Summary

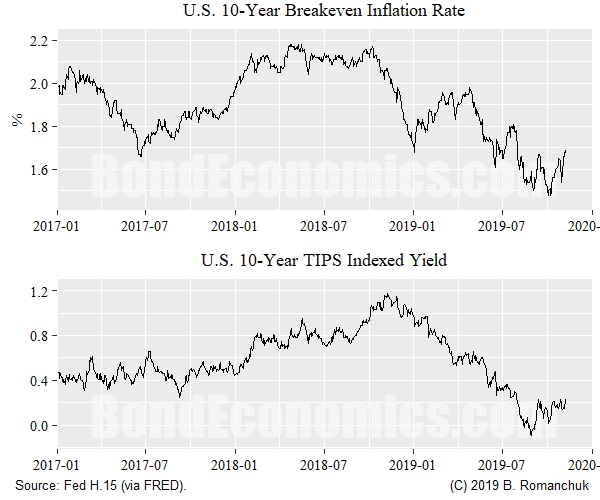

The recent rise in Treasury yields has largely been a rising breakeven inflation story.

Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade.

The recent rise in Treasury yields has largely been a rising breakeven inflation story. Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

(The 10-year breakeven inflation rate is the nominal Treasury yield less the quoted yield on the 10-year index-linked TIPS. The breakeven inflation rate is [approximately] the inflation rate required for the 10-year TIPS total return to match the 10-year conventional Treasury total return. This should match forecast average expected inflation under the assumption of market efficiency. My book Breakeven Inflation Analysis provides a deep dive into the issues around this concept.)

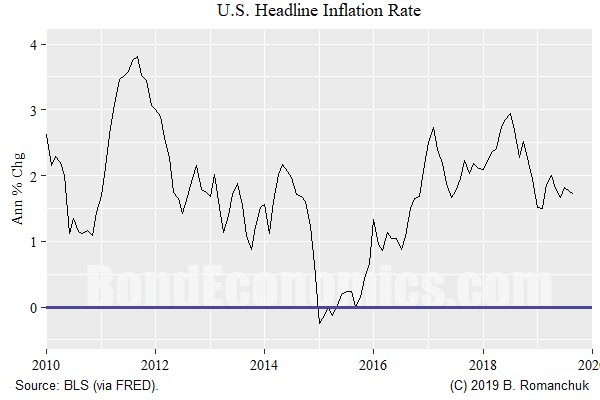

It seems clear that recession risks are being taken out of Treasury market pricing. The previous low of 1.5% breakeven inflation seems to have been somewhat aggressive when compared to inflation performance over the past decade (shown below).

There is certainly no significant inflation risk premium embedded in the breakeven inflation curve. The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade. This is perhaps somewhat surprising this far into an decade-long expansion, but recession fears have meant that risks are seen as symmetric.

Looking forward, it seems likely that breakeven inflation rate movements will explain most of the changes in nominal yields, under the assumption that yield movements are not large. Breakeven inflation rates are still well below their average of recent years, and thus, might "re-normalise" closer to 2% if the Treasury bear market continues.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

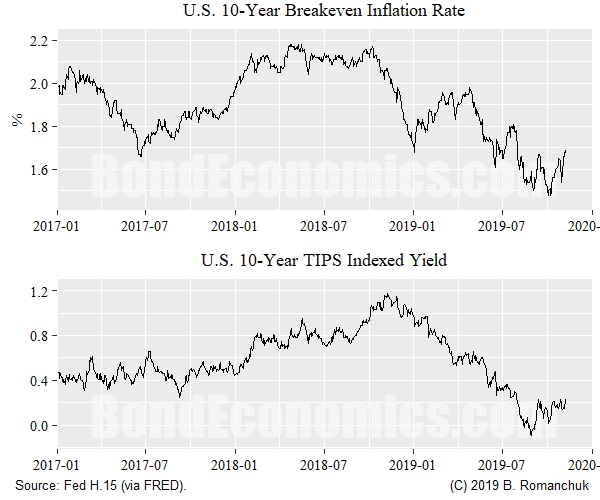

The recent rise in Treasury yields has largely been a rising breakeven inflation story.

