Amarin Corporation Plc's (NASDAQ:AMRN) Shares Lagging The Industry But So Is The Business

Amarin Corporation Plc's (NASDAQ:AMRN) Shares Lagging The Industry But So Is The Business

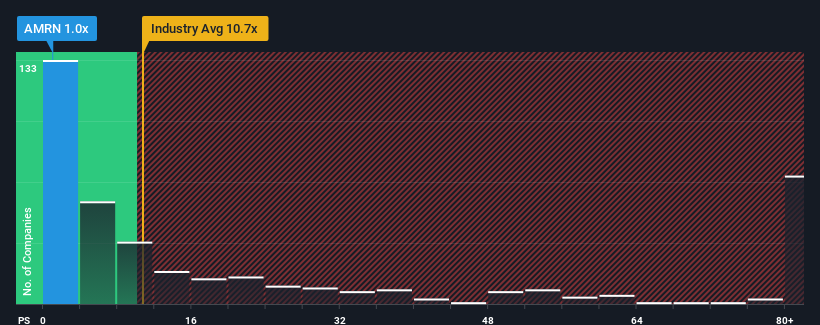

With a price-to-sales (or "P/S") ratio of 1x Amarin Corporation plc (NASDAQ:AMRN) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 10.7x and even P/S higher than 46x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

價格與銷售額(或 “P/S”)的比率爲 1 倍 阿瑪琳公司 plc 納斯達克股票代碼:AMRN)目前可能正在發出非常看漲的信號,因爲在美國所有生物技術公司中,將近一半的市盈率高於10.7倍,甚至市盈率高於46倍也並不罕見。儘管如此,我們需要更深入地挖掘,以確定大幅降低的市盈率是否有合理的基礎。

View our latest analysis for Amarin

查看我們對 Amarin 的最新分析

How Amarin Has Been Performing

Amarin 的表現如何

Amarin hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Amarin最近表現不佳,因爲與其他公司相比,其收入下降不佳,後者的平均收入有所增長。也許市盈率仍然很低,因爲投資者認爲收入強勁增長的前景尚未出現。因此,儘管你可以說這隻股票很便宜,但投資者在認爲股票物有所值之前會尋求改善。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

關於低市盈率,收入增長指標告訴我們什麼?

In order to justify its P/S ratio, Amarin would need to produce anemic growth that's substantially trailing the industry.

爲了證明其市盈率是合理的,Amarin需要實現遠遠落後於該行業的疲軟增長。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. The last three years don't look nice either as the company has shrunk revenue by 37% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

首先回顧一下,該公司去年的收入增長並不令人興奮,因爲它公佈了令人失望的27%的下降幅度。過去三年看起來也不太好,因爲該公司的總收入減少了37%。因此,可以公平地說,最近的收入增長對公司來說是不可取的。

Turning to the outlook, the next three years should generate growth of 7.3% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 110% growth per year, the company is positioned for a weaker revenue result.

關於前景,根據關注該公司的四位分析師的估計,未來三年將實現7.3%的年增長率。該行業預計每年將實現110%的增長,因此該公司的收入業績將疲軟。

In light of this, it's understandable that Amarin's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

有鑑於此,可以理解的是,Amarin的市盈率低於大多數其他公司。顯然,許多股東不願堅持下去,而該公司可能將目光投向不那麼繁榮的未來。

The Final Word

最後一句話

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

雖然市銷比不應該是決定你是否買入股票的決定性因素,但它是衡量收入預期的有力晴雨表。

As we suspected, our examination of Amarin's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

正如我們所懷疑的那樣,我們對Amarin分析師預測的審查表明,其收入前景不佳是其低市盈率的原因。目前,股東們正在接受低市盈率,因爲他們承認未來的收入可能不會帶來任何驚喜。除非這些條件得到改善,否則它們將繼續在這些水平附近構成股價的障礙。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Amarin, and understanding should be part of your investment process.

始終需要考慮永遠存在的投資風險幽靈。我們已經確定了 1 個帶有 Amarin 的警告標誌,理解應該是你投資過程的一部分。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然, 具有良好收益增長曆史的盈利公司通常是更安全的選擇。所以你可能希望看到這個 免費的 收集其他市盈率合理且收益強勁增長的公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。