Revenues Tell The Story For Huasu Holdings Co.,Ltd (SZSE:000509)

Revenues Tell The Story For Huasu Holdings Co.,Ltd (SZSE:000509)

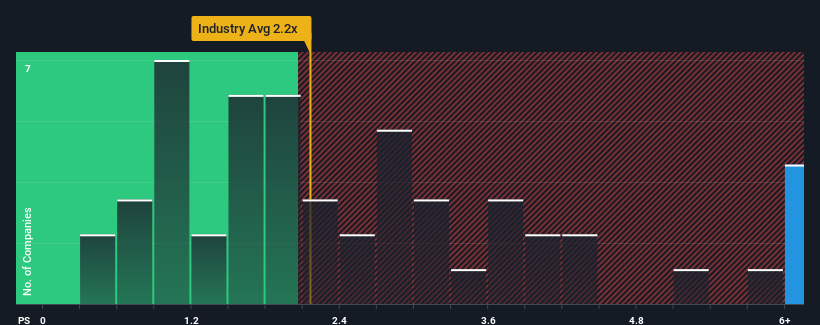

When you see that almost half of the companies in the Building industry in China have price-to-sales ratios (or "P/S") below 2.2x, Huasu Holdings Co.,Ltd (SZSE:000509) looks to be giving off strong sell signals with its 6.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

當你看到中國建築業幾乎一半的公司的市銷率(P/S)低於2.2倍時,華數控股有限公司深圳證券交易所(SZSE:000509)的本益比為6.4倍,S的本益比為6.4倍,似乎正在發出強烈的賣出信號。儘管如此,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此之高。

Check out our latest analysis for Huasu HoldingsLtd

查看我們對華數控股有限公司的最新分析

How Has Huasu HoldingsLtd Performed Recently?

華數控股最近表現如何?

For example, consider that Huasu HoldingsLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

例如,考慮到華數控股有限公司最近的財務表現一直很差,因為它的收入一直在下降。或許,市場認為該公司在不久的將來可以做得足夠好,跑贏業內其他公司,這使得本益比和S的本益比保持在較高水平。你真的希望如此,否則你會無緣無故地付出相當大的代價。

Is There Enough Revenue Growth Forecasted For Huasu HoldingsLtd?

華數控股有限公司的收入增長預測是否足夠?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

有一個固有的假設,即一家公司的本益比應該遠遠超過行業,就像華數控股有限公司的本益比應該被認為是合理的。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

首先回顧一下,該公司去年的收入增長並不令人興奮,因為它公佈了令人失望的18%的下降。最近三年的營收出現了令人難以置信的整體增長,這與過去12個月形成了鮮明對比。因此,儘管該公司過去做得很好,但看到收入增長如此嚴重地下滑,有些令人擔憂。

When compared to the industry's one-year growth forecast of 24%, the most recent medium-term revenue trajectory is noticeably more alluring

與該行業24%的一年增長預測相比,最近的中期收入軌跡明顯更具誘惑力

In light of this, it's understandable that Huasu HoldingsLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

有鑒於此,華數控股有限公司的P/S坐在其他大多數公司的前面也是可以理解的。據推測,股東們並不熱衷於出售他們認為將繼續勝過整個行業的股票。

The Bottom Line On Huasu HoldingsLtd's P/S

華數控股有限公司P/S的底線

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

We've established that Huasu HoldingsLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

我們已經確定,華數控股有限公司維持其高本益比是因為其最近三年的增長高於更廣泛的行業預期,正如預期的那樣。眼下,股東們對P/S很滿意,因為他們非常有信心收入不會受到威脅。除非近期中期情況有所改變,否則將繼續為股價提供有力支撐。

Before you take the next step, you should know about the 2 warning signs for Huasu HoldingsLtd that we have uncovered.

在您採取下一步之前,您應該瞭解華數控股有限公司的2個警告標誌我們已經發現了。

If you're unsure about the strength of Huasu HoldingsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不確定華數控股有限公司的業務實力,為什麼不探索我們的互動列表,為其他一些你可能沒有達到預期的公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.