Summary

Contrary to popular opinion, gold tends to perform relatively poorly when inflation expectations are rising and relatively well when inflation expectations are falling.

A large part of the reason for the strong inverse relationship between gold's relative strength and inflation expectations is the general view that "inflation" of 2-3% is not just normal, it is beneficial.

Eventually the rate of "price inflation" will rise to a level where it starts being seen by the public as a major economic problem, and, as a result, the desire to maintain cash savings will enter a steep decline.

Editor's note: Originally published at tsi-blog.com on November 11, 2019.

Editor's note: Originally published at tsi-blog.com on November 11, 2019.

In an earlier blog post I discussed the relationship between gold and inflation expectations. Contrary to popular opinion, gold tends to perform relatively poorly when inflation expectations are rising and relatively well when inflation expectations are falling.

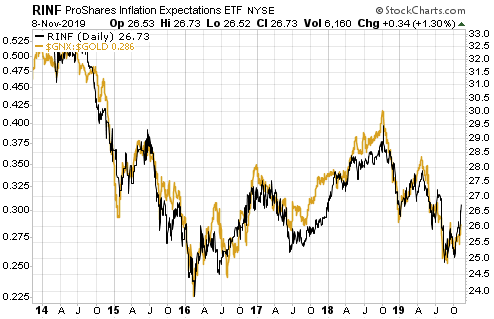

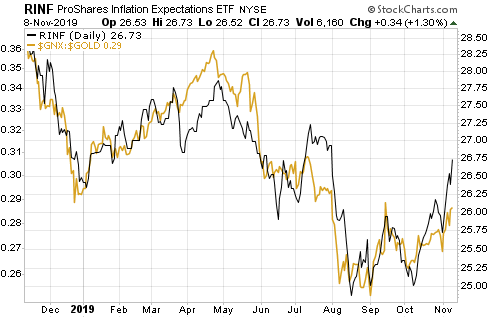

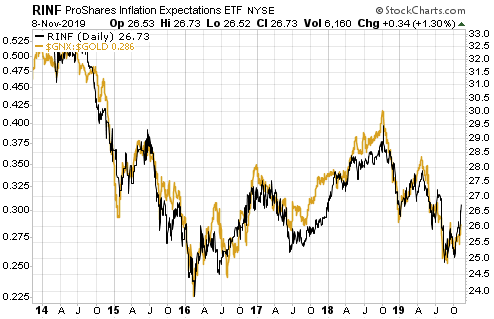

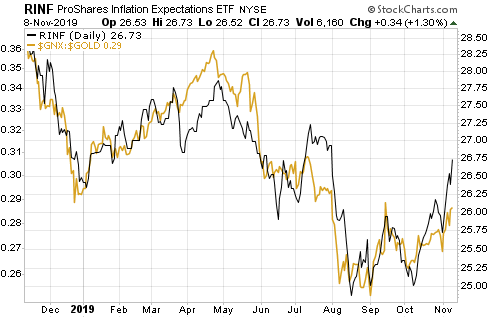

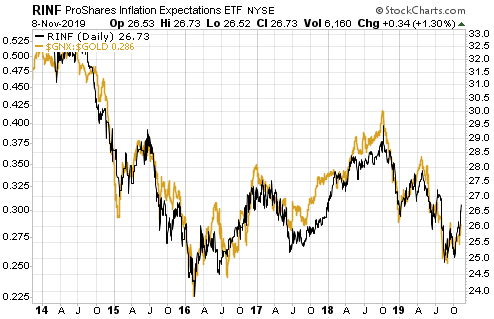

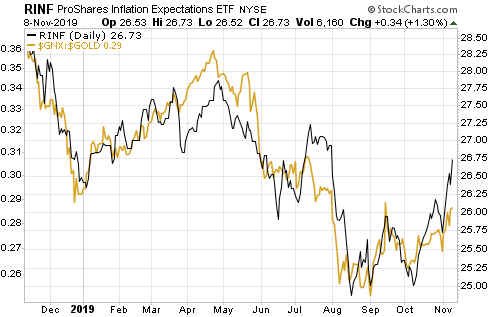

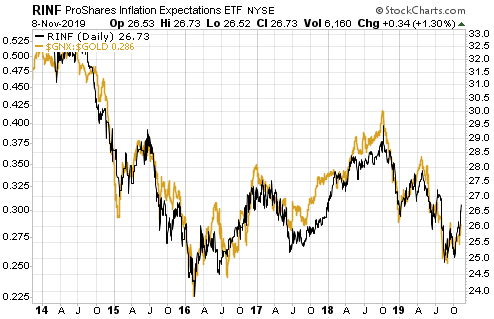

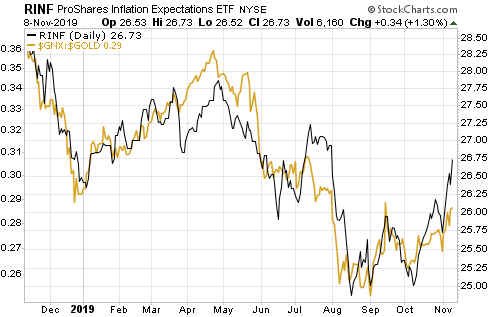

The relationship outlined above is very clear on the following charts. The first chart shows that over the past 6 years there has been a strong positive correlation between RINF, an ETF designed to move in the same direction as the expected CPI, and the commodity/gold ratio (the S&P Spot Commodity Index divided by the US$ gold price). In other words, it shows that a broad basket of commodities has outperformed gold during periods when inflation expectations were rising and underperformed gold during periods when inflation expectations were falling. The second chart shows the same comparison over the past 12 months. Notice that inflation expectations bottomed for the year (to date) in mid-August and the commodity/gold ratio bottomed about two weeks later.

A large part of the reason for the strong inverse relationship between gold's relative strength and inflation expectations is the general view that "inflation" of 2-3% is not just normal, it is beneficial. In fact, most people have been conditioned to believe that it's a serious economic problem necessitating draconian central bank intervention if money fails to lose purchasing power at a slow and steady pace.

