Risks Still Elevated At These Prices As China Best Group Holding Limited (HKG:370) Shares Dive 34%

Risks Still Elevated At These Prices As China Best Group Holding Limited (HKG:370) Shares Dive 34%

To the annoyance of some shareholders, China Best Group Holding Limited (HKG:370) shares are down a considerable 34% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

令一些股東惱火的是,中國百世集團控股有限公司(HKG:370)該公司股價在過去一個月大幅下跌34%,延續了可怕的漲勢。最近的下跌為股東們災難性的12個月畫上了句號,在此期間,他們坐擁75%的損失。

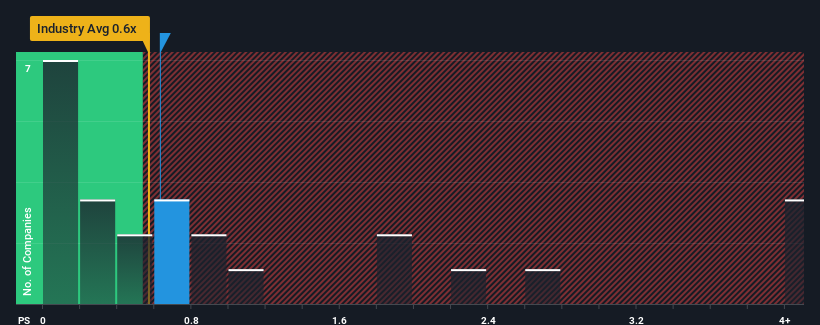

Even after such a large drop in price, you could still be forgiven for feeling indifferent about China Best Group Holding's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Retail Distributors industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

即使價格下跌如此之大,你仍然可以原諒對中國百世控股0.6倍的P/S比率的無動於衷,因為香港零售分銷商行業的中位數價格與銷售額(或“P/S”)比率大致相同。儘管這可能不會令人驚訝,但如果P/S比率不合理,投資者可能會錯過潛在的機會,或者忽視迫在眉睫的失望情緒。

Check out our latest analysis for China Best Group Holding

看看我們對中國最佳集團控股的最新分析

How Has China Best Group Holding Performed Recently?

中國最佳集團控股近期表現如何?

As an illustration, revenue has deteriorated at China Best Group Holding over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

舉個例子,中國最佳集團控股公司過去一年的收入一直在惡化,這一點都不理想。一種可能性是,S的本益比是溫和的,因為投資者認為,該公司在不久的將來可能仍會採取足夠的措施,與更廣泛的行業保持一致。如果不是,那麼現有股東可能會對股價的生存能力感到有點緊張。

Is There Some Revenue Growth Forecasted For China Best Group Holding?

中國最佳集團控股有沒有一些收入增長的預測?

China Best Group Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

中國最佳集團控股的本益比/S比率對於一家預計只會實現適度增長,而且重要的是表現與行業一致的公司來說是典型的。

Retrospectively, the last year delivered a frustrating 41% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

回顧過去一年,該公司的營收令人沮喪地下降了41%。這給它的長期良好運行帶來了抑制,因為它三年的收入增長仍然是值得注意的23%。因此,儘管股東們更願意繼續運營,但他們對中期營收增長率大致滿意。

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

與預計在未來12個月內實現23%增長的行業相比,根據最近的中期年化收入結果,該公司的增長勢頭較弱。

With this information, we find it interesting that China Best Group Holding is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

有了這些資訊,我們發現有趣的是,與行業相比,中國最佳集團控股的本益比與S相當。顯然,該公司的許多投資者並不像最近的情況所顯示的那樣悲觀,他們現在不願拋售自己的股票。如果本益比/S指數跌至與近期增速更接近的水準,他們可能會在未來感到失望。

What We Can Learn From China Best Group Holding's P/S?

我們可以從中國最佳集團控股的P/S那裡學到什麼?

With its share price dropping off a cliff, the P/S for China Best Group Holding looks to be in line with the rest of the Retail Distributors industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

在股價跌落懸崖的情況下,中國最佳集團控股的本益比S看起來與零售分銷商行業的其他公司一致。我們會說,市銷率的力量主要不是作為一種估值工具,而是衡量當前投資者的情緒和未來預期。

Our examination of China Best Group Holding revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我們對中國最佳集團控股的調查顯示,其糟糕的三年營收趨勢並沒有導致本益比低於我們的預期,因為它們看起來比目前的行業前景更糟糕。目前,我們對本益比/S感到不舒服,因為這種收入表現不太可能長期支持更積極的情緒。除非近期的中期狀況有所改善,否則很難接受當前股價為公允價值。

There are also other vital risk factors to consider and we've discovered 3 warning signs for China Best Group Holding (1 can't be ignored!) that you should be aware of before investing here.

還有其他重要的風險因素需要考慮,我們發現中國最佳集團控股的3個警示信號(1不容忽視!)在這裡投資之前你應該意識到這一點。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

As an illustration, revenue has deteriorated at China Best Group Holding over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

As an illustration, revenue has deteriorated at China Best Group Holding over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.