平。個人投資者情緒肯定對股市的上升趨勢做出了積極反應,但目前的看漲水平只落在平均看漲水平的正負一個標準差的中間。由於周度讀數可能會波動,人們應該評估看漲水平的移動平均線,在這種情況下,是8期移動平均線。這八個時期的均值維持在31.2%的低位。

The jump higher in the bullishness level is also impacting the bull/bear spread which equals 16.4 in this week's reading. The long-term average for the bull/bear spread is 5.3 percentage points.

看漲水平的上升也影響了牛熊價差,在本週的讀數中,牛熊價差等於16.4。牛/熊價差的長期平均值為5.3個百分點。

The sentiment measures are contrarian ones and tend to be most actionable at their extremes. With this noted, the current bullish sentiment level is not at an extreme; however, investors will want to keep an eye on individual investor sentiment as the recent equity market move seems to be having a favorable impact on individual investors.

情緒指標是反向的,在極端情況下往往最具可操作性。有了這一點,目前的看漲情緒水平並不是極端的;然而,投資者將希望密切關注個人投資者的情緒,因為最近的股市走勢似乎對個人投資者產生了有利的影響。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者按:本文的摘要項目符號是由尋求Alpha編輯選擇的。

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the