Eventually the rate of "price inflation" will rise to a level where it starts being seen by the public as a major economic problem, and, as a result, the desire to maintain cash savings will enter a steep decline. It is at this point that the relationship depicted above will stop working and the demand for gold will begin to surge in parallel with rising inflation expectations. In other words, at some point the relationship depicted on the above chart will reverse due to declining confidence in the official money. This point probably will arrive within the next 10 years, but probably won't arrive within the next 12 months. Over the next 12 months it's likely that gold will continue to be favoured during periods of falling inflation expectations and other commodities will continue to be favoured during periods of rising inflation expectations.

So, if you think that the recent inflation-expectations bounce is the start of a trend then you should be looking for opportunities to increase your exposure to commodities such as oil and copper, not gold. My guess is that inflation expectations bottomed during August-October of this year, but I'm open to the possibility that the bottoming process will extend into early next year.

Original post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

Contrary to popular opinion, gold tends to perform relatively poorly when inflation expectations are rising and relatively well when inflation expectations are falling.

與普遍看法相反,當通脹預期上升時,黃金往往表現相對較差,而當通脹預期下降時,黃金往往表現相對較好。

A large part of the reason for the strong inverse relationship between gold's relative strength and inflation expectations is the general view that "inflation" of 2-3% is not just normal, it is beneficial.

黃金的相對強弱與通脹預期之間存在着強烈的反向關係,很大一部分原因是人們普遍認為,2-3%的“通脹”不僅是正常的,而且是有益的。

Eventually the rate of "price inflation" will rise to a level where it starts being seen by the public as a major economic problem, and, as a result, the desire to maintain cash savings will enter a steep decline.

最終,“物價通脹率”將上升到被公眾視為一個主要經濟問題的水平,因此,保持現金儲蓄的願望將進入急劇下降的階段。

Editor's note: Originally published at tsi-blog.com on November 11, 2019.

