QingHai HuaDing Industrial CO.,LTD. (SHSE:600243) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

QingHai HuaDing Industrial CO.,LTD. (SHSE:600243) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

QingHai HuaDing Industrial CO.,LTD. (SHSE:600243) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 37%.

青海省華鼎實業有限公司。(上海證券交易所股票代碼:600243)股東們會很興奮地看到股價經歷了一個很棒的月份,上漲了28%,並從之前的疲軟中恢復過來。在過去的30天裡,年度漲幅達到了非常大的37%。

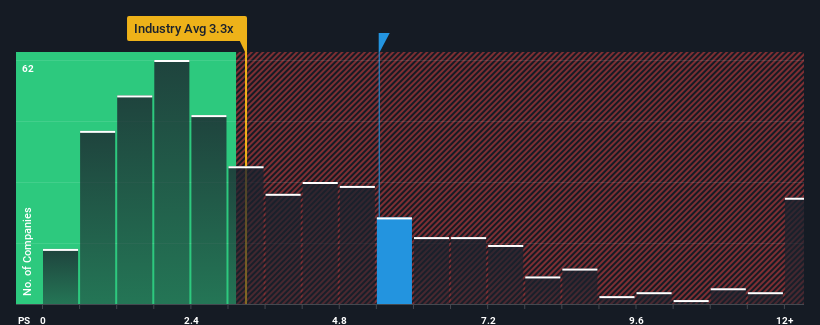

Following the firm bounce in price, you could be forgiven for thinking QingHai HuaDing IndustrialLTD is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.4x, considering almost half the companies in China's Machinery industry have P/S ratios below 3.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

隨著股價的強勁反彈,你可能會認為青海華鼎工業股份有限公司是一隻值得迴避的股票,市銷率(P/S)為5.4倍,考慮到中國所在機械行業近一半的公司P/S比率低於3.3倍,這是情有可原的。儘管如此,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此之高。

Check out our latest analysis for QingHai HuaDing IndustrialLTD

查看我們對青海華鼎工業LTD的最新分析

What Does QingHai HuaDing IndustrialLTD's Recent Performance Look Like?

青海華鼎實業LTD近期的表現如何?

For instance, QingHai HuaDing IndustrialLTD's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

例如,青海華鼎實業有限公司近期營收下滑的情況就不得不引起一些思考。或許,市場認為該公司在不久的將來可以做得足夠好,跑贏業內其他公司,這使得本益比和S的本益比保持在較高水平。你真的希望如此,否則你會無緣無故地付出相當大的代價。

What Are Revenue Growth Metrics Telling Us About The High P/S?

收入增長指標告訴我們關於高本益比的哪些資訊?

In order to justify its P/S ratio, QingHai HuaDing IndustrialLTD would need to produce outstanding growth that's well in excess of the industry.

為了證明其本益比/S比率的合理性,青海華鼎實業有限公司需要實現遠超行業的卓越增長。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. As a result, revenue from three years ago have also fallen 35% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

回顧過去一年的財務狀況,我們沮喪地看到該公司的收入下降到了35%。因此,三年前的營收總體上也下降了35%。因此,公平地說,最近的收入增長對公司來說是不可取的。

In contrast to the company, the rest of the industry is expected to grow by 31% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

與該公司形成鮮明對比的是,該行業其他業務預計明年將增長31%,這確實讓人對該公司最近的中期收入下降有了正確的認識。

With this information, we find it concerning that QingHai HuaDing IndustrialLTD is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

有了這些資訊,我們發現青海華鼎實業有限公司的本益比高於行業水準。似乎大多數投資者都忽視了最近糟糕的增長率,並希望該公司的業務前景有所好轉。如果本益比/S指數跌至與近期負增長更為一致的水準,現有股東很有可能正在為未來的失望做準備。

The Final Word

最後的結論

Shares in QingHai HuaDing IndustrialLTD have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

青海華鼎實業股份有限公司的股票最近出現了強勁的上行,這確實幫助提振了其本益比與S的比率。雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

Our examination of QingHai HuaDing IndustrialLTD revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

我們對青海華鼎實業有限公司的調查顯示,考慮到該行業的增長勢頭,該公司中期營收縮水並未導致本益比S像我們預期的那樣低。目前,我們對高本益比S並不滿意,因為這種收入表現不太可能長期支持這種積極的情緒。除非最近的中期狀況明顯改善,否則投資者將很難接受股價為公允價值。

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for QingHai HuaDing IndustrialLTD with six simple checks will allow you to discover any risks that could be an issue.

一家公司的資產負債表中可能隱藏著許多潛在風險。我們的免費對青海華鼎實業有限責任公司的資產負債表進行六項簡單的檢查,可以讓你發現任何可能成為問題的風險。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果強大的盈利公司激起了你的想像力,那麼你就會想要看看這個。免費本益比較低(但已證明它們可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.