Investors Don't See Light At End Of E2open Parent Holdings, Inc.'s (NYSE:ETWO) Tunnel And Push Stock Down 51%

Investors Don't See Light At End Of E2open Parent Holdings, Inc.'s (NYSE:ETWO) Tunnel And Push Stock Down 51%

E2open Parent Holdings, Inc. (NYSE:ETWO) shareholders that were waiting for something to happen have been dealt a blow with a 51% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

E2Open母公司控股公司。(紐約證券交易所股票代碼:ETWO)上個月股價下跌51%,等待著什麼事情發生的股東受到了打擊。對於任何長期股東來說,最後一個月以鎖定股價下跌53%的方式結束了一年的忘記。

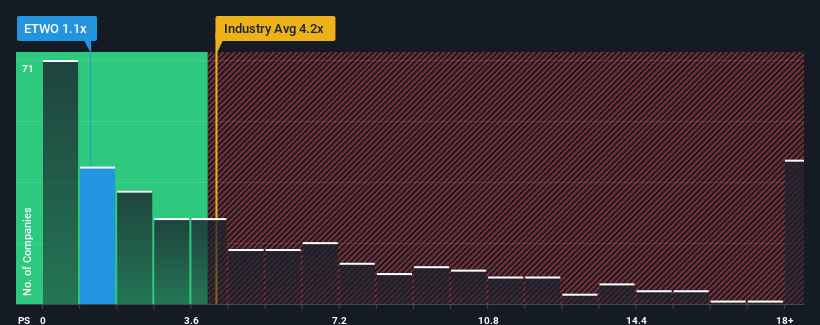

Since its price has dipped substantially, E2open Parent Holdings' price-to-sales (or "P/S") ratio of 1.1x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.2x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

由於它的價格已經大幅下降,E2Open Parent Holdings 1.1倍的市售比(或“P/S”)可能會讓它看起來像是一個強勁的買入,而在美國,大約一半的公司的P/S比率超過4.2倍,甚至P/S高於10倍的情況也很常見。然而,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此有限。

Check out our latest analysis for E2open Parent Holdings

查看我們對E2Open Parent Holdings的最新分析

How E2open Parent Holdings Has Been Performing

E2Open Parent Holdings的表現如何

E2open Parent Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

E2Open Parent Holdings可能會做得更好,因為它最近的收入增長速度低於大多數其他公司。或許市場預期當前營收增長不佳的趨勢將持續,這令P/S受到壓制。如果你仍然喜歡這家公司,你會希望收入不會變得更糟,希望你可以在它不再受青睞的時候買入一些股票。

Do Revenue Forecasts Match The Low P/S Ratio?

收入預測是否符合較低的本益比?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like E2open Parent Holdings' to be considered reasonable.

有一種固有的假設,即一家公司的表現應該遠遠遜於行業,才能讓像E2Open Parent Holdings這樣的本益比被認為是合理的。

Taking a look back first, we see that the company managed to grow revenues by a handy 7.9% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

首先回顧一下,我們看到該公司去年的收入輕鬆增長了7.9%。然而,由於在此期間之前的表現不太令人印象深刻,過去三年的收入增長幾乎為零。因此,在我們看來,在這段時間裡,該公司在收入增長方面取得了好壞參半的結果。

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 2.0% over the next year. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

展望未來,追蹤該公司的六位分析師的估計顯示,該公司營收增長將進入負值區間,明年將下降2.0%。與此同時,更廣泛的行業預計將增長13%,這描繪了一幅糟糕的圖景。

With this information, we are not surprised that E2open Parent Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有了這些資訊,我們對E2open母控股的本益比低於行業也就不足為奇了。儘管如此,不能保證P/S已經觸底,營收出現了逆轉。如果該公司不改善其營收增長,本益比S有可能跌至更低的水準。

What Does E2open Parent Holdings' P/S Mean For Investors?

E2Open Parent Holdings的P/S對投資者意味著什麼?

Shares in E2open Parent Holdings have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

E2Open母公司的股價暴跌,其P/S也跟著暴跌。我們會說,市銷率的力量主要不是作為一種估值工具,而是衡量當前投資者的情緒和未來預期。

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that E2open Parent Holdings' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, E2open Parent Holdings' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

鑑於營收預期遜於業內其他公司,E2Open Parent Holdings的P/S處於低端也就不足為奇了。在業內其他公司都在預測營收增長之際,E2Open母公司糟糕的前景證明其低本益比是合理的。除非這些條件得到改善,否則它們將繼續對股價在這些水準附近形成障礙。

There are also other vital risk factors to consider and we've discovered 2 warning signs for E2open Parent Holdings (1 is a bit concerning!) that you should be aware of before investing here.

還有其他重要的風險因素需要考慮,我們發現E2Open Parent Holdings的2個警告信號(1有點令人擔憂!)在這裡投資之前你應該意識到這一點。

If you're unsure about the strength of E2open Parent Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不確定E2Open Parent Holdings的業務實力,為什麼不探索我們的互動列表,為其他一些你可能沒有達到預期的公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

E2open Parent Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

E2open Parent Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.