In an earlier blog post I discussed the relationship between gold and inflation expectations. Contrary to popular opinion, gold tends to perform relatively poorly when inflation expectations are rising and relatively well when inflation expectations are falling.

在一個之前的博客帖子我討論了黃金和通脹預期之間的關係。與普遍看法相反,當通脹預期上升時,黃金往往表現相對較差,而當通脹預期下降時,黃金往往表現相對較好。

The relationship outlined above is very clear on the following charts. The first chart shows that over the past 6 years there has been a strong positive correlation between RINF, an ETF designed to move in the same direction as the expected CPI, and the commodity/gold ratio (the S&P Spot Commodity Index divided by the US$ gold price). In other words, it shows that a broad basket of commodities has outperformed gold during periods when inflation expectations were rising and underperformed gold during periods when inflation expectations were falling. The second chart shows the same comparison over the past 12 months. Notice that inflation expectations bottomed for the year (to date) in mid-August and the commodity/gold ratio bottomed about two weeks later.

在下面的圖表中,上面概述的關係非常清楚。第一張圖表顯示,在過去的6年裏,RINF,與預期CPI方向一致的ETF,以及商品/黃金比率(標準普爾現貨商品指數除以美元金價)。換句話説,它表明,在通脹預期上升的時期,一籃子大宗商品的表現優於黃金,在通脹預期下降的時期,一籃子大宗商品的表現遜於黃金。第二張圖表顯示了過去12個月的相同對比。請注意,今年(到目前為止)的通脹預期在8月中旬觸底,大宗商品/黃金比率在大約兩週後觸底。

A large part of the reason for the strong inverse relationship between gold's relative strength and inflation expectations is the general view that "inflation" of 2-3% is not just normal, it is beneficial. In fact, most people have been conditioned to believe that it's a serious economic problem necessitating draconian central bank intervention if money fails to lose purchasing power at a slow and steady pace.

黃金的相對強弱與通脹預期之間存在着強烈的反向關係,很大一部分原因是人們普遍認為,2-3%的“通脹”不僅是正常的,而且是有益的。事實上,大多數人已經習慣於相信,如果貨幣不能以緩慢而穩定的速度失去購買力,這是一個嚴重的經濟問題,需要中央銀行進行嚴厲的干預。

Eventually the rate of "price inflation" will rise to a level where it starts being seen by the public as a major economic problem, and, as a result, the desire to maintain cash savings will enter a steep decline. It is at this point that the relationship depicted above will stop working and the demand for gold will begin to surge in parallel with rising inflation expectations. In other words, at some point the relationship depicted on the above chart will reverse due to declining confidence in the official money. This point probably will arrive within the next 10 years, but probably won't arrive within the next 12 months. Over the next 12 months it's likely that gold will continue to be favoured during periods of falling inflation expectations and other commodities will continue to be favoured during periods of rising inflation expectations.

最終,“物價通脹率”將上升到被公眾視為一個主要經濟問題的水平,因此,保持現金儲蓄的願望將進入急劇下降的階段。正是在這一點上,上述關係將停止發揮作用,黃金需求將開始與不斷上升的通脹預期同步激增。換句話説,在某個時候,由於對官方貨幣的信心下降,上圖所描繪的關係將會逆轉。這一點可能會在未來10年內到來,但可能不會在未來12個月內到來。未來12個月,在通脹預期下降的時期,黃金可能會繼續受到青睞,而在通脹預期上升的時期,其他大宗商品可能會繼續受到青睞。

So, if you think that the recent inflation-expectations bounce is the start of a trend then you should be looking for opportunities to increase your exposure to commodities such as oil and copper, not gold. My guess is that inflation expectations bottomed during August-October of this year, but I'm open to the possibility that the bottoming process will extend into early next year.

因此,如果你認為最近的通脹預期反彈是一種趨勢的開始,那麼你應該尋找機會增加對石油和銅等大宗商品的敞口,而不是黃金。我的猜測是,通脹預期在今年8-10月觸底,但我對觸底過程延續到明年初的可能性持開放態度。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。

Editor's note: Originally published at

Editor's note: Originally published at