Do TravelSky Technology's (HKG:696) Earnings Warrant Your Attention?

Do TravelSky Technology's (HKG:696) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

對於初學者來說,收購一家向投資者講述一個好故事的公司似乎是一個好主意(也是一個令人興奮的前景),即使它目前沒有收入和利潤的記錄。有時,這些故事可能會矇蔽投資者的頭腦,導致他們以自己的情緒投資,而不是投資於良好的公司基本面。虧損的公司總是在分秒必爭地實現財務可持續性,因此這些公司的投資者可能承擔了比他們應該承擔的更多的風險。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in TravelSky Technology (HKG:696). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

如果這種公司不是你的風格,你喜歡能產生收入,甚至能賺錢的公司,那麼你很可能會對旅行者天空科技(HKG:696)。現在,這並不是說該公司提供了最好的投資機會,但盈利能力是商業成功的關鍵組成部分。

See our latest analysis for TravelSky Technology

查看我們對TravelSky Technology的最新分析

TravelSky Technology's Earnings Per Share Are Growing

TravelSky Technology的每股收益正在增長

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that TravelSky Technology's EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

如果一家公司能夠在足夠長的時間內保持每股收益(EPS)的增長,其股價最終應該會隨之而來。因此,有經驗的投資者在進行投資研究時密切關注公司每股收益是合理的。股東們會很高興地知道,TravelSky Technology的每股收益在過去三年裡以每年21%的復合增長率增長。如果這樣的增長持續到未來,那麼股東們將有很多值得微笑的地方。

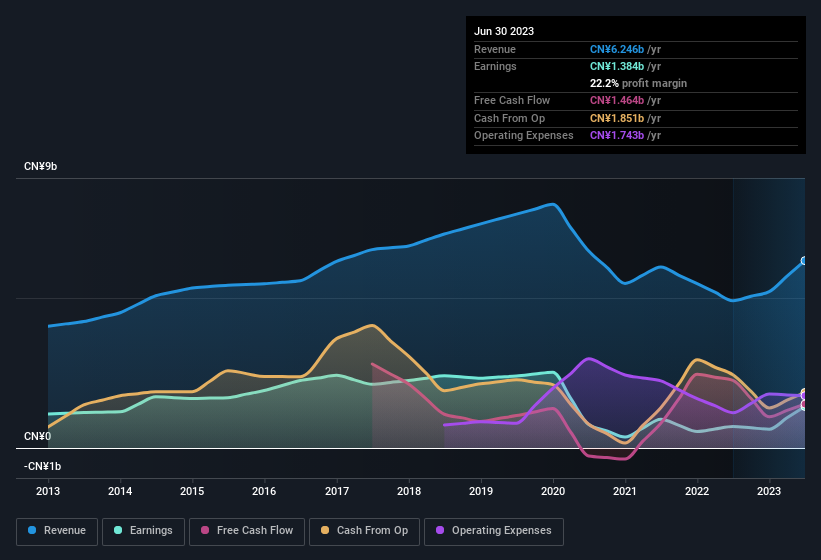

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of TravelSky Technology shareholders is that EBIT margins have grown from 12% to 20% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

要複核一家公司的增長,一種方法是觀察其收入和息稅前利潤(EBIT)的變化情況。TravelSky Technology股東聽到的消息是,在過去12個月中,息稅前利潤從12%增長到20%,收入也呈上升趨勢。這兩個都是衡量潛在增長的很好的指標。

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

你可以在下面的圖表中看到該公司的收入和收益增長趨勢。點擊圖表查看確切的數位。

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of TravelSky Technology's forecast profits?

在投資中,就像在生活中一樣,未來比過去更重要.那麼為什麼不來看看這個免費TravelSky技術的互動式可視化預測利潤?

Are TravelSky Technology Insiders Aligned With All Shareholders?

TravelSky Technology的內部人員是否與所有股東一致?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like TravelSky Technology with market caps between CN¥29b and CN¥88b is about CN¥6.7m.

一般來說,首席執行官的薪酬是值得考慮的,因為不合理的高薪酬可能會被認為是違背股東利益的。我們的分析發現,像TravelSky Technology這樣市值在290億元到88億元之間的公司的首席執行官的總薪酬中值約為670萬元。

The CEO of TravelSky Technology only received CN¥786k in total compensation for the year ending December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

截至2022年12月的一年裡,TravelSky科技的CEO只收到了78.6萬CN元的總薪酬。第一印象似乎表明了一種有利於股東的薪酬政策。CEO薪酬水準不是投資者最重要的衡量標準,但當薪酬適中時,這確實有助於加強CEO與普通股東之間的一致性。更廣泛地說,這也可能是良好治理的標誌。

Is TravelSky Technology Worth Keeping An Eye On?

TravelSky科技值得密切關注嗎?

For growth investors, TravelSky Technology's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of TravelSky Technology.

對於成長型投資者來說,TravelSky Technology的原始盈利增長率是夜間的燈塔。快速的增長是個好兆頭,而非常合理的CEO薪酬有助於建立對董事會的一些信心。基於這些因素,這只股票很可能值得在你的觀察名單上佔有一席之地,甚至值得進一步研究。當然,識別優質企業只是成功的一半;投資者需要知道股票是否被低估了。所以你可能會考慮這個免費TravelSky科技的現金流貼現估值。

Although TravelSky Technology certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

儘管TravelSky Technology看起來確實不錯,但如果內部人士買入股票,它可能會吸引更多的投資者。如果你想看到內幕交易,那麼這本書免費內部人士正在收購的成長型公司名單,可能正是你正在尋找的。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易指的是相關司法管轄區內的應報告交易.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that TravelSky Technology's EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that TravelSky Technology's EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.