Growing Earnings, Ensuring Investor Value: NVIDIA Adjusts Dividends With Consistent Growth

Growing Earnings, Ensuring Investor Value: NVIDIA Adjusts Dividends With Consistent Growth

At the end of September 28, 2023, NVIDIA (NASDAQ:NVDA) will reward its shareholders with a dividend payout of $0.04 per share, demonstrating an annualized dividend yield of 0.04%. Remember, only investors who held the stock before the ex-dividend date on September 06, 2023 will receive this payout.

2023年9月28日底, 英偉達(納斯達克股票代碼:NVDA) 將以每股0.04美元的股息獎勵其股東,表明年化股息收益率爲0.04%。請記住,只有在2023年9月6日除息日之前持有該股的投資者才能獲得這筆款項。

NVIDIA Recent Dividend Payouts

NVIDIA 最近的股息支付

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-09-06 | 4 | $0.04 | 0.04% | 2023-08-23 | 2023-09-07 | 2023-09-28 |

| 2023-06-07 | 4 | $0.04 | 0.05% | 2023-05-24 | 2023-06-08 | 2023-06-30 |

| 2023-03-07 | 4 | $0.04 | 0.08% | 2023-02-22 | 2023-03-08 | 2023-03-29 |

| 2022-11-30 | 4 | $0.04 | 0.1% | 2022-11-16 | 2022-12-01 | 2022-12-22 |

| 2022-09-07 | 4 | $0.04 | 0.09% | 2022-08-24 | 2022-09-08 | 2022-09-29 |

| 2022-06-08 | 4 | $0.04 | 0.1% | 2022-05-25 | 2022-06-09 | 2022-07-01 |

| 2022-03-02 | 4 | $0.04 | 0.06% | 2022-02-16 | 2022-03-03 | 2022-03-24 |

| 2021-12-01 | 4 | $0.04 | 0.05% | 2021-11-17 | 2021-12-02 | 2021-12-23 |

| 2021-08-31 | 4 | $0.04 | 0.08% | 2021-08-18 | 2021-09-01 | 2021-09-23 |

| 2021-06-09 | 4 | $0.16 | 0.1% | 2021-05-26 | 2021-06-10 | 2021-07-01 |

| 2021-03-09 | 4 | $0.16 | 0.11% | 2021-02-24 | 2021-03-10 | 2021-03-31 |

| 2020-12-03 | 4 | $0.16 | 0.12% | 2020-11-18 | 2020-12-04 | 2020-12-29 |

| 過期日期 | 每年付款 | 分紅 | 收益率 | 已宣佈 | 記錄 | 應付款 |

|---|---|---|---|---|---|---|

| 2023-09-06 | 4 | 0.04 美元 | 0.04% | 2023-08-23 | 2023-09-07 | 2023-09-28 |

| 2023-06-07 | 4 | 0.04 美元 | 0.05% | 2023-05-24 | 2023-06-08 | 2023-06-30 |

| 2023-03-07 | 4 | 0.04 美元 | 0.08% | 2023-02-22 | 2023-03-08 | 2023-03-29 |

| 2022-11-30 | 4 | 0.04 美元 | 0.1% | 2022-11-16 | 2022-12-01 | 2022-12-22 |

| 2022-09-07 | 4 | 0.04 美元 | 0.09% | 2022-08-24 | 2022-09-08 | 2022-09-29 |

| 2022-06-08 | 4 | 0.04 美元 | 0.1% | 2022-05-25 | 2022-06-09 | 2022-07-01 |

| 2022-03-02 | 4 | 0.04 美元 | 0.06% | 2022-02-16 | 2022-03-03 | 2022-03-24 |

| 2021-12-01 | 4 | 0.04 美元 | 0.05% | 2021-11-17 | 2021-12-02 | 2021-12-23 |

| 2021-08-31 | 4 | 0.04 美元 | 0.08% | 2021-08-18 | 2021-09-01 | 2021-09-23 |

| 2021-06-09 | 4 | 0.16 美元 | 0.1% | 2021-05-26 | 2021-06-10 | 2021-07-01 |

| 2021-03-09 | 4 | 0.16 美元 | 0.11% | 2021-02-24 | 2021-03-10 | 2021-03-31 |

| 2020-12-03 | 4 | 0.16 美元 | 0.12% | 2020-11-18 | 2020-12-04 | 2020-12-29 |

When it comes to dividend yield, NVIDIA falls behind its industry peers, with United Microelectronics (NYSE:UMC) boasting a higher annualized dividend yield of 8.48%.