美國國債收益率最近的上升在很大程度上是一個不斷上升的盈虧平衡通脹故事。

Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

誠然,這不是一個很大的變動,但10年期盈虧平衡似乎已經從1.5%的水平反彈。

The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade.

目前的水平(接近1.7%)處於過去10年觀察到的通脹率區間的中間。

The recent rise in Treasury yields has largely been a rising breakeven inflation story. Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

美國國債收益率最近的上升在很大程度上是一個不斷上升的盈虧平衡通脹故事。誠然,這不是一個很大的變動,但10年期盈虧平衡似乎已經從1.5%的水平反彈。

(The 10-year breakeven inflation rate is the nominal Treasury yield less the quoted yield on the 10-year index-linked TIPS. The breakeven inflation rate is [approximately] the inflation rate required for the 10-year TIPS total return to match the 10-year conventional Treasury total return. This should match forecast average expected inflation under the assumption of market efficiency. My book Breakeven Inflation Analysis provides a deep dive into the issues around this concept.)

(10年期盈虧平衡通脹率是名義國債收益率減去10年期與指數掛鈎的TIPS的報價收益率。盈虧平衡通貨膨脹率是[大約]10年期TIPS總回報所需的通貨膨脹率,才能與10年期常規國債總回報相匹配。在市場效率的假設下,這應該與預測的平均預期通脹率相符。我的書盈虧平衡通貨膨脹分析深入探討了圍繞這一概念的問題。)

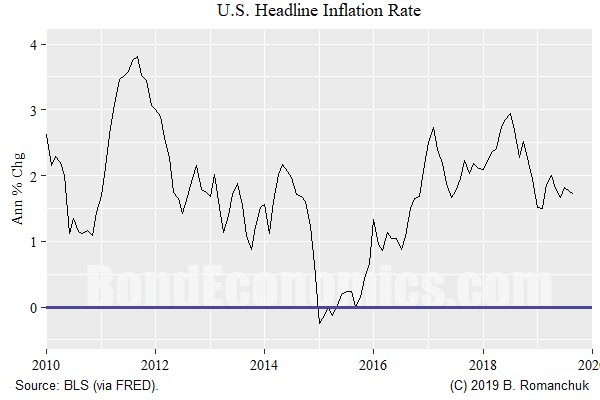

It seems clear that recession risks are being taken out of Treasury market pricing. The previous low of 1.5% breakeven inflation seems to have been somewhat aggressive when compared to inflation performance over the past decade (shown below).

似乎很明顯,衰退風險正在從國債市場定價中剔除。與過去十年的通脹表現(如下所示)相比,之前1.5%的盈虧平衡通脹率低點似乎有些咄咄逼人。

There is certainly no significant inflation risk premium embedded in the breakeven inflation curve. The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade. This is perhaps somewhat surprising this far into an decade-long expansion, but recession fears have meant that risks are seen as symmetric.

盈虧平衡通脹曲線中肯定沒有明顯的通脹風險溢價。目前的水平(接近1.7%)處於過去10年觀察到的通脹率區間的中間。在長達十年的擴張中,這可能有點令人驚訝,但對經濟衰退的擔憂意味着,人們認為風險是對稱的。

Looking forward, it seems likely that breakeven inflation rate movements will explain most of the changes in nominal yields, under the assumption that yield movements are not large. Breakeven inflation rates are still well below their average of recent years, and thus, might "re-normalise" closer to 2% if the Treasury bear market continues.

展望未來,在假設收益率變動幅度不大的情況下,盈虧平衡通脹率變動似乎將解釋名義收益率的大部分變動。盈虧平衡通脹率仍遠低於近幾年的平均水平,因此,如果美國國債熊市繼續下去,通脹率可能會“重新正常化”,接近2%。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。