Pangaea Connectivity Technology Limited's (HKG:1473) 37% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Pangaea Connectivity Technology Limited's (HKG:1473) 37% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Pangaea Connectivity Technology Limited (HKG:1473) share price has fared very poorly over the last month, falling by a substantial 37%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

這個盤古連通科技有限公司(HKG:1473)股價在過去一個月表現非常糟糕,大幅下跌37%。在過去的12個月裡一直持有股票的股東非但沒有得到回報,反而坐在股價下跌30%的位置上。

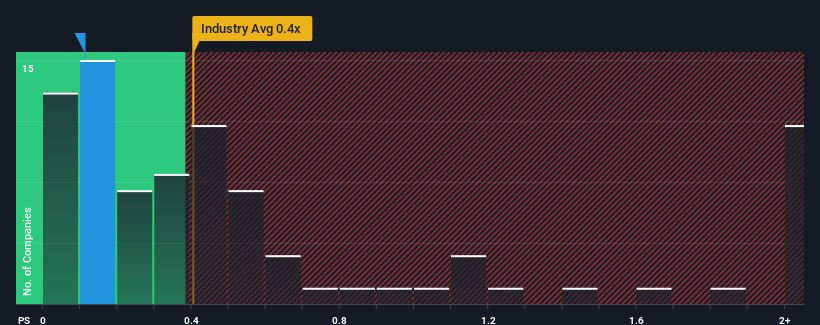

In spite of the heavy fall in price, there still wouldn't be many who think Pangaea Connectivity Technology's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Hong Kong's Electronic industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

儘管價格大幅下跌,但在香港電子行業的P/S中值約為0.4倍的情況下,仍不會有很多人認為盤古互聯科技0.1倍的市售比(P/S)值得一提。儘管這可能不會令人驚訝,但如果P/S比率不合理,投資者可能會錯過潛在的機會,或者忽視迫在眉睫的失望情緒。

See our latest analysis for Pangaea Connectivity Technology

查看我們對盤古連接技術的最新分析

What Does Pangaea Connectivity Technology's Recent Performance Look Like?

盤古互聯科技近期的表現如何?

As an illustration, revenue has deteriorated at Pangaea Connectivity Technology over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

舉個例子,在過去的一年裡,盤古連通科技公司的收入一直在惡化,這一點都不理想。一種可能性是,S的本益比是溫和的,因為投資者認為,該公司在不久的將來可能仍會採取足夠的措施,與更廣泛的行業保持一致。如果不是,那麼現有股東可能會對股價的生存能力感到有點緊張。

Do Revenue Forecasts Match The P/S Ratio?

收入預測是否與本益比匹配?

Pangaea Connectivity Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

對於一家預計只會實現適度增長,而且重要的是表現與行業一致的公司來說,盤古互聯科技的P/S比率將是典型的。

Retrospectively, the last year delivered a frustrating 2.1% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

回顧過去一年,該公司的營收令人沮喪地下降了2.1%。這給它的長期良好運行帶來了抑制,因為它三年的收入增長仍然是值得注意的23%。因此,我們可以從確認該公司在這段時間內總體上在收入增長方面做得很好開始,儘管在此過程中出現了一些小問題。

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

這與其他行業形成鮮明對比,預計明年該行業將增長17%,大大高於該公司最近的中期年化增長率。

With this in mind, we find it intriguing that Pangaea Connectivity Technology's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

考慮到這一點,我們發現耐人尋味的是,盤古互聯科技的P/S與其行業同行不相上下。顯然,該公司的許多投資者並不像最近的情況所顯示的那樣悲觀,他們現在不願拋售自己的股票。維持這些價格將很難實現,因為最近的收入趨勢可能最終會拖累股價。

The Bottom Line On Pangaea Connectivity Technology's P/S

盤古互聯技術的底線P/S

Pangaea Connectivity Technology's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

盤古互聯科技股價暴跌,使其本益比/S指數回到了與業內其他公司類似的地區。雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

We've established that Pangaea Connectivity Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

我們已經確定,盤古互聯科技的平均本益比S有點令人驚訝,因為該公司最近三年的增長低於更廣泛的行業預測。目前,我們對本益比/S感到不舒服,因為這種收入表現不太可能長期支持更積極的情緒。除非公司中期業績有明顯改善,否則很難阻止P/S比率下降至更合理的水準。

Before you take the next step, you should know about the 4 warning signs for Pangaea Connectivity Technology (2 are a bit concerning!) that we have uncovered.

在您採取下一步之前,您應該瞭解盤古連接技術的4個警示標誌(兩個有點令人擔憂!)我們已經發現了。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果強大的盈利公司激起了你的想像力,那麼你就會想要看看這個。免費本益比較低(但已證明它們可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

As an illustration, revenue has deteriorated at Pangaea Connectivity Technology over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

As an illustration, revenue has deteriorated at Pangaea Connectivity Technology over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.