在股息收益率方面,NVIDIA落後於業內同行, 聯合微電子(紐約證券交易所代碼:UMC) 年化股息收益率更高,爲8.48%。

Analyzing NVIDIA Financial Health

分析 NVIDIA 的財務狀況

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付穩定現金分紅的公司對尋求收入的投資者具有吸引力,而財務狀況良好的公司往往會維持其股息支付時間表。出於這個原因,投資者可以深入了解一家公司是增加還是減少了股息支付時間表,以及他們的收益是否在增長。

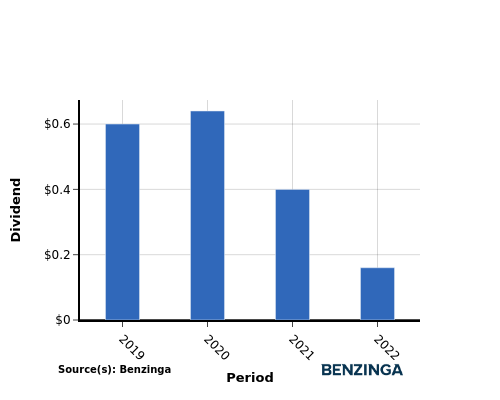

YoY Growth in Dividend Per Share

每股股息同比增長

The company experienced a decrease in dividend per share from 2019 to 2022, with the dividend per share decreasing from $0.60 to $0.16. This decline in dividends is concerning for investors and demands further analysis to determine the contributing factors.

從2019年到2022年,該公司的每股股息有所下降,每股股息從0.60美元降至0.16美元。股息的下降令投資者感到擔憂,需要進一步分析以確定促成因素。

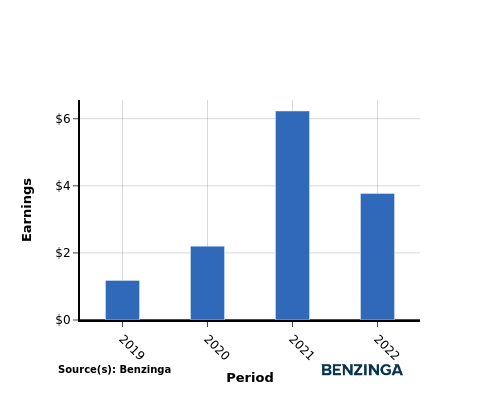

YoY Earnings Growth For NVIDIA

NVIDIA 的同比收益增長

The earnings chart illustrates an increase in NVIDIA's earnings per share, from $1.18 in 2019 to $3.77 in 2022. This positive earnings growth provides income-seeking investors with optimism, as it suggests potential for higher cash dividend payouts in the future.

收益表顯示,英偉達的每股收益從2019年的1.18美元增加到2022年的3.77美元。這種積極的收益增長爲尋求收入的投資者提供了樂觀情緒,因爲這表明未來有可能增加現金分紅支出。

Recap

回顧

In this article, we explore the recent dividend payout of NVIDIA and its significance for shareholders. The company has decided to distribute a dividend of $0.04 per share today, which equates to an annualized dividend yield of 0.04%.

在本文中,我們將探討NVIDIA最近的股息支付情況及其對股東的重要性。該公司決定今天派發每股0.04美元的股息,相當於年化股息收益率爲0.04%。

When it comes to dividend yield, NVIDIA falls behind its industry peers, with United Microelectronics boasting a higher annualized dividend yield of 8.48%.

在股息收益率方面,NVIDIA落後於業內同行,聯合微電子的年化股息收益率更高,爲8.48%。

Considering the decrease in dividend per share from 2019 to 2022 along with an increase in earnings per share, NVIDIA seems to be allocating more profits towards business expansion instead of dividend payments.

考慮到2019年至2022年每股股息的減少以及每股收益的增加,NVIDIA似乎將更多的利潤用於業務擴張,而不是股息支付。

It is essential for investors to closely track the company's performance in the coming quarters to remain updated regarding any alterations in financials or dividend disbursements.

投資者必須密切關注公司在未來幾個季度的業績,以隨時了解財務狀況或股息支付的任何變化。

\To keep track of which companies are distributing dividends, click here to visit our Dividends Calendar.

\ 要跟蹤哪些公司正在分配股息,請點擊此處訪問我們的股息日曆。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。